Candlestick charts are one of the most important and trending chart when it comes to crypto trading which shows all the data hidden behind a trade over a period of time.

Candlestick charts are thought to have been developed in the 18th century by Munehisa Homma ,

a Japanese rice trader of financial instruments

So therefore it is called the Japanese candlestick

In this post I will be explaining the japanese candlestick itself, some candle stick pattern like doji, hammer and gravestone. And I will also give a short tutorial about chart analysis which I the foundation of the strategies use in technical analysis.

So let's get started.

Japanese candlestick

Widely world wide, the most used and popular trading chart is the Japanese candlestick.

The Japanese candlestick chart displays a lot of hidden information a highly visual way which makes a lot of traders find it easy to check out their next signal, make technical analysis at a very fast rate.

It is also a good chart to confirm some signals and other traders technical analysis. So you should know how to read the candlestick chart properly, use them to confirm your trades or signals given to you in other not to run on loss.

But first you must understand how it works.

The candlestick Pattern

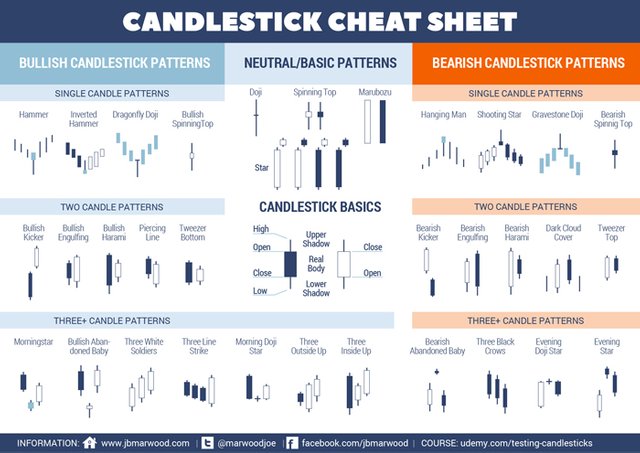

Candlestick is a thin vertical line which illustrates the a currency value at open, high, low and close over a period of the selected time. While the wide part of body represents the difference between the opening and the closing price.

Which I guess the pictures below explains more better.

Source

The part marked "upper shadow" and "lower shadow" are the high and low prices for that period respectively.

Doji

A Doji only show up once in a while. That's when you have a market balance and very good for drafting a very strong signal.

A Doji is represented by a candlestick with the upper and the lower shadow missing or shown very slightly.

The Hammer

We all know how an hammer looks like that's a longer tail a very small body seen all most close to the top.

Which is also seen most times all over the candlestick chart.

The hammers are very good for signals most expecially when seen near support or when it becomes a new era of support.

The Gravestone

The gravestone (or ‘tombstone’) is a candle with a long upper tail and a small body near the bottom of the candle, which is opposite of the hammer.

This is sign that sellers stepped into a hot market and created a graveyard for the buyers.

The gravestone are used most time for signals or in technical analysis, when seen near a resistance level.

It indicates that the buyer failed to push the up but the sellers made successful by pushing the price down.

Strategies Basics

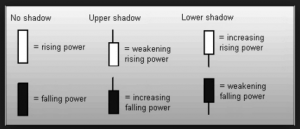

A very real body ( long body ) indicates higher pressure on that trade than a smaller body. For example there is more buying pressure in a longer body than a shorter one. Then also same theorem apply to selling too.

While trying to determine the group of traders (buyers or sellers) which was the strongest at the end of a trade or a candle over a period of time then you take a little time to study the shadows.

Long shadow at the lower part of a candle with a short shadow at the top of a candle signifies that the seller tried as much as possible to push the price down but the buyers succeed over them by pushing back up.

Vice ver sal of number 3

If a hammer or gravestone candle occurs near support or resistance, expect a reversal since the support/resistance has held.

Thanks for coming around.

You can also read the full details here Here

Great post, charting can be thought when starting out. And this is a great resource.

Upvoted, followed and resteemed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah

Thanks for coming around

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the good post https://9blz.com/hanging-man-candlestick-pattern/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit