Is JP Morgan Qualified to Talk About Cryptocurrencies?

In a recent and alleged internal report by JP Morgan, the big bank states that cryptocurrencies are “unlikely to disappear,” with a handful of the flagship cryptocurrencies (such as BTC, ETH, LTC, DASH, XRP (Ripple), and Cardano’s ADA) being here for the long-term.

However, it was not long ago that JP Morgan CEO Jamie Dimon slandered cryptocurrencies, calling them a fraud and valueless before retracting his statement and regretting his actionsseveral months later (after conveniently triggering a market crash).

While the alleged report is positive towards blockchain tech and cryptocurrencies, many remain skeptical and cautious when a major financial institution attempts to become an authority in a sector that’s designed and driven to eliminate the need for financial intermediaries.

Report Echoes Innovative Trend, Blockchain Patents Rising

Popular altcoins such as Dash, Cardano, and Litecoin have been great alternatives for investors, with Dash leading the pack in terms of growth in 2017. Despite the high levels of volatility and contrarian nature, the report states there is a place for digital assets.

“Cryptocurrencies are unlikely to disappear completely and could easily survive in varying forms and shapes among players who desire greater decentralization, peer-to-peer networks and anonymity, even as the latter is under threat.”

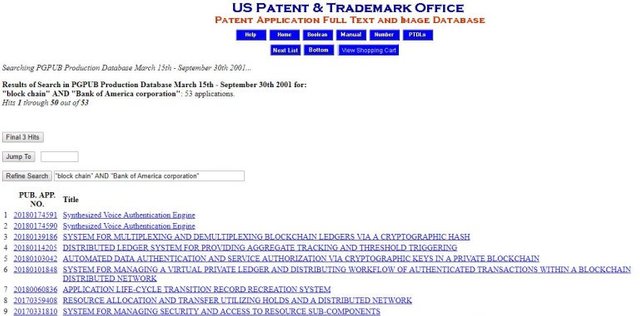

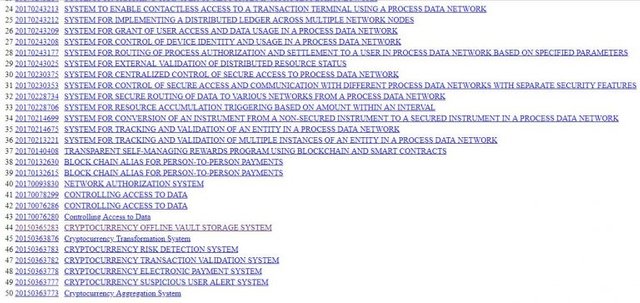

By connecting the dots, we can see that the report echoes other innovative trends. Blockchain patents by big banks are also a strong sign that financial institutions do not intend to be left behind in the technological dust.

The number of approved blockchain patents has doubled year after year, with China having the largest number, despite the negative stances seen by Chinese authorities.

Future Relationship Between Banks and Cryptocurrencies

The report also states there are some hurdles surrounding cryptocurrencies, such as the security of exchanges and volatility.

There could be a time in the future where financial institutions offer cryptocurrency storage options or accounts, similar to having a bank account that enables users to hold USD, GBP, or EUR.

It is also likely that fiat currencies become digitalized or tokenized and become cryptocurrencies themselves, with paper money being phased out. On a closing note, the report states and almost serves as an egotistical reminder to employees that government-backed currencies will remain dominant:

“It will be extremely hard for cryptocurrencies to displace and compete with government-issued currencies.”

Disclaimer: This is not investment advice. Please research, and only invest what you can afford to lose. Always read the whitepaper of the cryptocurrency you seek to purchase.

That is some nice analysis on positive sentiments shown by established big players. This is also evident with BlacRock showing its interest for potential in Crypto Currencies.

Amidst all these positive formations, do you think Bitcoin will be able to make it way through upcoming ETF approval by SEC?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit