The recent approval of 11 Bitcoin Spot ETFs by the US SEC, including giants like BlockRock, Fidelity, and Invesco, has set the stage for a financial landscape transformation Our report takes a close look at how these Bitcoin ETFs have been performing this month, using reliable data sources.

We're not just focusing on spot ETFs; we're also diving into Bitcoin Futures ETFs. Join us as we explore the trends, offering a detailed snapshot of the current state of Bitcoin ETFs in the market. This monthly report aims to provide a clear understanding of the latest happenings in the world of Bitcoin Exchange-Traded Funds.

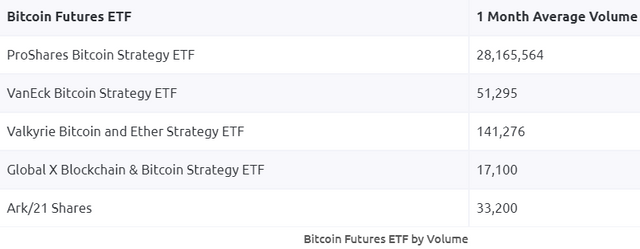

Analysis of Bitcoin Futures ETFs

In the Bitcoin Futures ETF market, ProShares Bitcoin Strategy ETF, VanEck Bitcoin Strategy ETF, Valkyrie Bitcoin and Ether Strategy ETF, Global X Blockchain & Bitcoin Strategy ETF, and Ark/21 Shares are top players, ranked by Asset Under Management (AUM). ProShares Bitcoin Strategy ETF leads with $2.28 billion in AUM, followed by VanEck Bitcoin Strategy ETF at $58.30 million, Valkyrie Bitcoin and Ether Strategy ETF at $38.20 million, Global X Blockchain & Bitcoin Strategy ETF at $26.10 million, and ARK/21 Shares with $8.01 million AUM.

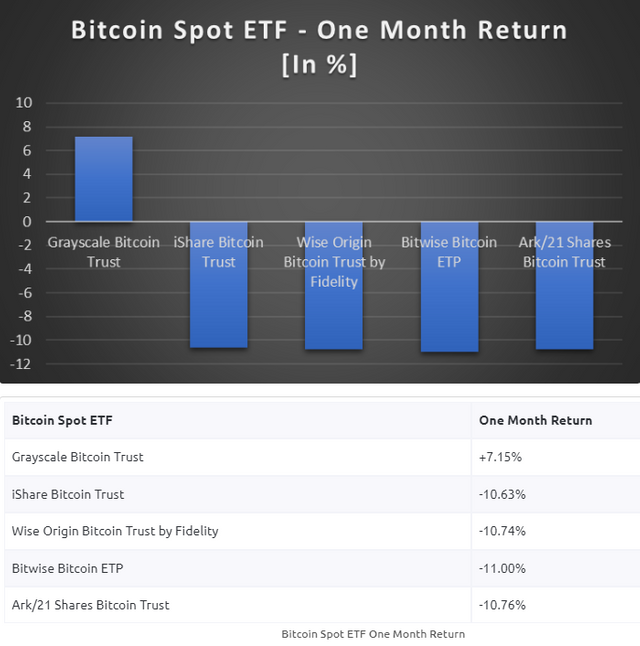

Analyzing One month Performance Spot Bitcoin ETF

--Grayscale Bitcoin Trust: +7.15% one-month return, demonstrating strength

--iShare Bitcoin Trust: -10.63% one-month return

--Wise Origin Bitcoin Trust: -10.74% one-month return

--Bitwise Bitcoin ETO: -11.00% one-month return

--Ark/21 Shares Bitcoin Trust: -10.76% one-month return

--Negative returns may be linked to market fluctuations

--Emphasizes the importance of diversification and risk management in dealing with ETF investment volatility.

Explore further details! Examine the positions of these top players using different measures. Join us in understanding the intricacies of the crypto financial landscape. Find exclusive insights in the report below for a comprehensive understanding.

https://coinpedia.org/research-report/monthly-bitcoin-etf-tracker-analysing-market-performance/