Hello everyone! Today's update dives into the recent developments in the Bitcoin market, shedding light on significant movements and what they mean for investors.

Bitcoin Market Overview

Bitcoin has seen considerable activity lately, especially notable during yesterday's events. As we analyze these movements, it becomes evident that strategic decisions during volatile times can yield substantial rewards.

Market Statistics

Market Performance: The cryptocurrency market has experienced fluctuations, with total market cap down to $2.3 trillion and Bitcoin dominance at 53%.

Market Sentiment: Fear and Greed Index remains at 30, signaling caution among investors. Historically, low fear levels have presented buying opportunities.

Who's Selling Bitcoin?

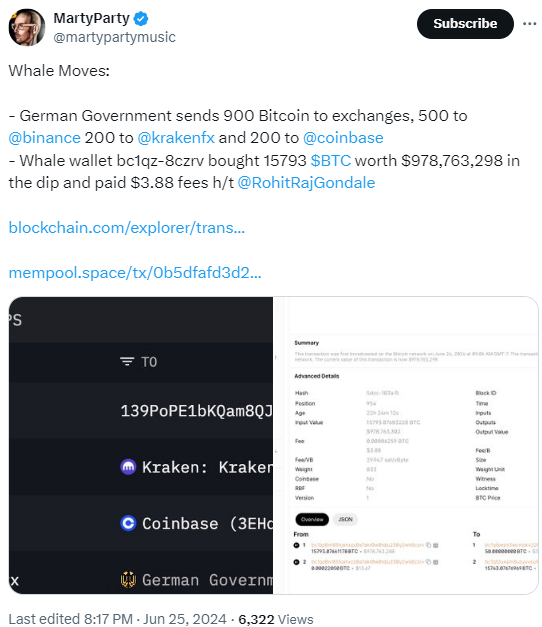

Recent reports indicate significant sell-offs, particularly by German authorities who have offloaded substantial amounts of Bitcoin. This action has affected market dynamics, contributing to the current climate of uncertainty.

Insights into Sell-Offs

German government wallets have transferred sizable amounts to exchanges like Binance, Kraken, and Coinbase, marking a strategic move amid market conditions. This move has drawn attention to governmental influences in the crypto space.

Analysis of Market Dynamics

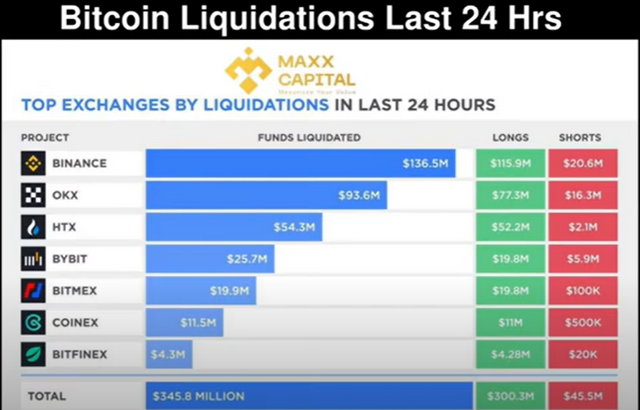

The recent cascade of liquidations, primarily affecting long positions, has been attributed to hedge funds' activities. This scenario underscores the risks associated with leveraged positions during market downturns.

Who's Buying Bitcoin?

Amidst the sell-offs, notable buyers have emerged, including institutional investors and high-net-worth individuals:

Institutional Interest: Entities like Gemini have seen substantial purchases, with notable transactions reaching $961 million.

Strategic Accumulation: Long-term investors and entities holding significant Bitcoin reserves have capitalized on lower prices, reaffirming confidence in Bitcoin's long-term potential.

Market Predictions and Future Prospects

Despite recent setbacks, indicators suggest a bullish outlook:

Technical Analysis: Charts suggest potential for a macro higher low, indicative of a bullish trend reversal.

Market Sentiment: With institutional interest and supportive technical indicators, the stage is set for a potential upward movement.

Key Developments in the Bitcoin Ecosystem

Beyond market dynamics, recent developments highlight Bitcoin's growing influence:

Regulatory Attention: Ongoing discussions and actions by governments and regulators continue to shape Bitcoin's narrative.

Institutional Adoption: Entities like Morgan Stanley are poised to introduce Bitcoin ETFs, signaling broader institutional adoption.

As we navigate through these fluctuations, understanding market dynamics and investor behavior becomes crucial. Bitcoin's resilience amidst challenges underscores its role as a hedge against economic uncertainties.

With Bitcoin trading at $62,000, the landscape remains dynamic. Stay informed, stay strategic, and embrace the opportunities presented by this evolving market.

Thank you for joining today's update. Stay tuned for further insights and analysis. Have a great day, and see you soon!