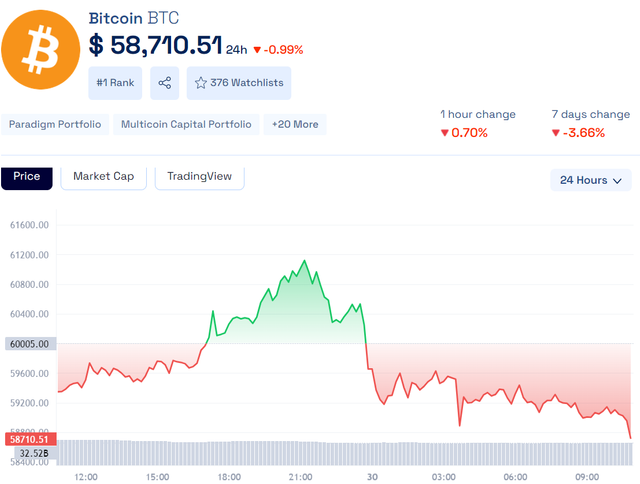

On Thursday, Bitcoin's price fell by 1% to $58,852.90 by 01:55 ET (05:55 GMT). This drop came as investors awaited a crucial U.S. inflation report, which was expected to influence future interest rate cuts. Bitcoin faced a significant decline in August, with losses approaching 9% for the month.

Challenges in August

Throughout August, Bitcoin struggled due to broader market movements that hit crypto prices hard. Concerns over token distributions and mass sales, particularly related to the defunct Mt Gox exchange, contributed to the downturn. Additionally, slowing capital inflows and diminishing enthusiasm for spot Bitcoin exchange-traded funds led to reduced speculative activity.

Retail interest in Bitcoin also declined. Fears of a U.S. recession led to losses across global financial markets early in August, with cryptocurrencies also affected. While stocks managed to recover, Bitcoin and other cryptocurrencies continued to face difficulties.

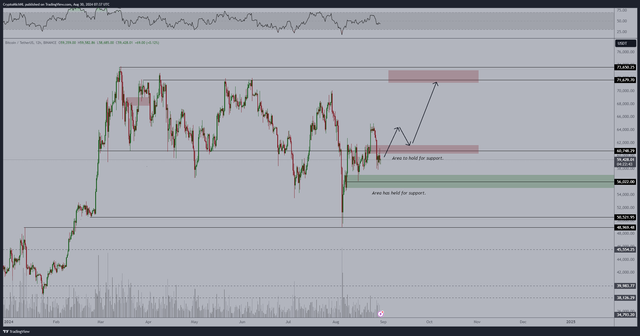

Bitcoin fluctuated between $50,000 and $60,000 during August but struggled to stay above $60,000 for long periods.

Broader Cryptocurrency Trends

Other cryptocurrencies also saw declines. Ethereum dropped by 1% to $2,515.61 and experienced a 22.2% loss in August, its worst month since January 2022. Altcoins like XRP, SOL, and ADA fell between 0.4% and 5%, while MATIC decreased by 3.3%.

Market Expectations

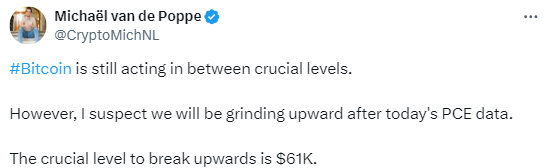

The market was on edge ahead of the PCE price index data, due later in the day. This inflation gauge is closely monitored by the Federal Reserve and could affect interest rate decisions. Lower rates would generally benefit cryptocurrencies by increasing liquidity and encouraging speculative trading.

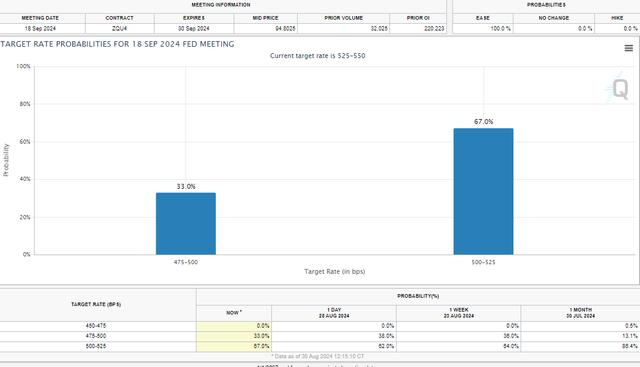

Traders were predicting a 25 basis point rate cut in September, according to CME Fedwatch. Such a move could provide some relief to the struggling cryptocurrency market.

Legal News

In legal news, Elon Musk won a lawsuit related to alleged Dogecoin manipulation. However, this outcome had little impact on Dogecoin's price.

As the market awaited further economic data and policy updates, cryptocurrencies continued to face a challenging environment with fluctuating prices and shifting investor sentiment.