Was there a case in your practice that you were refused getting a loan in a bank? I had it, the first time because my official earnings were too low. Then also because I "go abroad too often". In short, there are a lot of reasons for refusing, or banks are creating very unfavourable conditions for granting a loan. Such a monopoly already gets under the skin. Therefore, I was interested in the appearance of Distributed Credit Chain, a Chinese blockchain for lending.

How will this work?

DCC project was created by financiers who perfectly understand the role of credit institutions in the society and the degree of the trust in them. Decentralization of management helps to increase this trust. Regardless of whether you take a loan for personal purposes or for promotion of a business, you can count on favourable conditions and the absence of intermediaries (in this case – absence of banks).

Nowadays all structures, including banks, are moving to a virtual model of customer service. There are, for example, Tinkoff Bank in Russia, which do not have offices in the real world, but provides credit cards. Therefore, this can not be the cause of mistrust of virtual loans through the blockchain.

Why is it profitable?

Because even if you have an ambitious business plan but a hole in your pocket, you have nowhere to go from the suffocating conditions of creditors. Whereas this DCC project intends to break through the banking monopoly corridor, providing loans on more favourable terms and much faster. More than 37, 000 subscribers in the Telegram channel testify that "yes, it's profitable".

How the ecosystem will work

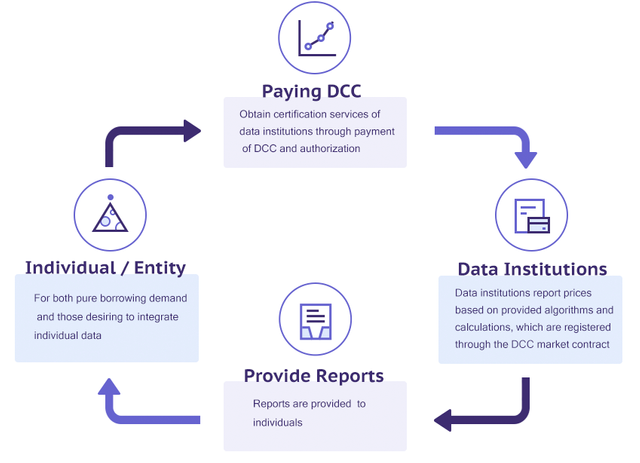

It will involve four key participants:

- Borrowers who provide information about themselves on reliably protected sites, and it is checked only once, saving for subsequent ones;

- Lenders who decide on their own terms and conditions;

- Insurers, who ensure high liquidity of transactions;

- Developers of Fin-tech applications, on which the work of smart contracts depends.

Undoubtedly, credit relations are needed, and they move us forward. No wonder the credits of other emperors allowed Spain to send expeditions to the New World and colonize the US - ironically, now it is the largest borrower in the world. And with the development of the blockade, the problem of monopoly and information leakage in lending should be resolved.

Advantages of DCC

- Victory over monopoly and distribution of income from loans between all users of the chain;

- Decentralization of management and general thinking;

- Branching of the banking system will increase efficiency in general;

- Large institutions for analysis will be able to monitor the market and respond to jumps or falls in time;

- It will be convenient for users of the platform to register and provide data not to intermediaries, but directly to creditors.

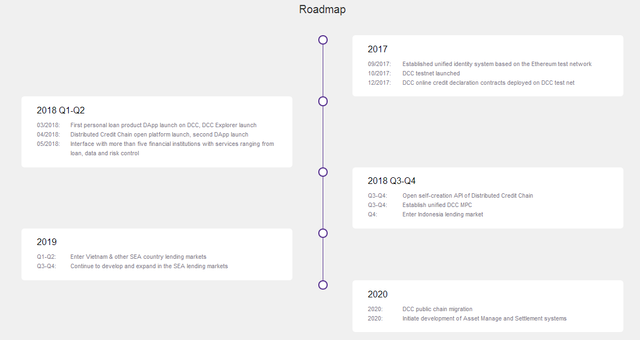

And do not forget about tokens, the system of which is also developed and allows you to earn suppliers of blockchain. I will follow the mainline of what is happening, keeping in the Documents this Road Map:

ICO of DCC project

While I wrote this article, all the dates on the official website for Pre Sale have suddenly disappeared. The Pre Sale round ended on June 28 at a rate of 1 DCC = 0.00007299 ETH, which is undeniably small. But the early completion of the ICO indicates a growing interest in the project. Now the tokens are sold only through listing. And here's how they plan to distribute:

- 20% will get the Management Team and I find it justly;

- 28% will go to support of the Foundation;

- 8% spent on marketing and promotion;

- only 2% were sold out under the ICO;

- 17% make Eco-Reward;

- 15% will be given to advisers and consultants.

Conclusion

Cross-border loans are something new. If this sector with the help of crypto-currency will become decentralized, then why do we need states? Reading the first pages of website, I immediately wanted to buy the project's tokens. Fortunately, they are already traded on several exchanges. And the price for the moment is even lower than during the ICO - it's time to buy!

This post was resteemed by @steemvote and received a 93.22% Upvote. Send 0.5 SBD or STEEM to @steemvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got a 50.49% upvote from @mitsuko courtesy of @crypto.invest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's a good area for blockchain technology.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not so many projects are trying to use blockchain in a proper way. This company tries to do so.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fair loans its good.👍 I'd use it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fair. That's the most important. You can't fake the code in the blockchain with open source framework.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post on dcc. I have also written a detailed review of dcc here: https://steemit.com/airhawk-project/@foley/distributed-credit-chain-dcc-world-s-first-distributed-credit-agency-on-the-blockchain

An upvote from you will be well appreciated

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit