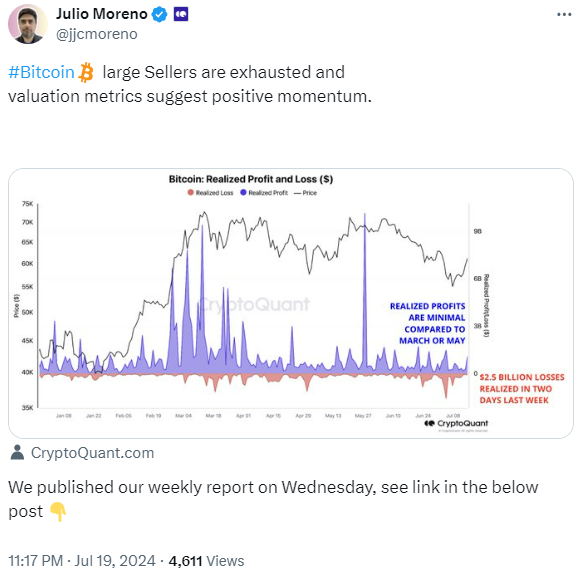

Bitcoin has recently seen a notable reduction in selling pressure from large investors, particularly those holding between 1,000 to 10,000 BTC. Julio Moreno, head of research at CryptoQuant, highlighted that these large sellers appear exhausted, indicating a potential shift in market dynamics. Unlike the significant realized profits during March and May when Bitcoin surpassed $71,000, current profits are minimal, suggesting a stronger hold among investors.

Positive Momentum: Bitcoin's Recent Surge

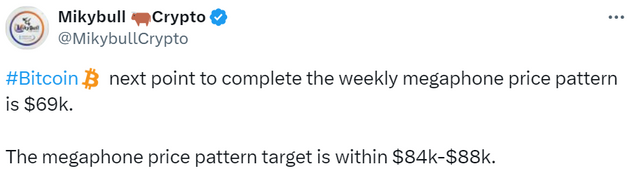

Bitcoin is trading at $67,088, marking a 12.15% increase over the past week. Traders are paying close attention to the critical $65,000 support level, with speculation mounting that Bitcoin could soon hit $69,000. Crypto trader Milkybull Crypto has pointed out that the next target to complete the weekly megaphone price pattern is $69,000, with potential further gains to $84,000-$88,000.

Critical Levels and Market Context

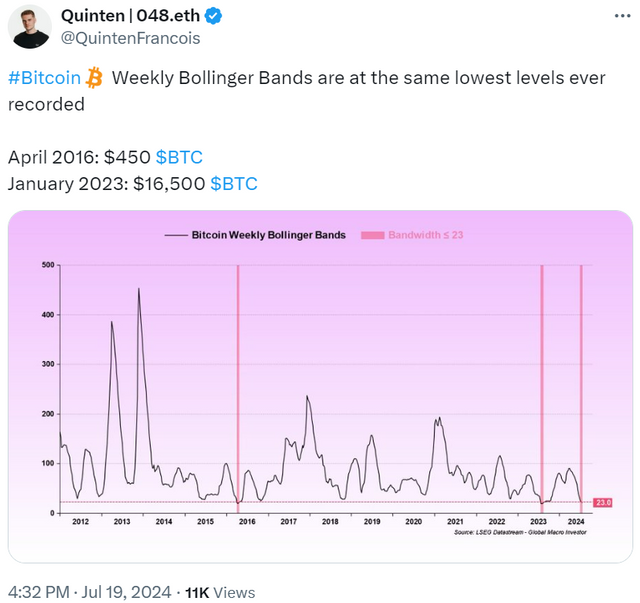

Reaching $69,000 could wipe out $261.9 million in short positions, according to CoinGlass data. Although Bitcoin hasn’t touched $67,000 since June 12, several bullish indicators suggest the uptrend may continue. Quinten Francois noted that weekly Bollinger Bands are at their lowest levels ever recorded, indicating strong momentum.

Bitcoin’s price experienced a sharp drop below $60,000 to $53,905 on July 5 before recovering. Philip Swift observed that Bitcoin’s price has returned to the Short-Term Holder Realized Price, a key indicator for speculative Bitcoin holders. On-chain College, a crypto trading account, also noted that Bitcoin breaking above key levels signals strong momentum and support at $64,000.

Ethereum ETFs: A New Opportunity for Investors

A significant milestone for the cryptocurrency market is on the horizon with the launch of nine spot Ethereum ETFs on July 23. This event offers new investment opportunities and marks a pivotal moment for Ethereum.

Launch Date and Platforms

After overcoming years of regulatory challenges, spot Ethereum ETFs are set to start trading on July 23. The Chicago Board Options Exchange (CBOE) confirmed the launch for five ETFs, including those from 21Shares, Fidelity, Invesco, VanEck, and Franklin. The remaining four ETFs are expected to list on Nasdaq or NYSE Arca around the same time.

Where to Trade

Investors will be able to purchase Ethereum ETF shares on major brokerage platforms such as Fidelity, E*TRADE, Robinhood, Charles Schwab, and TD Ameritrade. These ETFs will be listed alongside traditional assets, broadening their accessibility.

Fee Structure

Management fees for these ETFs range from 0.15% to 2.5%, with some offering temporary fee waivers.

Staking Availability

Currently, staking options are not available for these ETFs.

In summary, the reduction in Bitcoin's selling pressure, combined with positive momentum indicators, paints an optimistic picture for Bitcoin investors. Meanwhile, the upcoming launch of spot Ethereum ETFs opens new avenues for investment, reflecting the growing maturity and acceptance of cryptocurrency markets.