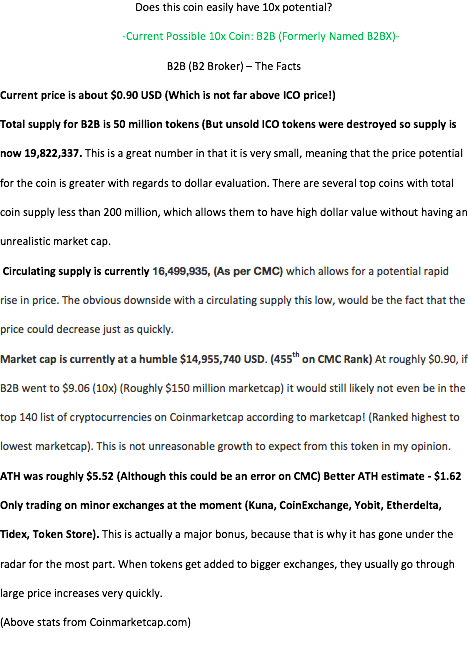

Does this coin easily have 10x potential?

-Current Possible 10x Coin: B2B (Formerly Named B2BX)-

B2B (B2 Broker) – The Facts

Current price is about $0.90 USD (Which is not far above ICO price!)

Total supply for B2B is 50 million tokens (But unsold ICO tokens were destroyed so supply is now 19,822,337. This is a great number in that it is very small, meaning that the price potential for the coin is greater with regards to dollar evaluation. There are several top coins with total coin supply less than 200 million, which allows them to have high dollar value without having an unrealistic market cap.

Circulating supply is currently 16,499,935, (As per CMC) which allows for a potential rapid rise in price. The obvious downside with a circulating supply this low, would be the fact that the price could decrease just as quickly.

Market cap is currently at a humble $14,955,740 USD. (455th on CMC Rank) At roughly $0.90, if B2B went to $9.06 (10x) (Roughly $150 million marketcap) it would still likely not even be in the top 140 list of cryptocurrencies on Coinmarketcap according to marketcap! (Ranked highest to lowest marketcap). This is not unreasonable growth to expect from this token in my opinion.

ATH was roughly $5.52 (Although this could be an error on CMC) Better ATH estimate - $1.62

Only trading on minor exchanges at the moment (Kuna, CoinExchange, Yobit, Etherdelta, Tidex, Token Store). This is actually a major bonus, because that is why it has gone under the radar for the most part. When tokens get added to bigger exchanges, they usually go through large price increases very quickly.

(Above stats from Coinmarketcap.com)

ICO token sale was from SEPT-NOV 17.

ICO price was $0.074 per 1 B2B.

ERC20 Token.

$8,078,602 of $29,500,000 raised.

35 team members.

Team from Russia.

(Above stats from icodrops.com)

B2B – The product/technology

B2B aims to be an institutional cryptocurrency exchange. Although this may provide an aspect of regulation, it will be a way for large institutional investors to enter cryptocurrency and feel safe doing so. The B2B ICO video also mentions the aspect of liquidity. Crypto is currently not an easy place for big institutional players with billions of dollars to be able to buy and sell large amounts if desired because individual exchanges just do not have enough volume, especially when it comes to coins other that BTC and ETH and XRP. By the time the buyer is able to get all their orders filled, the price will be much higher. And then there would also be no buyers at those levels if they wanted to sell those amounts back. The goal of B2B in my interpretation, put simply, is to be a connecting point for all the crypto exchanges… to provide significant liquidity for institutional investors. B2B has already aggregated 5 of the biggest crypto exchanges, which is very promising news. They also already have 35 brokerage companies as clients. They have a 40-page whitepaper which is very impressive in my opinion as well.

Positives:

B2B aims to tackle a crucial element of cryptocurrency that needs to be addressed. Liquidity can even be a problem for smaller investors in todays markets, depending on which coin or token is being traded. But even the larger cap coins run into trading problems, stalling of orders, and traffic overload if there is too much volume at one time. An example of this would be on one of the days Verge was on a big uptrend, my orders would not go through and when they did, they would not cancel and I got filled on the way down in price and ended up in a tough spot. And I was not even trading a very large amount of Verge.

B2B seems to be involved with many exchanges, brokerage firms, and potential interested clients as per my understanding of the whitepaper.

Low coin supply which allows for faster gains.

Not on major exchanges yet but plans to get listed on major exchanges, as per my message to the team on twitter.

Gets big institutional players interested: My opinion currently, from talking to pple as well as research, is that bigger players are more willing to get involved in futures trading of BTC because they are more confident that their funds will not get stolen. They also have much more confidence in entities like CBOE and CME. This is, in my opinion, preventing a large flow of money directly into cryptocurrency.

Very few people are talking about B2B currently, with regards to large Youtube reviews, etc. Which means that there is tremendous price upside once promoted and found out.

35 team members and 40-page whitepaper.

Negatives:

This project seems very centralized to me, and for that reason, it does not sit as well with me as it did, prior to my in depth research. Part of the upside of cryptocurrency is that it is decentralized and creates a freedom that is not seen in other areas. This is similar to my feelings on XRP being too centralized and controlled.

ICO did not achieve goal.

Thoughts:

Although there are only two main negatives that I could find, the centralization aspect seems to be a big issue. Some regulation is needed in crypto, but there is fear that this will lead to further regulation of the entire market, which definitely negative. For this reason, I am now unsure of how I feel about the project. It is important to get larger money players into the market with regards to adoption, as well as making crypto more mainstream and reputable. But this is not positive if it hurts the freedom that crypto provides in many ways. In my opinion, if B2B can establish a way for institutional players to enter the market with confidence, and improve liquidity, while still leaving us with a free decentralized market, then that would be a positive situation. But who knows if that is even possible. I have personally invested in B2B as of right now, but I am currently unsure of how I now feel about the outcome with regards to centralization. I have also not been paid or compensated by B2B to write this article.

At the end of the day, readers need to decide what they think the future will be for B2B, and how it will affect crypto as a whole. More research may be required, but hopefully I have given some awareness to this potentially undervalued token and given a good amount of content to assist in educating the public. B2B could go nowhere in price or even go down. But it also could also bring large gain. Decide for yourself based on the data and your own research ;)

(**Everything written, said, tweeted, etc. is based on my personal opinion, my interpretation of the data/material, and is not financial or investment advice whatsoever)

Sources:

https://coinmarketcap.com/currencies/b2bx/#markets

https://icodrops.com/b2bx/

https://www.b2bx.pro/docs/b2bx_white_paper-en.pdf

Newsbtc (B2 Broker Image)