Bitcoin (BTC) has recently faced significant price volatility, reaching five-month lows. Despite this, indicators suggest bullish sentiments might dominate, hinting at potential price resurgence.

Key Catalysts for Bullish Momentum

Bullish Divergence on the Price Chart

BTC dropped over 10.50% in early July, hovering around $57,000, with a low of $53,550. This decline was influenced by Mt. Gox's ongoing BTC reimbursements and German government liquidations. Amidst the fall, a bullish divergence between falling prices and rising Relative Strength Index (RSI) suggests reduced selling pressure, potentially setting the stage for a rebound.

September Rate Cut Prospects

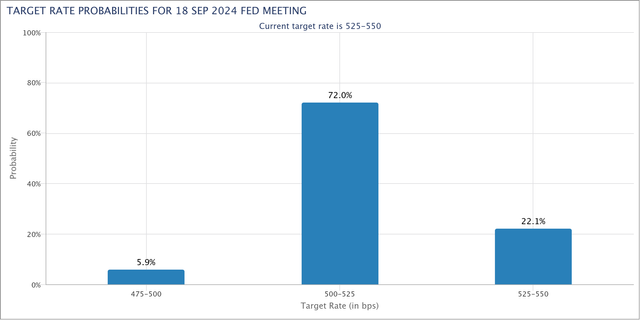

The likelihood of interest rate cuts in September is increasing, with a 72% probability of a 25 basis points cut by the Federal Reserve. This expectation is fueled by a slowdown in U.S. hiring, favoring riskier assets like Bitcoin over safe-haven investments.

Increasing M2 Supply

Growing M2 supply, indicating total money circulation, could fuel Bitcoin's bull market. Increased liquidity historically leads to higher investments across assets, including cryptocurrencies.

Market Conditions and Impact

- Tensions and Selling Pressure

Tensions around the U.S. Presidential elections and a $9 billion Mt. Gox release have intensified selling pressures, impacting Bitcoin and altcoins like Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and Litecoin (LTC).

- Market Fear & Greed Index

The Market Fear & Greed Index at 28 (Fear) reflects cautious investor sentiment.

The global crypto market cap is $2.04 trillion, down 3.45% daily. The 2024 bull run drives interest in altcoins, highlighted by Altcoin Daily's insights.

Altcoin Daily spotlights promising altcoins beyond Bitcoin and Ethereum (ETH), offering investment opportunities amidst market dynamics.

Want to know Which are those Altcoins ?👇

https://coinpedia.org/news/top-9-cryptos-that-can-make-you-rich-by-2025/