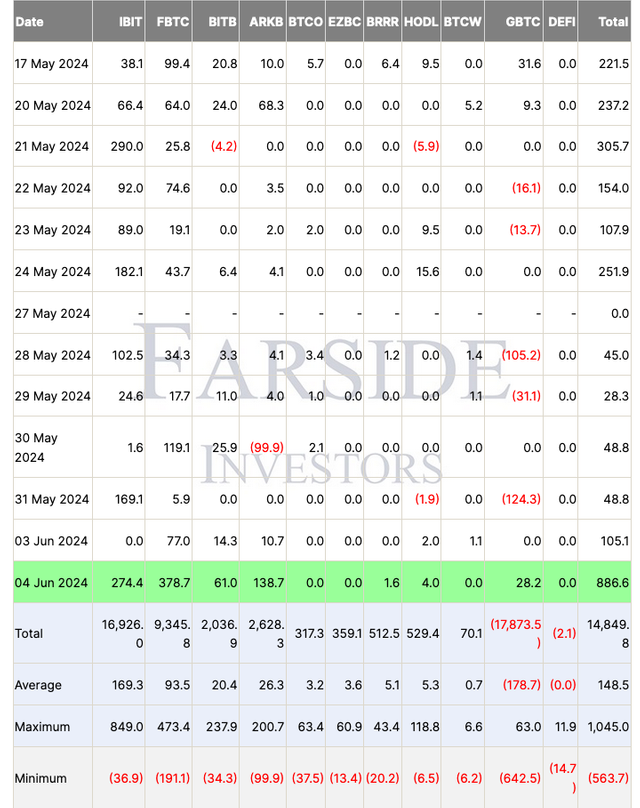

United States-based spot Bitcoin exchange-traded funds (ETFs) recently experienced a significant surge in net inflows, marking their second-highest inflow day on record, according to initial data.

Key Inflows

---The Fidelity Wise Origin Bitcoin Fund (FBTC) took the lead in inflows, garnering $378.7 million, followed closely by BlackRock’s iShares Bitcoin Trust (IBIT) with $274.4 million, as per early data from Farside Investors.

---The ARK 21Shares Bitcoin ETF (ARKB) secured the third spot with $138.7 million in net inflows, according to Farside data.

Notable Trends

This surge represents the highest net inflows since March 12, when these funds collectively received a record $1.04 billion. Notably, Bitcoin reached an all-time high of $73,679 just a day later on March 13.

Grayscale Bitcoin Trust

Farside data also highlighted a rare inflow day of $28.2 million for the Grayscale Bitcoin Trust (GBTC). This marks the seventh inflow day for GBTC since its transition from a closed-end fund to a spot ETF in January.

Market Analysis

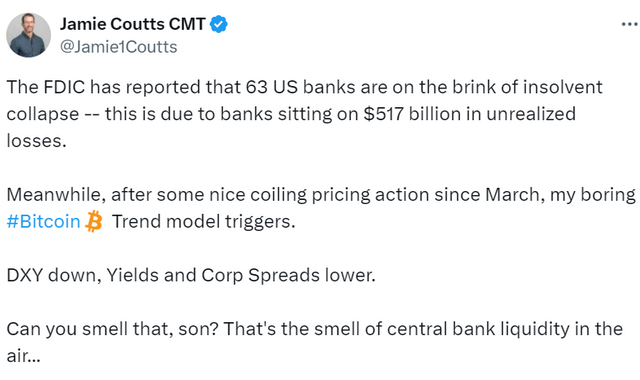

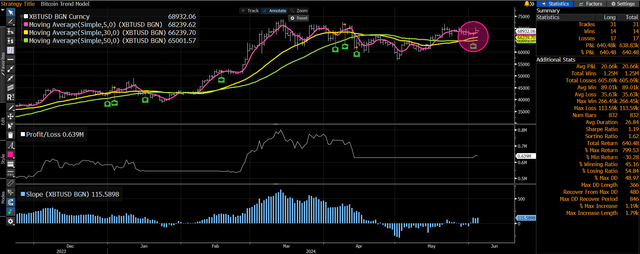

Bitcoin's average price across various time frames, including five-day, 30-day, and 50-day periods, has exhibited minimal divergence, indicating subdued volatility. This scenario often precedes a potential price breakout in either direction.

Implications

Bitcoin appears poised at a crucial price juncture, with its average price consolidating within a narrow range across multiple time frames. Analysts suggest this pattern signals a forthcoming price breakout.

Expert Insights

Commenting on Bitcoin's price behavior, Real Vision's chief crypto analyst Jamie Coutts remarked on June 4 about the significant consistency in Bitcoin's average price across short-term periods, hinting at a potential trigger for his Bitcoin Trend model.

https://coinpedia.org/news/bitcoin-etf-shatters-records-with-886m-inflow-btc-price-skyrockets-ahead-of-fed-cuts/