In cooperation with cryptocurrency exchange platforms, banking channels are expanding with new services. Cryptocurrency only exchanges on crypto trading platforms. These Cryptocurrency exchanges, cryptocurrency trading, and holding companies are now expanding their business. They perform well from the point of view of the client. Having a completely decentralized platform and trading without fiat is not literary.

Although cryptocurrencies are not useful as fiat money, the consequence of cryptocurrency trading is that you have to convert it to your country’s traditional money. Where cryptocurrencies are legal to trade or not properly regulated there is often the purchase and sale of crypto from credit cards. From traditional currency to cryptocurrency and cryptocurrency to traditional currency, exchanges have become an easier way of collaborating with the central bank.

Banks are now seeing cryptocurrency trading successfully. Banks provide multiple services to improve clients. Enabling the purchase of crypto from credit cards is a new approach.

Is it really true or just a bluff of RBC? A recent update from the Canadian banking service shows how the country is embracing cryptocurrency and bitcoin. The Royal Bank of Canada is about to launch a new service for its clients. Opening a bank crypto trading account is a new approach for the bank. Clients can trade with it, too.

While rumours are flowing in the industry Coindesk took initiative for confirmation. From the report of coindesk, we have accurate information that the Royal Bank of Canada is not opening any crypto platform for clients. But think about how it would be great if it does open the service. Well, sooner or later crypto firm and banking sectors will work along for building a better financial architecture.

Central banks are following trends in cryptocurrency. China is one of the biggest financial giants and was the biggest cryptocurrency rival before a month ago. But soon after it declared its interest in cryptocurrency and blockchain technology, it boosted the market for cryptocurrency. People’s Bank of China is planning to launch the gold-backed cryptocurrency of the Chinese government with stability. This facilitates the elimination of cryptocurrency laws within the country. The new law in China is being established to secure the platform for their digital currency. Now PBOC is about to serve the cryptocurrency trading service with or before the launch of their currency.

Now it’s almost clear how banks support cryptocurrencies to grow and the transaction would always be easier for crypto users. Banks are known to protect your assets. So, banks are opening cryptocurrency security services. The Swiss bank has recently announced the opening of a link between the traditional bank and the crypto bank. SEBA has already been certified by the Swiss Financial Market Supervisory Authority (FINMA). And now clients can open up and trade in both ways. The Swiss government, holding a positive stand for cryptocurrencies, is now embracing this new idea.

Banks know the benefits of connecting to the cryptocurrency sector. According to some idealists, cryptocurrencies could be a revolution in the currency system. Countries newly established stable coins could be the future of a currency system where paper money is no longer useful. Some people also don’t accept cryptocurrency as a valuable asset.

A traditional bank does not constitute a threat to anti-money laundering cases that a crypto bank does. The cooperation of traditional banks will provide a high level of assurance to crypto banks. Recently, the TRM labs have taken one step to solve the problem. The lab is eagerly forwarding its stand to the adoption of crypto, almost eliminating the risks associated with it. The project has raised almost $5.9 million for start-up operations. The company is accompanied by big names in the crypto industries. Paypal, which has already withdrawn its support from Libra, has now invested another blockchain event. The other two capital investors are Reddit and Blockchain.

The new financial institutional solution of TRM is ready to change the meaning of banking institutions. While it has support like PayPal, Reddit will bring the perfect platform for banks and cryptos.

In an interview, TRM representative said,

“Financial institutions use TRM to risk-score their cryptocurrency-related transactions, customers, or partnerships, helping them to simplify customer due diligence and meet regulatory requirements.”

Cryptocurrency and banking relationships haven’t stopped yet. The UK crypto firm has reported that they are entering a new banking option. Collaboration with the US bank will give the wings to explore the international market. This new approach has gone through the regulatory procedure and has been adopted by legislation. The Cashaa is now ready to celebrate its international market agreement with US banks.

Cryptocurrencies cannot live without a central bank transaction. From India, many crypto exchanges had to be closed this year because RBI had refused to trade. This leads the company to a massive loss, but the client was unaffected. So, if the government and the central bank do not have crypto exchanges, it is set to be doomed.

Cryptocurrency is one of the technological revolutions in the financial and technology system. One blockchain theory is linked to both technology and finance under one roof set. Regulations, however, still interfere with the concept in a number of fields. The government needs to pursue multiple asset security investigations and investigations. As many illegal events have taken place under the blockchain platform, the authorities need to be assured that they could rely on some decentralized sector.

Without proper verification, the government would not allow any new technology to enter the central banks for which the entire economic backbone could have been disrupted. Other countries are seeing cryptocurrencies as a solution to the devastating economic sectors. Like the Central Bank of Bahamas, its crypto idea came up under the name of Sand Dollar.

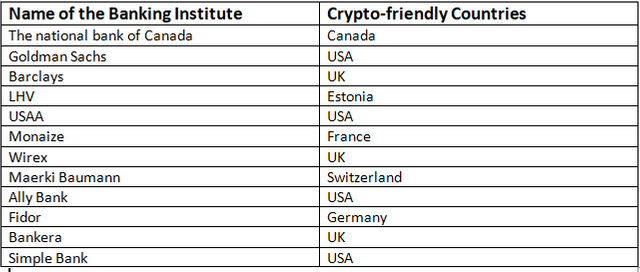

The friendship between banks and crypto will not be possible unless the government approves it. Here are some examples of a crypto-friendly institution where you can see the relationship between two sectors and analyze how clients are happy and profitable with the relationship.

As far as financial sectors rise, the crypto exchanges are getting a trading pass. The easy transfer of currency is made easier by linking the bank account to the crypto account. People could easily buy cryptocurrency with any Visa card. With these simple facilities, banks are helping the crypto business expand in every corner of the country. The support of banks is very valuable to the countries of crypto business. If you can’t transfer your crypt to the file, it would be unhelpful. So, crypto exchanges work well if the banking collaboration works well with them.

Follow us on our social channels:

https://www.coinbreze.com/

Telegram: https://t.me/coinbreze

Twitter: https://twitter.com/coinbreze

Facebook: https://www.facebook.com/Coinbreze

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@coinbreze/how-the-expansion-of-banking-channels-and-visa-card-helps-a-cryptocurrency-exchange-and-its-ced971f680df

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit