A recent period of turmoil around the closely watched round number level was extended by Bitcoin's rebound to $30,000 level. The largest token traded for $29,195 on Thursday, up 3.7%. Additionally, gains were recorded for smaller tokens like Ether, Cardano, and Avalanche, indicating a generally upbeat crypto market. The price of Bitcoin is currently rising as short positions are being wiped out in a market with fewer order books. The overall crypto market cap was exchanging close $1.22 trillion, somewhere around 0.85% in the past 24 hours. At the moment, the total volume of DeFi is 4.96 billion, or 7.53 percent of the crypto market's 24-hour volume. The total volume of all stablecoins is currently $59.39 billion, or 90.07% of the crypto market's 24-hour volume.

When Wall Street opened on April 27, Bitcoin was stuck at $29,000 because GDP growth in the United States fell short of expectations. After the previous day's sudden volatility, the data showed that BTC/USD was once again struggling. After a flash correction on claims that Mt. Gox and U.S. price broke above $29,800 on April 26, the largest cryptocurrency had sold more than $300 million in long and short positions, resulting in a 24-hour gain of 9.6% to $30,024 on Bitstamp. Bitcoin's rally, according to some commentators, was sparked by the 50% drop in First Republic Bank (FRB) shares on April 25. If Bitcoin bulls are unable to break the $30,000 resistance, they will probably be content with a gain of $575 million. However, leveraged downside bets on futures contracts recently led to the forced liquidation of $166 million, leaving the bears with less leeway. Bitcoin bulls are well-positioned for April's $3.2 billion monthly BTC options expiration due to the bullish momentum generated by First Republic Bank's issuance.

Even though the price of ether experienced a correction of 13.7% between April 18 and April 21, it has remained above $1,820 for the past three weeks. However, a longer-term perspective is more encouraging, as the S&P 500 stock index has remained stable while Ether has increased by 20.8% in three months. However, professional investors were not encouraged by the gains, as indicated by ETH options and futures metrics. Weakening macroeconomic circumstances have given crypto resources forward movement in 2023, including the continuous financial emergency. Since February, whales and market makers have been driving bearishness on the Ethereum network due to the decreasing total value locked (TVL) and average transaction fees above $4. According to data, Ethereum decentralized applications reached 15.3 million ETH in TVL on April 24. This is down 30% from 22.0 million ETH six months ago. Ether's difficulty exceeding $2,000 may also indicate traders' expectations of a May 3 interest rate increase by the Federal Reserve.

After the US economy expanded at a modest annual rate of 1.1% in the first quarter, well below the 2% expected, the macroeconomic risks of a recession increased. In the mean time, expansion kept on burdening the economy as the individual utilization cost list rose 4.2% in the principal quarter. The FRB mess comes after the bank's earnings report showed that customers withdrew their funds caused deposits to fall by 40.8% in the quarter. Notably, the bank got $30 billion in cash in March, but it lost more than $100 billion in cash every quarter. In contrast, the Federal Reserve of the United States indicated that interest rates would rise above 5%. The central bank may be able to control inflation by increasing the cost of capital, but the unintended result is a weaker economy and a bear market structure for risky assets like bitcoin.

Technical Outlook

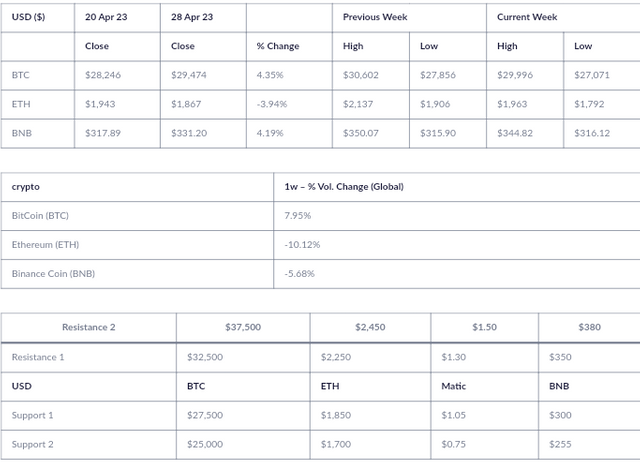

BITCOIN

Bitcoin saw a sharp convention up to $31,000 from $19,550. Nonetheless, the bulls neglected to push the costs over the critical opposition of $32,500 and the resource began making little 'Turning Top' and 'Doji' candles that demonstrated uncertainty in pattern. BTC saw some benefit booking and the costs dropped to $26,942. Post this move, the resource took support at its multi Day Moving normal and is attempting to go up yet with low volumes. To observe a further meeting BTC needs to break, close and support over the vital opposition of $32,500.

ETH

ETH witnessed a sharp rally and surged almost by 56% from the recent bottom of $1,370 to the high of $2,146.5. Post this move, the asset started to consolidate and was trading in a range from $2,125 to $2,055. ETH gave a range breakout on the downside and has seen some correction and the prices have dropped to $1,787. The asset is trying to take support at its 50 Day Moving Average. However, ETH bulls may face major hurdles at the psychological level of $2,000 while $1,750 will act as a strong support.

BNB

BNB after making a high of $350 made a ‘Tweezer Top’ Candle that witnessed a profit booking and the prices plunged to $315. The asset too took support at its 50-Day Moving Average and moved upwards up to $345. However, the bulls were not able to break the recent high of $350 (Tweezer Top pattern). Hence to further rally, BNB needs to break and close above $350 whereas a break below $300 will lead to further downfall.

❇ Weekly Snapshot ❇

⚛ Market Updates ⚛

🔯The launch of “Robinhood Connect,” a fiat-to-crypto on-ramp featuring support for decentralised applications (DApps) and self-custody wallets, was announced at Consensus 2023 on April 27.

🔯Circle, the creator of US Dollar Coin, has launched a mainnet protocol that lets users transfer USDC between Ethereum and Avalanche, according to an April 26 announcement.

🔯The Hong Kong Securities Futures Commission (SFC) is reportedly set to release crypto exchange licensing guidelines next month. The incoming guidelines will provide support to crypto trading platforms that will be able to offer trading services to retail investors on June 1.

🔯The former CFO of a special purpose acquisition company (SPAC) was sentenced to three years in prison after embezzling $5 million that was used to trade crypto assets and “meme stocks.”