Recently, the so-called initial coin placement (ICO) has become one of the most common methods of raising funds for launching and developing projects in the cryptocurrency industry. Most ICOs use the Ethereum network as a platform, or, more precisely, the smart contracts of this network. When conducting fundraising campaigns, ICO organizers usually accept ETH or BTC as payment, charging investors with tokens instead. Most often, these are tokens of the ERC-20 standard.

What does the acronym ERC-20 mean?

ERC (Ethereum Request for Comments) is an official protocol for making suggestions for improving the Ethereum network; 20 - unique identification number of the offer. Technical specifications for tokens produced on the Ethereum block system were published in 2015. Tokens meeting these specifications are known as ERC-20 tokens and in fact are smart contracts for the Ethereum block system. Despite the fact that the ERC-20 tokens function within the framework installed by the Ethereum command, this framework is quite broad, providing developers with greater flexibility when creating them. The ERC-20 standard defines a set of rules that must be met in order for a token to be accepted and able to interact with other tokens on the network. The tokens themselves are block-assets, which can have value and can be sent and received like any other cryptocurrency.

What was the reason for creating the ERC-20 standard?

Among the most famous ERC-20 tokens are: ZUZ Token, 0x, Aragon, Augur, Aeternity, Aion, Binance Coin, BAT, Bancor, Civic, Decentraland, Dentacoin, DigixDAO, Dragon, District0x, EOS, FirstBlood, Gnosis, Golem, Iconomi, Kin , KuCoin, Kyber, Melonport, Matchpool, Numeraire, OmiseGo, Po.et, Raiden, RChain, Ripio, SingularDTV, Status, Storj, TAAS, TenX, TTron, VeChain, Veritaseum, Viberate, WeTrust, Wings and iExec RLC.

What are the main characteristics of the ERC-20 protocol?

The ERC-20 standard provides six mandatory and three optional (but recommended) parameters for any smart contract.

Required parameters include the total supply function, which is responsible for the general release of tokens, making it impossible to create new tokens when the maximum number is reached.

The balance 0f function determines the initial number of tokens assigned to a specific address. Usually, this is the address belonging to the organizers of the ICO.

Also, the standard describes two methods for moving tokens, necessary for their distribution among users and the possibility of making transactions. So, the transfer function provides the transfer of tokens to the user who invested in the project during the ICO; the transfer from the function is necessary for making transactions between users. In addition, two more functions are needed to verify the two previous methods for moving tokens. The approve function is used to verify that a smart contract can distribute tokens based on total emissions, while the allowance function is necessary to verify that the address has sufficient balance to send tokens to another address.

Among the optional parameters is the definition of the maximum number of fractional digits after the decimal point (for comparison, bitcoin has eight such digits - 1.00000000 BTC), the name of the token and its symbol. The set of these parameters allows exchanges and purse providers to create a single code base that interacts with any smart contract ERC-20.

Are there any risks when using ERC-20 tokens?

Since ERC-20 tokens are actually smart contracts, they, despite all their efficiency, have certain risks. For example, a smart contract cannot be changed after it was initiated by the organizers of ICO, it can also contain bugs and vulnerabilities that can lead to a loss of funds. The history of Ethereum knows many similar incidents - one of the most famous examples was the hacking of The DAO in 2016. To eliminate its consequences and return funds to the network, a hardcore was conducted, as a result of which the new chain continued to exist under the name Ethereum, and opponents of such a decision retained the old chain, announcing the creation of Ethereum Classic.

Before the appearance of the ERC-20 standard, there were many compatibility problems between different forms of Ethereum-token, each of which had an absolutely unique smart contract. In other words, in order for a stock exchange or purse to support a token, its creators each time needed to write a completely new code. Thus, supporting a growing number of tokens became increasingly problematic, taking too much time. To solve this problem, a standard protocol for all tokens was created.

How do ERC-20 tokens differ from traditional crypto currency?

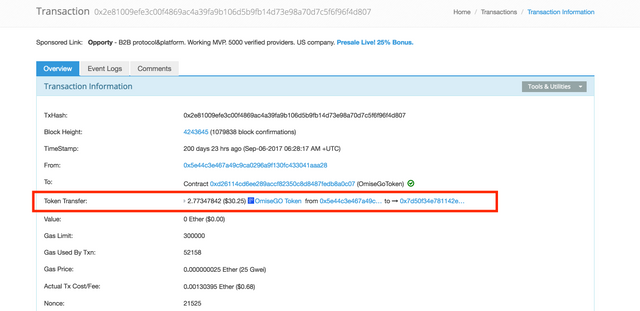

The difference of ERC-20 tokens from other known cryptocurrencies, for example, bitcoin or Litecoin, is that they are bound to the Ethereum network, use the format of addresses received within this network and are sent using Ethereum-transactions. Accordingly, transactions involving ERC-20 tokens can be traced in the block browser.

At first glance, such a transaction may look empty, since the 'Value' field is set to zero, but the number of tokens sent (in this case – Coalichain) can be seen in a separate field. It is important to understand that the ERC-20 tokens are not completely independent - as mentioned above, they are based on the Ethereum block system, on the distributed computing capabilities of which they rely on their work.

What are the ERC-20 tokens for?

Scenarios for using ERC-20 tokens are very different. For example, they can act as project shares, certificates confirming ownership of assets, points in loyalty programs or as a cryptocurrency. Also, there are options in which ERC-20 tokens simultaneously perform several such roles.

What other problems can arise with ERC-20 tokens?

It should be noted that the ERC-20 protocol is not always sufficient for purposes that are pursued when creating tokens and does not in itself guarantee that the token will be useful, valuable or functional. In addition, one of the drawbacks of the standard ERC-20 can be considered that it makes the possibility of creating tokens a fairly trivial matter at the technical level. This allows many projects to simply run ICO, which is confirmed by the total number of tokens - as of May 1, 2018, there were already about 80,000. This leads to an abundance of similar to each other tokens, significantly hindering the process of their selection by investors. Another problem is that tokens can be mistakenly sent to a smart contract by another ICO. In this case, if the smart contract does not provide such an opportunity, the tokens will be lost. As of the end of 2017 this way, more than $ 3 million was lost! To solve this problem, the proposal ERC-223, describing the situation in which the transaction inconsistent with the ERC-20 standard is rejected. You can also expect that certain changes in the future will undergo the ERC-20 protocol itself.