Recently, U.S.-based spot Bitcoin exchange-traded funds (ETFs) experienced a significant turnaround with over $100 million in net inflows, countering two consecutive days of outflows. This surge follows shifts in inflation data and signals from the Federal Open Market Committee (FOMC) regarding interest rates.

Inflow Reversal Amid Economic Indicators

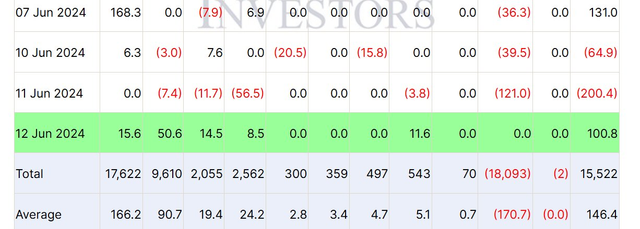

On Wednesday, June 12, spot Bitcoin ETFs in the U.S. saw a total inflow of $100.8 million, marking a noteworthy reversal that has bolstered market sentiment. This comes in anticipation of upcoming economic data releases and central bank decisions, such as the U.S. Producer Price Index (PPI) and the Bank of Japan's interest rate decision.

Key Players in the Inflow

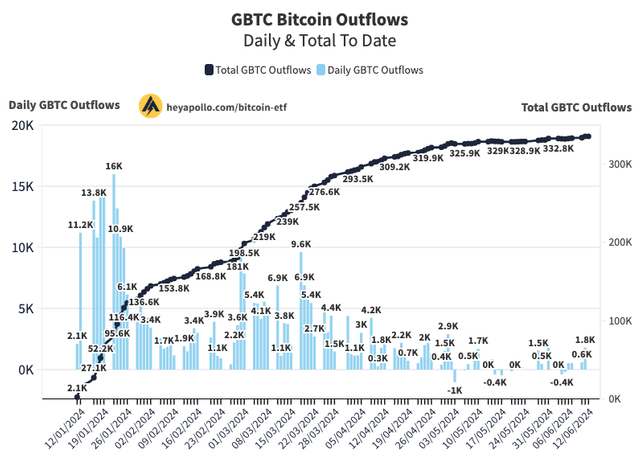

Fidelity Bitcoin ETF (FBTC) led the charge with an inflow of $50.6 million, underscoring strong investor confidence. Other notable ETFs like Bitwise Bitcoin ETF (BITB), VanEck Bitcoin ETF (HODL), and Ark 21Shares Bitcoin ETF (ARKB) followed suit with inflows of $14.5 million, $11.6 million, and $8.5 million, respectively. However, Grayscale Bitcoin Trust (GBTC) recorded zero inflow after recent outflows, signaling caution among investors.

Market Outlook and Price Forecast

Despite the positive inflows, concerns linger over potential downward pressure on Bitcoin's price. Wall Street expectations of a Federal Reserve rate cut in September contrast with the FOMC's more conservative stance, influencing market dynamics. Additionally, options traders are eyeing opportunities to sell Bitcoin ahead of the monthly crypto expiry on June 28, with projections suggesting a price ceiling around $55,000.

Technical and Trading Insights

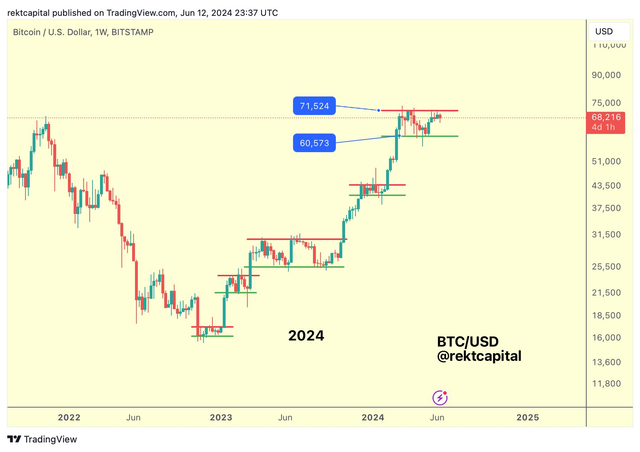

Market analysts like Rekt Capital highlight ongoing "Re-Accumulation ranges" in Bitcoin's cycle, suggesting periodic buying opportunities amidst price volatility. Whales in the market are observed to be actively trading rather than holding positions, contributing to market fluctuations.

Current Price Dynamics

As of the latest data, Bitcoin is trading around $67,559, having fluctuated between a low of $67,028 and a high of $69,977 over the past 24 hours. This movement reflects heightened trading activity, indicating sustained interest and potential volatility ahead.

While recent inflows into Bitcoin ETFs signal renewed investor interest, potential risks from economic indicators and trading behaviors suggest a cautious market sentiment. As stakeholders navigate upcoming data releases and market movements, the trajectory of Bitcoin's price remains uncertain amidst evolving global economic conditions.