Is that worth investing in cryptocurrencies?

What kind of vision are they going to offer me?

These were the most commonly asked questions for newcomers. When a new entity enters the market, this takes years of confidence to create a trustworthy forum for shareholders. Others are willing to take risks. Now the problem is, are cryptocurrencies a threat or a safe investment?

Every investment strategy is capable of avoiding the threat in stock markets. You’re losing your money, whether it’s a traditional market share or a crypto company if you don’t analyze. If I were to suggest that cryptocurrencies are the best place to invest then I would have been totally wrong. Nonetheless, cryptocurrencies are the most valuable commodity to acquire when you obey the correct investing policy.

I’m going to guide you through this post on how to invest in cryptocurrencies and its logic behind it.

Why Are People Afraid To Engage In Cryptocurrency?

This needs a great deal of confidence to believe in any new concept. Although the cryptocurrencies are a 10-year-old story, it absorbs most of the threat around it.

Bubble Risks

The values for cryptocurrencies are the most unpredictable in general, where the high risk of failure is always related to speculation. Most of the case studies indicate that failures happen mainly in the cryptocurrency bubble. Therefore, if you see that the market is growing large in value, you should not invest in cryptocurrencies. Though it’s up to your judgment, sometimes the bubble promises to make quick money as well.

Regulation

Another major fact that is people kind of are putting a step back from investing in cryptocurrency is its regulation process. Most of the countries have banned the ICOs and holding any crypto fund will be a punishable offense. Some of the countries are still in the process of regulation. Binding cryptocurrencies under a central body has become the many country's main mottoes.

Trust Issues

There are almost 2,500 cryptocurrencies listed on the market. Citizens are always scared to choose where to spend and what will carry the maximum amount to the wallet? Many choices contribute to uncertainty and people can make a mistake or end up choosing the wrong crypt at the wrong timeframe.

Apart from the aforementioned, citizens always have a private reason to avoid investment. Yet are they ever taking a small leap towards cryptocurrencies? If you never seek, you’ll never know the utility of crypto-trading in your asset class.

Why Do You Want To Trade In Cryptocurrency?

I understand that many newcomers are not used to the investment advice in bitcoin or altcoins. Nevertheless, their lack of information on cryptocurrency trading prevents them from participating. But they don’t know how good or competitive it can be if they join the crypto community.

If I’m suggesting you to invest in cryptocurrencies then I must have some good reason to convince you. If you are starting from the beginning then there are many factors that you should know then only you can full confidence over crypto investments.

Profitable

Investing in blockchain is not a joke. A minor miscalculation can contribute to a negative result. Cryptocurrencies in the long-term cycle guarantee high returns. But if you buy some cryptocurrency in your crypto-bubble nation, you’ll need to sell in the short term. Holding cryptocurrency amid price hikes could cost you more. Therefore, if you want to make money from cryptocurrencies, you’ll get the highest profit in the long run. Both short-term and long-term cryptocurrencies are always lucrative.

Security

Bitcoin is a non-government asset that has no impact on the status of stock markets. Therefore, if your country faces any economic issues and decreases the saving rate, then cryptocurrencies are the only thing that can save your property. When it comes to stable property, cryptocurrencies are considered to be “safe heaven.” As the national regulators do not deal with it, the sector is completely safe to deposit the capital in digital form.

Ease of Payment

When you keep a Bitcoin wallet, don’t hesitate for days for a foreign transfer. Since no government organization manages the payment method, several authentication measures are not necessary. The global transfer, however, for personal or business purposes, is quicker than the traditional route. Your payment can take minutes to complete.

Transaction Fees

You may be conscious of global intra-bank or inter-bank transaction fees. The charges for the new system needed a high percentage of the principal amount. But the autonomous pool for cryptocurrency trading payments is restricted to about 3%, which is less than the conventional exchange rate.

Cryptocurrencies do not only have trading options, but you can receive as well as use the services provided by the cryptocurrencies. You can also buy your vehicle, water, grocery items, etc. from chosen shops. Therefore, cryptocurrencies are a ton of uses rather than banking, and with cryptocurrency, you’re going to enjoy high earnings.

So, there are growing ways to use the cryptocurrency, and you can be confident that you have protection for your property. How long are you trying to get interested in the crypto investment? Let me lead you through the fundamentals of cryptocurrency investment? Various cryptocurrency investment strategies are needed to ensure that investments are made in a safe manner.

What Do You Need To Learn Before You Trade In Cryptocurrency?

The first phase in “how to invest in cryptocurrencies” instruction is needed to understand the fundamentals of the cryptocurrency market. You need to find out how big the lake is before you move onto the sector. You can’t immerse yourself in the pool without learning how to dive or you can use a swimming float.

Here are some precautions you need to take before you start investing in the crypto-market.

#1 The demand for crypto and the stock markets are not the same. If you want to invest in bitcoin share after researching NYSE, this isn’t going to help. You need to research the market fluctuations and the operating theory of the crypto-market.

#2 You need to pick up your cryptocurrencies. Conduct extensive research on top volume coins and high rated cryptocurrencies. The one you choose will ensure that you have the full list of requirements. Over 2500 crypto coins only a few are known to be secure, but you are free to choose any cryptocurrency.

#3 The market fluctuation of the cryptocurrency you chose must be carefully studied. If you don’t obey the map, you can lose yourself.

#4 “Invest the sum of cryptocurrencies that you can afford to lose” is a straightforward investment strategy. Don’t sell your house or vehicle or any of your physical assets to buy a virtual commodity. Cryptocurrency Investment Strategy suggests that the more you spend, the more you win. Nonetheless, they’re not asking you to gamble all your possessions to hang on to some digital currency.

#5 Just play safe and try buying cryptocurrencies when the price is low when they are removed as soon as possible when they are boosted. Trading during bubbles required skills and highly trained professionals. Also, if anyone wanted to buy crypto stock in their bubble era, don’t save it for too long. In the year 2017, the first bitcoin bubble created several billionaires, earning more than 19,000 US dollars for one BTC.

#6 Read the white paper that offers you the most cryptocurrency resources and also gives you the credibility of trading.

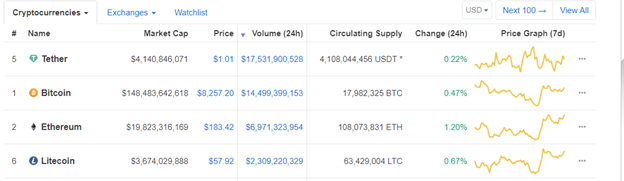

#7 The trading volume for cryptocurrency needs to be analyzed. This will show that people are actively buying and selling bitcoin on the internet. Here is a snapshot of the trading volume of the top 6 cryptocurrencies for 24 hours at the time of writing.

#8 Search for the recently launched ICOs that you’ll get at a low price but expect a long return after that.

#9 The country’s constitutional frameworks on cryptocurrency are the biggest factor here. If your nation does not accept cryptocurrencies, you should not continue. The electronic trading platform can not be bound by the law as it is entirely autonomous. Nevertheless, you can transact in cryptocurrencies using other fiat currencies that permit exchanges such as USD, Eur, etc.

Check out the global stance on cryptocurrencies: https://medium.com/altcoin-magazine/global-stance-on-cryptocurrency-13863a3cc5b6

#10 Last but not least, the fact that is highly influential in order to make a transition in market capitalization is its appeal. The more popularly traded in cryptocurrency news on the web, the more likely it is to have an impact on price fluctuations. And keep up-to-date with various crypto news around the world.

Here’s the top ten cryptocurrency trade headlines for September: https://medium.com/@coinbreze/september-news-update-with-top-10-news-of-cryptocurrency-eeb58458f9f

Though the starting of the cryptocurrency doesn’t bring a move, now in 10 years of celebration we have witnessed massive growth of the industries. We could expect flourished enhancement in the future and investing in cryptocurrency might be a great choice.

Disclaimer: The above suggestion should not be taken as market advice. Market Risks are always changing its color so, you have to be careful before every investment you make and thing blog will not be responsible for any of your trading results.