For those of you new to the crytocurrency world, I wanted to share my day trading mistakes and some of the lessons I have learned. I hope you can learn from my mistakes and avoid them yourselves. My cryptocurrency trading and investing career is brief and I have only been in this game since May of this year (2017). I started with $5,000 with the hopes of turning it into something that can one day pay for my college education. I was eager, but I did not jump in completely blind. I did a substantial amount of research into cryptocurrency history for weeks before buying my first Bitcoin, but I had no idea just how unprepared I was...

1. Don't be fooled by early wins and get over confident.

For my very first few trades I did not want to risk much and only considered the top 10 currencies listed at that time. I settled on Ethereum and got lucky with a couple of quick wins following the bulls and selling a day or two later while they drove the prices up and down. I did it again the following few nights and again got lucky with some nice wins following the rise of Ethereum during several ICO periods. Being still new and a bit paranoid, I only used small amounts to play so my wins were limited to a few hundred bucks. Unfortunately, these early successes made me over confident in my abilities as a trader and lead me to my first mistake which easily wiped out all my wins to date and cut into my original investment.

Beware of the lucky breaks, they may make you over confident and blind to easily avoidable mistakes due to greed.

2. Do your homework! Take the time to research what you are buying into.

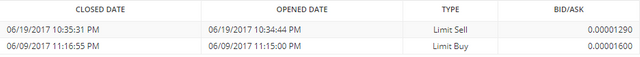

When I was starting out, I wanted to make a couple of quick trades to boost my overall holdings before making any long term investing decisions. I decided to use a large chunk of my total BTC to do some day trading with. I decided to trade on a popular coin at the time at 1600 satoshis while the coin was already on its way down from a peak thinking its due for a comeback and a healthy profit for my wallet. Based on my 10 minutes of research into this coin I thought it might have a surge within a few days because surely it couldn't just keep dropping... After buying and holding for a couple of days, I watched it steadily drop in value and my investment start to bleed.

A few days later I did my due diligence and researched it much more intensely and found a reason why the company was receiving so much attention in the first place and why it did not last long enough for a second surge. Long story short, there was a lot of excitement about a major appearance by the company at an event. After the event proved to be a disappointment for the company, many people were looking to get rid of their investment and I was the guy they sold it to. I realized how over exposed I left my cryptocurrency portfolio and sold at 1290. This was my first loss in cryptocurrency investing that taught me a very valuable lesson: Do your homework! If I had just taken the time to read their white paper and catch up on their recent developments in the media, I would have seen the drop coming and maybe even avoided it in the first place. But you all know what they say about hindsight always being 20/20...

As embarrassing as this mistake was, I printed out a screenshot of this loss and taped it to my desk. Now every time I start to feel a little extra greedy I have a reminder on my desk to hold me back.

3. Wait for a Bitcoin drop before buying in.

I purchased my Bitcoin at about $2650. For my investment of $5000 I got about 1.84 BTC. With how volatile Bitcoin is naturally, it was just a matter of time before it dropped. If I just waited for a week or two for a drop, I could have saved a few hundred bucks for the same number of BTC's. But then again, I would have missed a couple of my early wins (on ETH and XRP), so I don't feel too bad about this one and only consider it my 3rd worst mistake.

4. Day trading on hype and not learning from my mistakes.

Before my first loss really set in and I sold it, I continued to try and make some quick money. This lead me to invest in several companies based on Youtube videos hyping up their quality. The promoters I saw made good arguments in the way they showed their charts and their analysis of the possible future of the coins, so I skipped doing the research myself and made the same mistake again! I skipped my homework, just like in Mistake #2, and bought a coin I knew little about just because I thought that with the Youtuber promoting it, it MUST go up in value and then I can dump it for a profit before everyone else does...

Except that didn't happen and I got left out in the cold! The Youtube promoter suggested a sell price that was never realized and then later wrote it off as just market madness that his prediction did not come true. I will never forget how he claimed that he was lucky enough to get out right at the very peak before the mass sell. Or his excuses for the false promises, while profiting from the misfortunes of his followers. And yet they still follow...

