NOIA Network aims to build a programmable internet by creating a global Software Defined Network (SDN) on the public Internet. NOIA seeks to achieve this by utilizing Segment Routing, IPv6, and the blockchain technology. If you had a hard time following that, then that's ok. Today, we will not be getting into the finer details of the project. Instead, let's focus solely on the NOIA token.

Early market advantage

With NOIA, you have the advantage of entering the market early. To give you an example, let's look at EOS. Within a two-year gap from July 16, 2017 - July 16, 2019, the price of EOS went up from $1.33 to $4.28, more than tripling in the process.

Let's look at it this way. If you had invested $1,000 in EOS around July 16, 2017, you would have gotten ~752 EOS tokens. Fast-forward to today, those tokens would have been worth $3,200. That's a 220% increase in total valuation!

However, just having an early market advantage isn’t enough, the project must bring in some real utility into the network to ensure sustained growth.

Judging the value of the token

The value of a token can be judged via the following metrics:

- Short-term value.

- Long-term value.

Short-term value

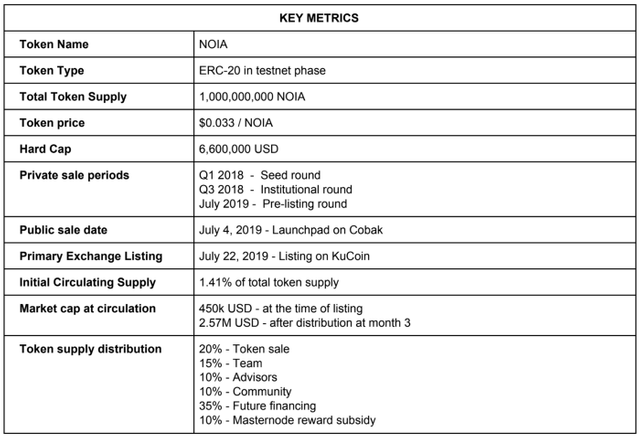

The short-term value proposition of a token is based purely on speculation. So, let’s look at how NOIA stands here. Check out the following table:

Did you notice the initial circulating supply? It is just 1.41% of the total token supply. So, why is this significant?

Back in the wild west days of crypto in 2017 and 2018, the ICO world was rife with pump-and-dump schemes. ICO or Initial Coin Offerings is a token crowdsale where investors can buy the native tokens of a dApp with Bitcoin or Ethereum. In a pump-and-dump scheme, a wealthy investor or a cabal of rich investors buy the lion's share of these tokens, which "pumps" or increases its price or makes them overvalued. Soon after, they dump off all these tokens to pocket a nice little profit for themselves. However, this causes the value of these tokens to plummet. As a result, innocent investors who were playing it by the book take a massive hit on their portfolio.

If this sounds far-fetched to you, then consider this December 2018 report by the MIT Technology Review. According to the report, pump-and-dump schemes accounted for about $7 million worth of trading volume per month.

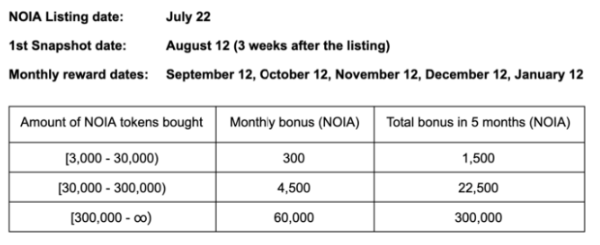

The way NOIA is countering this is by only allowing a small portion of its supply to be available during the initial circulating supply. Plus, they are also adding extra incentives to make sure that investors hold on to their tokens. For that, refer to the following table:

The NOIA tokens are getting listed on July 22 in KuCoin. Three weeks after that, the monthly bonus schemes will begin. You will get NOIA airdropped into your wallet on September 12, October 12, November 12, December 12, and January 12 for a total five bonus months.

- If you own anywhere between 3,000-30,000 NOIA tokens, you will get a monthly bonus of 300 NOIA for a total five-month haul of 1,500 NOIA.

- If you own anywhere between 30,000-300,000 NOIA tokens, you will get a monthly bonus of 4,500 NOIA for a total five-month haul of 22,500 NOIA.

- If you own >300,000 NOIA tokens, you will get a monthly bonus of 60,000 NOIA for a total five-month haul of 300,000 NOIA. In essence, you get back your initial investment.

Because of this five-month airdrop plan, investors who choose to hold on to their tokens will be handsomely rewarded for their loyalty. So, this begs the question, what happens after the airdrop period is over? What is the long-term value of the NOIA tokens?

Believe it or not, this is where NOIA tokens shine even more.

Long-term value

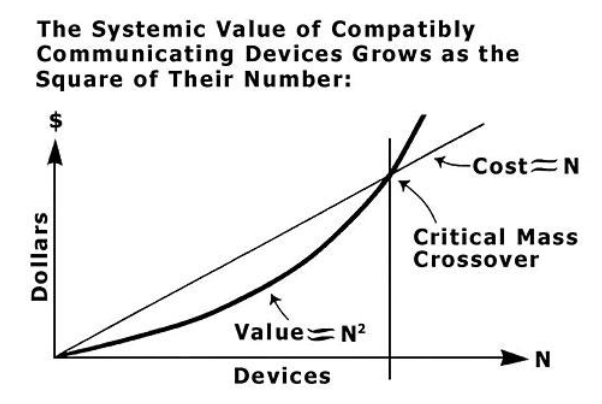

When it comes to long-term valuation, this is where NOIA has an unfair advantage over its peers. NOIA is trying to make the internet faster and more efficient (to put it very crudely). This is something that affects every one of us. Look at how quickly technologies such as broadband and optical fibers got adopted because everyone wants their internet to be faster and better. Plus, even more than individuals, businesses who want to scale up their current product will be heavily tempted to join the NOIA network. As more and more nodes enter the network, it will continue to get stronger, and this is when Metcalfe's Law will come into play.

Metcalfe’s Law is a theory of network effect. According to Wikipedia, “Metcalfe's law states the effect of a telecommunications network is proportional to the square of the number of connected users of the system (n^2).”

Image Credit: Andrew Chen

In simple terms, Metcalfe’s Law states that more the people involved in a network, the more valuable it will be.

To understand this, consider the following example:

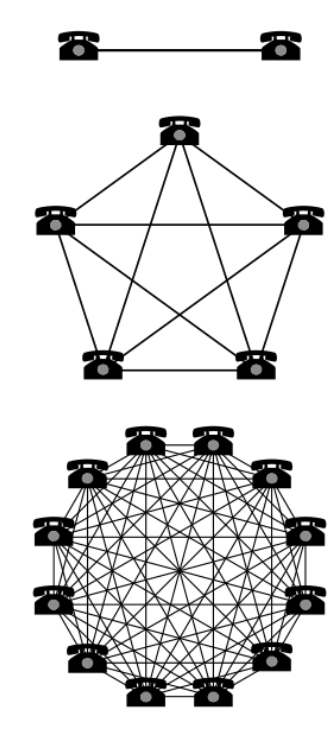

If only one person owned a telephone, then it won't be valuable at all. However, if two or more people own a phone, then it is instantly more valuable since they can now connect with each other and share information. Check out the following diagram:

Image Credit: Wikipedia.

As per the diagram, If you have two telephones in the network, then you can only make one connection. If there are 5 phones, then you can make 10 connections. However, if there are 12 phones in the network then you can make 66 connections. That’s a pretty impressive exponential growth!

Plus, one more thing that you shouldn’t forget about networks is that they tend to have a life of their own. Meaning, as more and more people use them, they manage to attract more and more users. This is the reason why most successful networks tend to enjoy extreme exponential growth.

Conclusion: Bringing it all together

So, if we are to summarize everything that we have learned above, what do we get?

- NOIA is still in the early-market stage.

- In the short-term, NOIA is protected from pump-and-dumps via intricately planned airdrops.

- In the long-term, NOIA Network leverages the Metcalfe’s Law to create immense value within its network.

If you look at all the facts, then it is easy to see why investing in NOIA tokens is a complete no-brainer.

That's great news! I'm still using their NOIA node applicacion 😄

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Noia Network team have been making headlines! Saw them getting coverage on Boxmining and BlockchainBrad, the other day! Never thought blockchain could be used to decentralize Internet infrastructure

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Highly recommend watching both reviews. However, I found BlockchainBrad's Review to share more insights surrounding the project and the approach they're taking with their tokenomics. Watch both!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

tip!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Seems like a fair approach! Interesting analysis here that can be applied to other projects

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Appreciate the comment! Will be applying this analysis to other projects! Thanks for the heads up. tip! 0.05

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nicerrr One.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @crypto.hype!

You just got a 0.09% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypto.hype! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit