In a surprising turn of events, a significant Bitcoin entity recently transferred 1,800 BTC worth $114 million to Binance. This move swiftly drove down Bitcoin's price from $63,800 to $62,500, sparking widespread market concerns about further sell-offs.

Accumulation and Sell-Offs: Insights into Market Behavior

Previously, this entity had amassed over $400 million worth of Bitcoin from a prominent exchange. Recently, it has been actively reshuffling its holdings, withdrawing substantial amounts from exchanges like Binance and OKX. Over the past few days alone, it has moved back 3,481 BTC valued at $217 million to Binance, strategically taking advantage of price recoveries.

As of now, the entity still holds a significant 7,867 BTC, valued around $494 million. Its actions are closely watched by the market, as any future moves could amplify market volatility.

Bitcoin Miners Join the Sell-Off

Adding to the downward pressure, Bitcoin miners have been actively selling off their holdings. Within the last 72 hours, miners collectively sold more than 2,300 BTC, equivalent to approximately $145 million. This strategy is seen as a response to the recent Halving event, where block rewards were reduced, prompting miners to manage their profitability by selling accumulated BTC.

Government Involvement in Bitcoin Liquidations

Beyond entities and miners, governmental bodies are also influencing market dynamics. Recently, the German government liquidated over 1,500 BTC, a portion of which was promptly sent to major exchanges like Coinbase, Kraken, and Bitstamp. Since June, Germany has sold more than 2,700 BTC, contributing further to market volatility.

Market Impact and Future Speculations

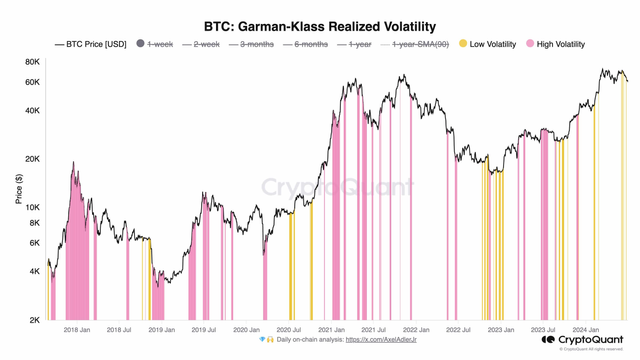

These combined actions—whale movements, miner sell-offs, and governmental liquidations—have intensified the downward pressure on Bitcoin's price. This volatility underscores the current uncertainties in the market, as investors and traders navigate these large-scale movements.

Expert Insights and Market Outlook

Ki Young Ju, CEO of CryptoQuant, weighed in on the situation, describing the current Bitcoin market as "boring" but also highlighting it as an opportunity for strategic accumulation. Despite the reduced volatility and cautious market sentiment, Ju believes that the underlying bullish cycle remains intact, presenting potential opportunities for informed investors.

As the market reacts to these significant movements, the future trajectory of Bitcoin's price remains uncertain. Investors are advised to monitor developments closely, as further sell-offs or strategic accumulations could continue to shape market dynamics in the coming weeks. The interplay between institutional actions, mining economics, and governmental policies will likely dictate Bitcoin's short-term price movements.