Another painful pill to swallow and another lesson learned! Don't trust a promoter unless you can replicate their data! Anyone can modify a chart to look ripe and promising. Fortunately, this time it only cost me about a hundred bucks all together in losses.

5. Buying something as soon as it hits the market.

Having started my crypto investing too late to participate in some of the April and May ICO's, I thought I could make up for it by buying some of those coins as soon as they hit the market. This time around I DID do my homework and made sure that I was very well informed about the coins I was looking to trade. I took the first opportunity to buy the coins I wanted and picked a reasonable entry point for both with only a small experimental amount of BTC (.001) for each.

The problem came when I realized that even if a company has a great business plan (white paper), good marketing, and apparently a dedicated development team, those things are not proven and remain a theory until time passes and progress is made to back up the claims. A new company may look and sound great, but some times it just takes time to find out that their plan can only ever be a theory and can never work in the real world. Within a couple of days my new coins lost over 40% and found a new resting place going forward. I eventually sold them having lost hope in their potential a few weeks later at a 31% total loss.

This experience taught me that the age old saying: If it sounds too good to be true, it probably is. Not all great ideas can work in the real world.

Conclusion

I am mostly mentioning my losses here, but I have had my share of successful trades. Since getting started in May I am up to 2.41 BTC across my various wallets and holdings. At today's exchange rate ($2,628) that is approximately $6,333 and I am not including what I am mining with my computer, my Waves based tokens (MRTs, WavesGo, etc), or my recent ICO purchases that I have not received yet (Civic). So even with my painful losses I am still making decent money and a great ROI for only a couple of months in the game.

I have intentionally left off the names of some of the coins I have invested in so that people do not think I am trying to talk down the coins or hype up others. I do mention a few specifically because their examples are helpful explain what happened and paint a vivid picture. In no way am I promoting or demoting any coin based on my own experience.

It has taken a while for me to assemble a proper investment strategy, but I am now about 90% investor and 10% day trader. I hope you all enjoyed reading about my painful mistakes and they help you avoid doing the same. I will be posting another article in the coming days to share more of my investing strategies and insights, so stay tuned!

Thank you for reading and please upvote, follow, and resteem if your enjoyed my article. Or at least upvote 😉

Crypt0.Critic Images: CleverCat

This blog is written for informational and entertainment purposes only. As the author, I can honestly say that I am in no way associated with any blockchain based company. My opinions are my own and are offered freely. My opinions and suggestions and are NOT INVESTMENT ADVICE! Please do your own research before considering any high risk investments.

I bought ETH at $8 and then sold at $30........ Everybody fucks up sometimes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True Flip {ICO} - Already running a transparent blockchain lottery! Bomb! Bonus 20%! Hurry! :)

The platform is already working and making a profit :)

https://steemit.com/ico/@happycoin/true-flip-ico-already-running-a-transparent-blockchain-lottery-bomb-bonus-20-hurry

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Still a nice trade! Oh if only I had the balls to get into crypto a year ago...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't know why but i can feel the Digibyte vibe on the second point.

I did the same mistake and that was my first big loss. Lesson learned.

Thank you for the post, some very good advice here !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

LMAO! I was trying not to be obvious, but clearly I failed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The 2nd point is probably the most important and a lot of people fall for it. I invested about $60 into SWT (Swarm Token) just to lose half of it because I didn't do proper research and it was being shill so hard around reddit and /biz/.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree, I can't emphasize enough how important it is to educate yourself.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great advice! Thanks for sharing!

What do you think about diversifying among 10-20 coins versus focusing on the hot plays? Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

10-20 seems like a lot of coins, but I guess it would depend on the size of your portfolio. I can make a case for it or against it, but in the end I would still limit myself to staying below 10. The main reason is that I would rather concentrate on having a stronger portfolio over additional chances for small profits here and there. When Bitcoin drops, no one wants to hold a bunch of crap coins. I am not saying that you are, but often with big spreads that is the case.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is by falling that one learns to market. In any case I will follow you, you are intelligent.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nicely Explained loved your Post the Details are good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypt0.critic! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very useful tips! Thank you. Still wishing I had kept some of my ethereum early on :) Been doing a lot of homework, and this is part of it. Great post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit