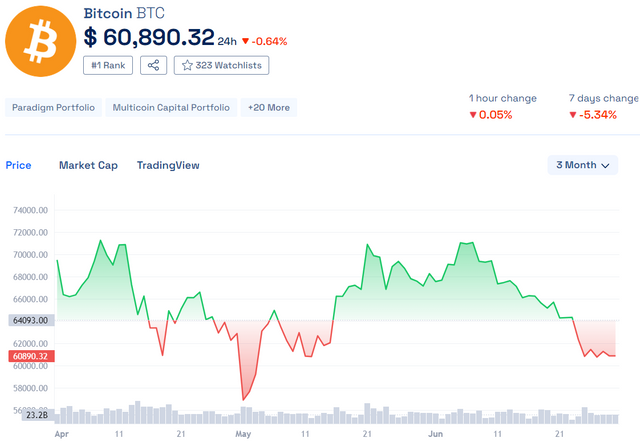

Bitcoin has seen a significant setback in Q2 2024, with its price dropping nearly 15%. Earlier bullish predictions of a $100,000 target have been tempered by persistent selling pressure in April and June. Despite a brief May recovery, Bitcoin struggles below $60,000 as the quarter ends.

Current Price Trends

At the Q2 start, Bitcoin traded just under $71,000. As of now, about 60 hours before Q2 closes, Bitcoin is at $60,800, down over 14% for the quarter. Ethereum (ETH) also faced challenges, dropping 5% in the same period.

Factors Influencing Market Dynamics

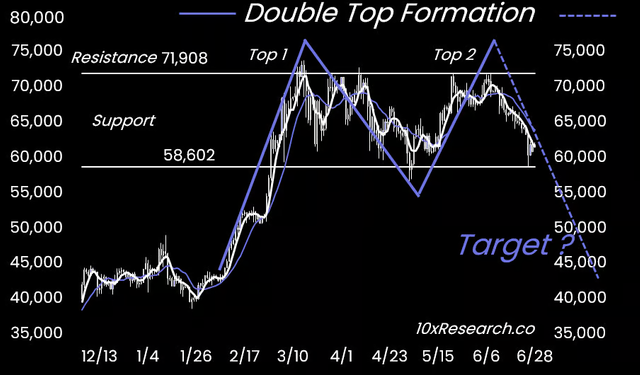

Bitcoin surged from January 2023 lows to a record above $73,500 in mid-March 2024. Catalysts included anticipation and approval of a spot Bitcoin ETF, driving inflows. Expectations of U.S. Federal Reserve rate cuts in 2024 boosted sentiment, but inflation pressures persisted with no signs of easing.

Outlook for Bitcoin in Q3

Analysts like Markus Thielen from 10X Research have indicated a bearish outlook for Bitcoin heading into the third quarter. Thielen identified multiple reasons why Bitcoin's price could potentially drop further, suggesting a decline to $55,000 in the near term.

https://mail.10xresearch.co/p/10-reasons-bitcoin-fall-55000

The market sentiment remains cautious, with many trend-following funds observing similar signals and potentially increasing their short positions. Moreover, political factors, including speculation around potential U.S. presidential candidates and their stance on cryptocurrencies, continue to add uncertainty to market dynamics.

As Bitcoin and altcoins navigate through the volatile waters of the cryptocurrency market, investors remain watchful of unfolding economic and political developments that could influence future price movements. The second quarter of 2024 has underscored the challenges and uncertainties inherent in the crypto landscape, highlighting the importance of staying informed and adaptable in navigating these turbulent times.

https://coinpedia.org/news/why-is-bitcoin-price-continuing-to-fall-is-bear-taking-over-the-market/

This is a reference from chatgpt

Bitcoin has historically shown resilience and the ability to recover from dips, including those around 15%. Several factors can influence Bitcoin's recovery from a dip in Q3:

Market Sentiment: Positive news, such as regulatory clarity or increased adoption by businesses and institutions, can boost market sentiment and drive prices up.

Macroeconomic Factors: Changes in the broader economic environment, such as interest rate policies, inflation, and global economic stability, can impact Bitcoin's price.

Institutional Investment: Increased interest and investment from institutional investors can provide substantial support and drive demand.

Technological Developments: Advances in Bitcoin technology, improvements in the Lightning Network, and other upgrades can enhance its utility and attractiveness.

Historical Trends: Looking at historical data, Bitcoin has often experienced dips followed by recoveries. For example, it has bounced back from significant drops in the past due to various factors, including market cycles and increased adoption.

While past performance is not a guarantee of future results, Bitcoin's ability to recover from dips has been demonstrated multiple times. However, it's important to note that the cryptocurrency market is highly volatile and influenced by many unpredictable factors. Therefore, investors should proceed with caution and consider their risk tolerance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit