IEO has been identified as a start-up marketing strategy to avoid the regulation of ICOs (initial coin offerings). When countries have drawn a strict line over the Initial Coin Offering, the crypto-world has found another loophole in the name of the Initial Exchange Offerings (IEOs).

Two of these forms may sound similar, but the nature of the actions is completely at odds with another. Countries such as China, South Korea, Algeria; Bolivia has enforced a law on the total ban on ICOs. Other countries, such as the USA, Russia, etc. allow ICOs to trade under strict regulation lawmaking specially developed for ICOs.

It all starts when China took the step to ban ICOs in the nation. So, when cryptocurrencies are drowning under the rules of the IEOs nations, they provided their assistance to save them from sinking.

As it is new in the cryptocurrency, do not wonder about it anywhere else. Here, I’m going to get you covered in this blog with everything you need to understand about IEOs.

So, What Is IEOs?

Initial Exchange Offering is an oftentimes offered token on the Crypto Exchanges platform where no regulation acquaints a barrier. Dominating all IEO-related regulatory challenges is the most promising platform for crypto traders. For IEOs a minimum listing price and a percentage of token sales need to be paid. The payments facilitate the selling of token in the platform of the exchange for a startup to raise the funds. Participants need to enrol the name on the exchange platform which automatically gathers the crows during the sale.

With a substantial increase in cryptocurrencies, there has been an increase in exchange platforms. So, with every phase towards technical furtherance, the IEOs are another invention of the Crypto Revolution.

Which Platform Supports IEOs?

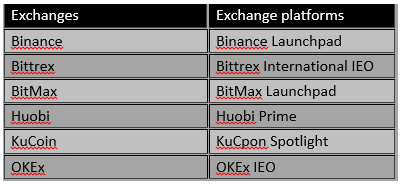

New initiation involves the adoption of another fresh technology. Since IEOs has begun its token, it needs a platform to embrace IEOs and validate their listing on an approved platform. Binance Launchpad is one of its first types intended to promote exchanges with IEOs and to provide an original boost to crypto markets.

Following the launch of Binance Launchpad in January 2019, the future possibilities for other crypto-exchange organizations have changed. After laws that tighten or even ban the launch of ICOs in many nations, this demonstrates light in the dark age of ICOs. Now, crypto-exchange industries like Bittrex, BitMax, Huobi, KuCoin, OKEx have launched their own IEO platform. These networks will be used on the posting and complete set of funds.

Successful Stories Of Exchanges Platforms:

Exchange platforms have brought prosperity to several IEOs. The tales are numerous here, and I am going to give you data about the two people who have received a substantial amount of attention in the crypto globe.

#1

The glory of BitTorrent gives motivation to many IEOs for exchange platforms. The token named TRON raised $7.2 million in its first sale within 15 minutes. Two crowdsale sessions were capable of trading 59.4 billion tokens. Binanace launchpad BTT was exchanged via Binance Coin and TRON tokens, which bring forth a history after an enormous achievement.

#2

This is one of the quick stories that have raised $6 million in 10 seconds. Noteworthy fundraising was able to get 69,204,152 FET for Will Follow in seconds. Fetch.AI the IEO token brings Will Follow with 2758 contributors to the crypto sector.

The potency of these stories has resulted in massive adoption, leading to further exchanges to build platforms for the collection of funds. Not only for the funds, but also many exchanges, the loophole was discovered and willingly working on the IEOs project, bringing several enthusiasts to the project support.

Don’t Blend IEOs With ICOs — They Are Not Same:

You may have learned that IEOs are only options to ICOs. Although, indeed, there are still some separate characteristics that add a stronger dimension to ICOs for crypto traders. IEOs solve every problem faced by traders in Initial Coin Offerings (ICOs). The variables that are opposite to IEOs from ICOs, I’m going to take you on a trip to discover these circumstances.

Platform: It is very important to understand where the original products are being sold. Exchange organisations perform IEO sales only on their platform. However, ICO sales are made on the developers ‘ websites.

Crowdsale Countryparty: for IEOs, the corresponding cryptocurrency Exchange platforms will start the project. By following the unique nature of the project, ICOs could only be the initiator of the project.

Management: ICO’s healthy agreements are managed by the fresh token-selling sector. However, the Smart Contract Regulations of IEOs have taken care of the Cryptocurrency Exchange Platform.

Confirmation: IEOs is much simpler to buy than ICOs. Once you are enrolled with the Exchange Platform, no further substantiation must be eligible for IEO sales. Whereas the KYC / AML information must be checked by the startup management team.

Budget Requisite: an enormous collection of cash needed to initiate the marketing of token sales in ICOs. IEOs needed a relatively small budget because the exchange platform is marketing it so that IEOs get instant attention from the crowd.

Company Verification: not everyone is qualified to launch an IEO sale. In order to carry out an IEO sale company, a screening test was acquired before the IEOs started the process of raising funds. ICOs do not involve any authentication from anyone in the crypto globe. Anyone can set up an ICO to boost the project.

Token Listing: While the verification was carried out by Exchanges systems and the firm also cooperated with Exchange, the token list was automatically entered on its platform. However, in a separate way the ICOs token need to reach out for listing in Crypto–World Exchange Platforms.

Now, you are well conscious of the distinction between ICOs and IEOs. Now concentrate on the prosperous locations that IEOs attract most project lovers.

Find Out IEOs Main Features That Influence Public:

Trust:

Fidelity is one of the main issues encountered by the audience. ICOs can be provided with any startup without being screened. In the past few years, multiple frauds have been registered with ICOs. Whereas IEOs are offered by Exchanges platforms for where cryptocurrency trading is the main service. Proper authentication is needed to register the sale of IEO. The sale of IEO is not accessible to all. With trust in the exchange platforms, IEOs are more likely to be considered a trustworthy project.

Listing:

The submission of tokens on the swap system will take place shortly after the closure of the purchase of the tokens. This instant enrollment sometimes appears to be expensive compared to ICOs. However, this is performed automatically because of the confidence of the exchange systems.

Do You Want To Know The Process To Enter An IEO Sale?

Here, I detailed onto the information. IEOs also look more authentic than ICOs. It is surprising to find new IEOs in the enterprise. So, look for an IEO crowdsale promotional template and get data about the transfer system that will make the transfer. Once you have filled up with the data, register yourself on the Exchange Platform. Next, do the KYC / AML checks closely. Without adequate checking, you will not be permitted to log on to a swap site that will result in an IEO selling forbiddance.

After proper verification, you must search for the cryptocurrencies to support the IEOs. Volume up your account that would be acceptable to the crowdsale and then just wait for the crowdsale to begin.

What Is The Future Of Crypto-World With The IEOs?

Providing an honest forum for the IEO stockholder is supposed to be a focal point of appeal. The future is very safe with the notion of IEOs, and it also prevents ICO fraud. This will assist the fresh inaugural to roll up the money. As a result, more money will motivate the builder to take fresh initiatives commonly. Exchanges have built up confidence over the last few years. Their safety leadership offers more confidence to IEOs.