The Spot Bitcoin Exchange-Traded Fund (ETF) has quickly become a significant focal point at the crossroads of cryptocurrency and traditional finance during its inaugural week. Positioned as a more regulated and secure option for investors entering the Bitcoin market, the anticipation surrounding this new ETF is palpable.

Here are the highlights from its opening day:

🔵 On January 11, investors actively traded shares across ten SEC-sanctioned funds.

🔵 The Grayscale Bitcoin Trust, valued at $28 billion, saw the highest share turnover.

🔵 Trading volumes for Grayscale exceeded $2 billion, contributing to a cumulative volume of $4.6 billion on the first day.

🔵 Approximately $2.33 billion worth of Grayscale fund shares were traded on the opening day.

Total Trading Volume and Market Share:

In the first four days of trading, BlackRock's spot Bitcoin ETF achieved a significant milestone by amassing $1 billion in assets. It became the first among recently launched ETFs tracking spot Bitcoin prices to reach this asset level. Fidelity followed suit, becoming the second entity to attain the $1 billion asset milestone.

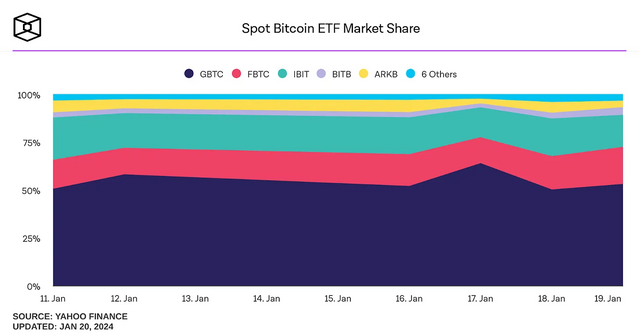

By the sixth trading day, the total trading volume for the 11 spot Bitcoin ETFs surpassed $16.4 billion. As of January 19, Grayscale holds nearly 53% ownership, leading the market share in spot Bitcoin. Notably, Grayscale, BlackRock, and Fidelity collectively command over 90% of the total volume.

On January 19, the daily volume surged to $2.6 billion, compared to $2.1 billion the previous day. However, these figures are lower than the $3 billion volume observed last Friday and the initial $4.6 billion on the first day of trading.

Amidst Bitcoin's price fluctuations, dropping from $49K to a precarious position below $40K, the emergence of ETFs seems to be influencing market dynamics. Notably, substantial outflows from Grayscale Bitcoin Trust (GBTC), totaling around 10,824 BTC valued at $445 million, have potentially introduced additional supply. The repercussions of Grayscale's massive withdrawals, combined with the contrast in expense ratios, raise questions about the success prospects of the Spot Bitcoin ETF. For more in-depth information, explore our comprehensive report by clicking below.

https://coinpedia.org/news/weekly-spot-bitcoin-etf-report-insights-after-its-first-trading-week/