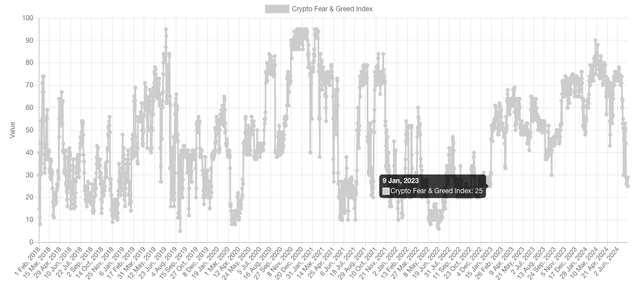

Bitcoin's recent struggles to reclaim key price levels have driven the Crypto Fear & Greed Index to its lowest point since January 2023, marking a shift to "extreme fear" in investor sentiment.

The Decline in Crypto Fear & Greed Index

The Crypto Fear & Greed Index, a gauge of market sentiment towards Bitcoin and cryptocurrencies, has plummeted to "extreme fear," highlighting widespread apprehension among investors. This drop comes amidst Bitcoin's inability to breach the $60,000 threshold in recent days.

Market Analysis by Justin Bennett

Crypto and forex trader Justin Bennett, in a July 11 update, noted Bitcoin's repeated failure to surpass $60,000 and highlighted the formation of a potential "rising wedge" pattern, signaling possible downward movement in the near term.

Price Volatility and Recent Movements

Bitcoin experienced volatility with prices peaking at $59,485 on July 10, only to retreat to $57,000 within 12 hours. Although briefly rallying to $59,529 on July 11, Bitcoin struggled to maintain these levels.

Current Bitcoin Price and Performance

As of the latest data, Bitcoin is trading at $57,499, marking a 23% decline from its peak recorded on March 14, according to TradingView.

Factors Influencing Bitcoin's Price Decline

Mt. Gox Creditors and Market Impact

Recent negative sentiment has been attributed to Mt. Gox initiating repayments to creditors starting July 5, potentially injecting up to $8.5 billion worth of Bitcoin into circulation.

German Government's Bitcoin Sales

Large-scale Bitcoin sales by the German Government further contributed to downward pressure. Reports indicate 16,254 BTC, valued at approximately $935 million, were transferred to market makers and exchanges recently, according to Arkham intelligence.

Understanding the Crypto Fear & Greed Index

Components and Weightage

The Crypto Fear & Greed Index considers factors like market volatility (25%), trading volume (25%), Bitcoin's dominance (10%), and trends (10%). Previously, it also incorporated market surveys (15%), though this component is currently on hold.

Historical Trend and Recent Scores

Bitcoin's index score has steadily declined since reaching a high of 90 ("extreme greed") on March 5, coinciding with Bitcoin's previous all-time high of $69,000 in November 2021.

Bitcoin's recent price struggles, combined with external factors like Mt. Gox's creditor repayments and governmental Bitcoin sales, have intensified market uncertainty. The shift to "extreme fear" on the Crypto Fear & Greed Index underscores current challenges in Bitcoin's price recovery and investor sentiment. As market dynamics evolve, stakeholders remain vigilant for potential shifts in sentiment and market stabilization efforts.