11th of march 2018

As a large percentage of Altcoins are dependent on the movement of Bitcoin, a little volatility in its price and market cap can have a crucial impact on Altcoins.

While most of the coins are strugling due to the unpredictable nature of this market, some cryptoassets are holding their ground and showing stability in their prices.

NEO certainly belongs to the list of such stable digital coins.

Since 6th February of 2018, NEO has shown a significant upsurge and is currently holding the sixth position on Coinmarketcap.com. A few aspects of this coin can be the potential reasons behind NEO having a very successful 2018.

NEO’s Architecture:

NEO is a blockchain platform as well as a cryptoasset, that enables Smart Contracts along with the development of digital assets.

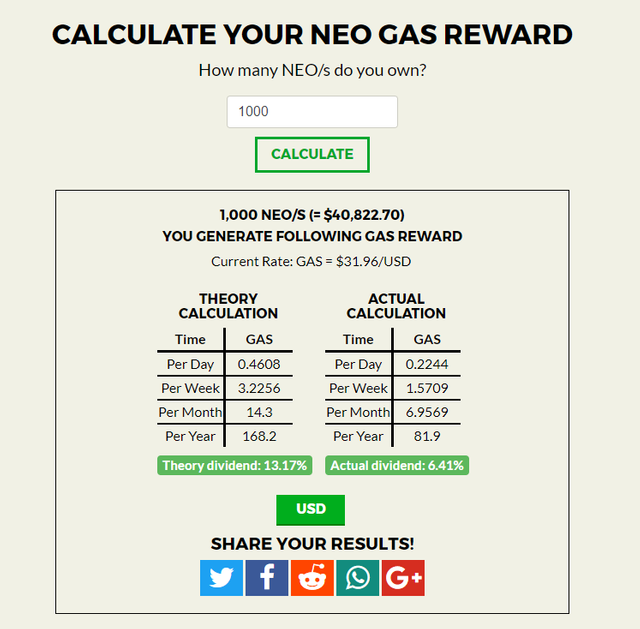

It uses a unique delegated Byzantine Fault Tolerance (DBFt) Consensus mechanism and as a result, it can carry out more than 10,000 transactions per second . Another feature of NEO’s mechanism is that it can be staked to produce a cryptocurrency named GAS

The GAS token fuels the platform and is used to pay for the deployment of smart contracts and computation within the network.

NEO holders receive GAS tokens, which contributes to protecting them from market fluctuations and works as an incentive for hodling NEO, generating a “small” but appreciated passive income.

Why the Market Trends in Favour of NEO:

Association with Onchain: investors expect a bright future for both NEO and GAS, because of its affiliation with Onchain. ONCHAIN is an entity that helps business organizations across the globe implement blockchain into their operations.

Onchain was developed in order to separate the digital currency from the blockchain development team. Onchain offers a sui generis blockchain solution known as DNA that helps in benefiting of blockchain technology.

Hence the growth of this cryptocurrency is tied to the success of Onchain, as it offers extra traction along with more interest from clients and business enterprises.

Various Assets: Most of cryptocurrency platforms focus on trading their related digital currencies only. For instance, the Ethereum blockchain platform only focuses on trading their cryptocurrency Ether.

NEO, on the other hand, incorporates a significant number of assets on its platform, including its own.

This unique feature makes NEO a globally accepted system of smart economy. This variety of assets is likely to make a positive impact on NEO’s future.

Technology improvement: Despite its similarity with Ethereum , NEO’s developers were able to make considerable improvements over Ethereum.

Ethereum smart contracts can only be written in Ethereum’s native and specific programming language known as SOLIDITY.

On the other hand, NEO smart contracts can be developed using familiar languages like C#, Java, JavaScript, Python, etc, making NEO a much more user-friendly and accessible platform.

Partnerships: In December of 2017, NEO engaged in a partnership with 18 major financial institutions along with cryptocurrencies like Red Pulse, Nex, Qlink, among others.

Such partnerships are likely to give more exposure and eventually increase its liquidity.

Market Scenario :

As per the data of 11th March 2018, NEO holds the 6th position on Coinmarketcap with a market cap around $5.5 billion USD with an individual value of $85 USD.

If NEO continues to follow the upward trend and holds its ground even when other cryptocurrencies are suffering from drastic losses, 2018 can be a very promising year for this coin. Although it is just the beginning, with the right partnerships and listing on right exchanges, NEO and its GAS token can become prime cryptoassets of 2018.

Thanks for sharing this, very insightful. Its high time I start acquiring some NEO for my blockfolio

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks! I am new to steemit, so I appreciate your feedback, it means a lot to me. Still have to read through the rules of the platform though, not familiar with them yet between Steem, Steem power, SBD, upvotes, power ups and downs, etc..

I am deeply invested into NEO, it is a big portion of my portfolio. I split 70% NEO and 30% GAS.

I think right now is the best time to acquire NEO and GAS since the price is down by more than 20%, and below its 34 hourly SMA.

I feel GAS is even more undervalued, since it is the cryptocurrency that developers have to use in order to build Dapps on the NEO Blockchain.

Now I am looking for other assets with good potential. I'll write reviews about what has most of my attention like VECHAIN, BTCP, MONERO, CPC... to name a few.

In what do you see potential for 2018/2019 ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Lets say I am new on steemit as well, I joined in September last year and wasn't active until a month ago. I am still learning as well but from my recent activity on steemit I am loving it, besides the money aspect you get to read very insightful posts with great contents.

The steem in my opinion is the coin, while the Steem power determines the power(strength) of your reward from your upvotes comments...so the bigger your Steem power the bigger your your reward and the SBD (Steem Backed Dollar) is your steem that remains constant regaless of the market value of Steem due to fluctuation. I hope I am correct and someone with more knowledge is welcome to correct me...

I see potential in Lunyr it is a blockchain based knowledge sharing and you get paid for writing. district0x DNT as well

THC

I am with you on Vechain

I will like to stock up LTC

DASH

and lets hope STEEM goes beyond $10 before the end of 2018!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just finished and posted an article on VECHAIN and its real world use cases. Let me know what you think !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I will check it out

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit