Grayscale is set to launch a new spot Ether exchange-traded fund (ETF), and if it mirrors the path of its Bitcoin ETF, it could impact the price of Ethereum (ETH) in the short term.

Potential Outflows

When the Grayscale Bitcoin Trust (GBTC) converted to an ETF on January 11, it saw significant outflows. In the first month, 23% of its assets, totaling $6.5 billion, were withdrawn. Analysts from Kaiko suggest that Grayscale's Ether ETF (ETHE) could see similar outflows. With ETHE’s assets under management (AUM) at $11 billion, this could mean average daily outflows of $110 million, which is about 30% of ETH’s average daily trading volume on Coinbase.

Impact on Trading Discounts

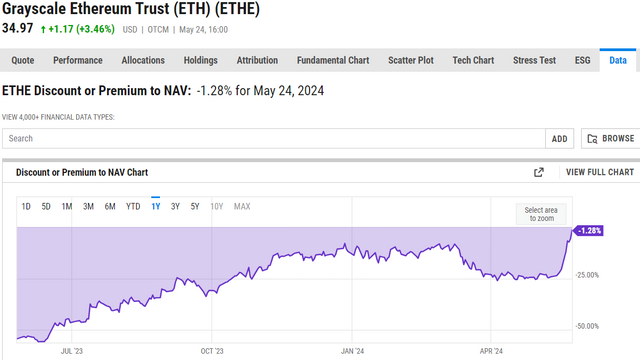

Currently, ETHE trades at a significant discount to its net asset value (NAV), with the discount reaching up to 26% in the past three months. https://research.kaiko.com/insights/is-eth-headed-for-a-bull-run -Kaiko's research suggests that once ETHE becomes a spot ETF, outflows or redemptions are likely as the discount narrows.

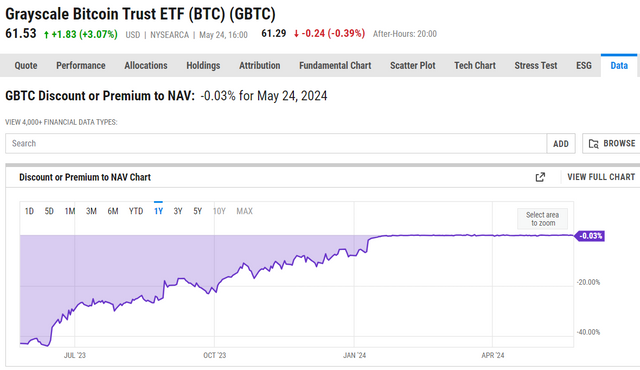

This trend was observed with GBTC, which traded at a 17% discount before its conversion but saw this discount diminish over time, allowing many investors to exit at favorable prices. As of May 24, GBTC's discount has narrowed to just 0.03%, according to YCharts.

Market Reactions

The anticipation of ETHE becoming a spot ETF has already influenced its market behavior. After the initial approval for spot Ether ETFs by the Securities and Exchange Commission (SEC) on May 23, ETHE’s discount to NAV significantly narrowed. On May 1, ETHE was trading at a 25% discount, but this shrank to 1.28% by May 24 amid speculation about the SEC’s approval.

Long-Term Implications for Ethereum

While there might be short-term volatility and outflows, the broader significance of this development is important. Even if initial inflows into the Ether ETF are lower than expected, the approval reduces regulatory uncertainty, which has been a significant factor affecting ETH’s performance over the past year.

As Grayscale's spot Ether ETF nears its launch, investors should be prepared for potential short-term price pressures and outflows. However, the long-term outlook for Ethereum is positive, with the ETF approval providing a clearer regulatory landscape and potentially increasing confidence in ETH as an asset.

For More Details on Such Research Report You can visit Below Link

https://coinpedia.org/research-report/