Bitcoin is poised for a potential comeback in July after a challenging June, where its value dropped nearly 7%. According to Coinglass data tracking Bitcoin's monthly returns since 2013, June historically sees a minor slump of about 0.35%.

Historical Rebound Patterns

https://www.coinglass.com/today

Historical data reveals a promising trend: whenever Bitcoin ends June on a downtrend, July typically marks a significant recovery. On average, Bitcoin has bounced back by approximately 7.42% in July following lackluster Junes. In seven out of the last 11 years, Bitcoin has posted gains exceeding 8% during July.

Insights from Memecoin Analyst Murad

Memecoin analyst Murad has underscored this pattern to their substantial following on X, noting Bitcoin has surged by at least 28% in the initial weeks of July over the past six years.

Challenges Ahead: Mt. Gox and German Government Sales

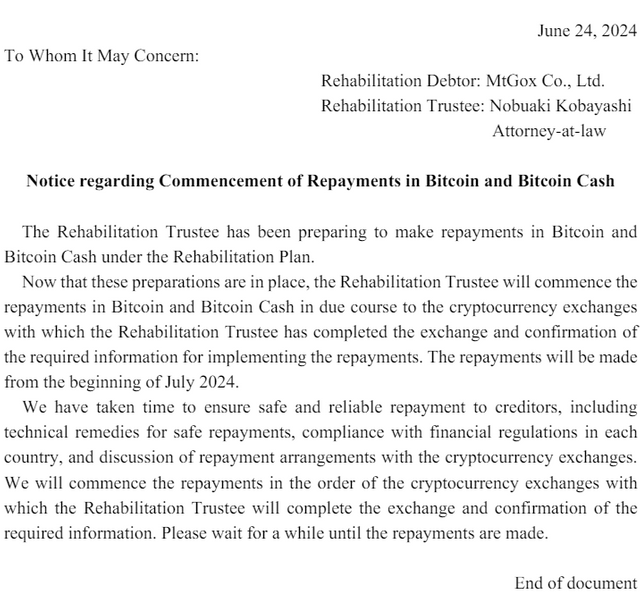

Analysts are cautious about Bitcoin's July performance this year. Concerns loom over factors such as the German government's sale of Bitcoin and the impending Mt. Gox repayments, which could exert downward pressure on Bitcoin's price.

Impact of Mt. Gox Repayments

Starting in early July, Mt. Gox creditors are expected to receive repayments amounting to approximately $8.5 billion in BTC. Market analysts suggest only about $4 billion of this could directly impact the spot BTC market, tempering concerns about oversupply.

Expert Opinion: Jonathan de Wet's Perspective

Jonathan de Wet, chief investment officer at ZeroCap, remains cautiously optimistic despite challenges. He notes Bitcoin has shown resilience, trading robustly in the low to mid $60,000 range. However, de Wet warns of a possible dip to around $57,000 if Mt. Gox repayments trigger market volatility.

While Bitcoin historically thrives in July, achieving notable gains after lackluster Junes, the current landscape presents unique challenges. Investors should monitor developments closely, particularly the impacts of Mt. Gox repayments and government actions, which could influence Bitcoin's short-term price movements.