Bitcoin ETFs are seeing significant inflows, with Grayscale's Mini BTC Trust ETF leading with $191 million. Despite this, Bitcoin’s price remains highly volatile.

Bitcoin ETFs Experience Major Inflows

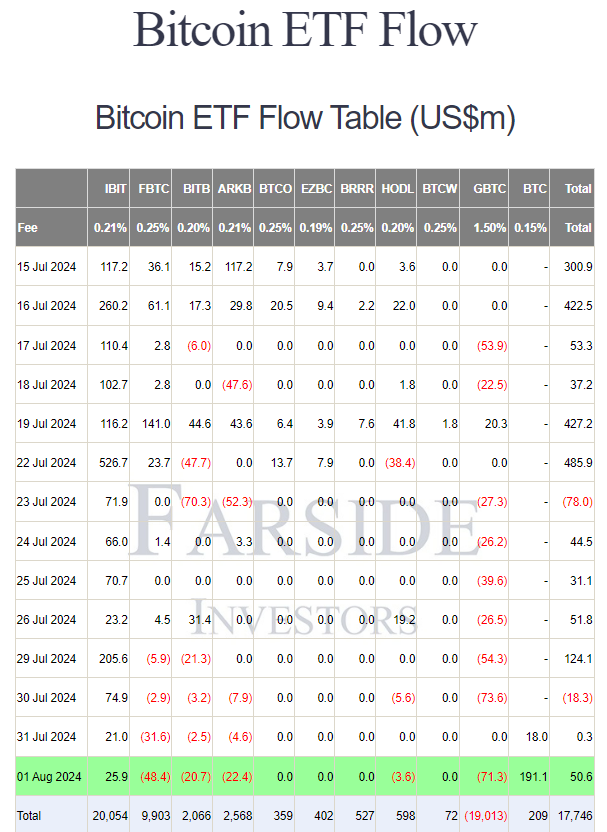

On August 1, Bitcoin ETFs saw notable inflows. Grayscale’s Mini BTC Trust ETF, with the lowest trading fees, recorded $191.1 million. BlackRock’s IBIT ETF also saw $25.9 million in inflows.

However, other Bitcoin ETFs faced outflows. Fidelity’s FBTC had $48.4 million in outflows, Bitwise’s BITB $20.7 million, and Ark 21Shares’ ARKB $22.4 million. Grayscale’s GBTC saw $71.3 million in outflows due to its high 1.5% fee, with its price falling to $50.53—a 2.96% drop.

Ether ETFs Struggle with Continued Outflows

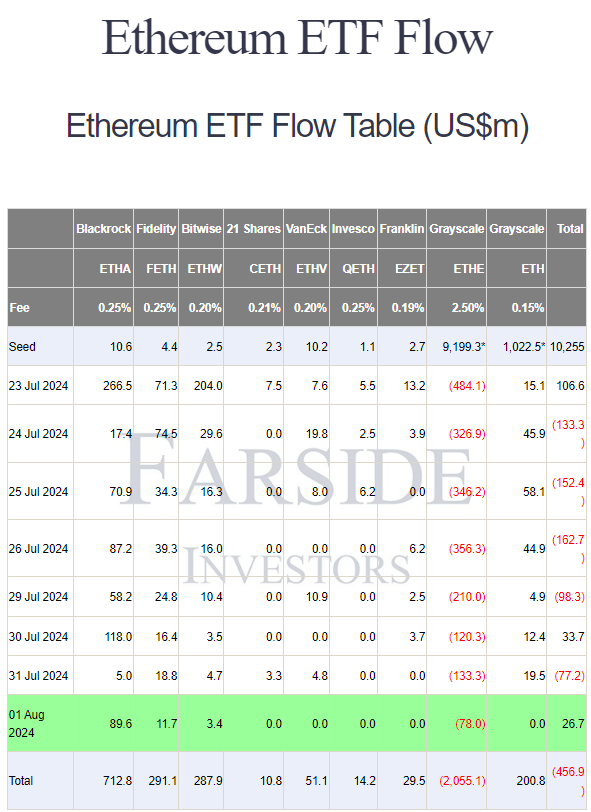

Grayscale’s Ethereum ETF (ETHE) faced $78.8 million in outflows as of August 1, pushing the total to over $2 billion. However, outflows may be slowing, hinting at a possible market shift.

Bitcoin’s Price Volatility Continues

Despite ETF inflows, Bitcoin's price remains volatile. It’s trading at $64,352, up 0.09%, with a 24-hour range of $62,248.94 to $65,593.24.

Recent volatility includes $2.5 billion in liquidations as Bitcoin fell below $63,000. Today’s expiry of 37,000 Bitcoin options adds to the market uncertainty.

Institutional Interest Boosts Market Optimism

In positive news, MicroStrategy plans a $2 billion equity offering to buy more Bitcoin, and Coinbase exceeded Q2 earnings estimates. Additionally, institutional interest in Bitcoin is growing, with firms like Mercado Libre and BNY Mellon revealing their holdings. This institutional involvement supports a bullish outlook for Bitcoin and related products.