In mathematics, before we start to talk about anything, solving or discussing any problem – we define key concepts related to the problem being addressed, so we are actually on the same page.

Due to that, to begin our considerations related to moral hazard, risk transfer and trust, we will define following key concepts:

Moral hazard - the thesis claiming that the subject protected from risk may behave differently than if he were fully exposed to risk. For example, an insured person may behave more risky compared to a situation where she or he would not have insurance. Moral gambling is growing because individuals and institutions do not bear the consequences of their actions and therefore tend to be less cautious than they would be if they were to suffer full effects.

Information asymmetry - a situation in which one of the parties of the transaction has more information from the other side. The scope of information available to the parties making the transaction is therefore diversified. For example: if A is trying to sell a car, which doesn’t work properly, to B, but only A knows that the car is broken.

Risk (understood as a threat and an opportunity) - the possibility of obtaining a result that differs from the expected one (it may differs in advantageous or disadvantageous).

A financial intermediary – a person who should have an adequate knowledge about the offered financial products and skills in the broadly understood finances (including financial mathematics) that will allow the intermediary to select an the optimal product for a specific client (in theory it is a product that provides the client with maximum usability). (VERY IMPORTANT!) The situation in which the intermediary can’t be objective, or what is much worse, has a conflict of interests with his clients is unacceptable. However these situations occurs due to intermediaries remuneration system based on commissions.

The scale of unethical behavior of financial intermediaries that emerge from the phenomenon of moral hazard is difficult to estimate. Nevertheless, the fact is that many press articles can be pointed out, which give examples of sales by financial intermediaries of financial products that are not adequate to the client's needs, or even harmful and extremely risky products for the client.

The best evidence of that the clients financial intermediaries are victims of moral hazard are groups of people who organized in order to file a class action lawsuit, claiming that they were harmed when buying the recommended financial product. In their opinion, they did not obtain important, or sometimes crucial information about the product (e.g. that the profit after the end of the long-term contract may be symbolic) or even obtained false information (e.g. about the conditions for early termination of the contract) from the intermediaries, who were supposed to not only provide the clients with all essential guidance, but also explain it in a simple, understandable way (not necessarily using financial jargon, which is fully understood only by a few).

Today we are going to try to find the answer for two questions given:

How is it possible for the creditors (banks) and for financial intermediaries to transfer all the risk on their clients (the debtors)?;

What does the moral hazard has to do with cryptocurrencies and how should you protect yourself?

Ad. 1 How is it possible for the creditors (banks) and for financial intermediaries to transfer all the risk on their clients (the debtors)?

I've been working in banks and loan companies for few years and it took me a while to see how greedy, rutheless and calculated it all is. In the end, if banks do not get too greedy to get blind, it is possible for banks to transfer all risk to their clients. Obviously, financial intermediaries are probably not fully aware of that, but they usually do not really care, since they got their comission, which in most cases is all they care about. Financial intermediary, in the following case, is just a party, a seller, who were supposed to deliver the client to the bank and convice the client, by gaining the clients trust, that he has got the best offer possible delivered on the silver platter.

So, how come that the creditor can make a great, profitable transaction, without risk of losing some of his money?

To answer that we will have to take a look on how the risk is measured and how it is possible for the bank to have the estimated loss close to 0, while for the client it is relatively high?

To answer that we will have to take a look on how the risk is actually measured.

Let L be a random variable, which represents the Loss. The expected value of a random variable L can be given by following equation:

E(L)=PD x EAD x LGD

Where E(L), PD, EAD, LGD are:

E(L) – Expected Loss

PD – Probability of Default, describing the likelihood of a default over a particular time horizon. It provides an estimate of the likelihood that a borrower will be unable to meet its debt obligations;

EAD – Exposure at Default can be defined as the gross exposure under a facility upon default of an obligor;

LGD - Loss Given Default

LGD=1-RR

RR – Recovery Rate, Recovery rate is the extent to which principal and accrued interest on defaulted debt can be recovered, expressed as a percentage of face value. The recovery rate can also be defined as the value of a security when it emerges from default. The recovery rate enables an estimate to be made of the loss that would arise in the event of default, which is calculated as (1 - Recovery Rate).

The higher E(L) the higher is the risk associated with the particular loan and the particular client.

An example:

Let’s imagine that we are a bank, a creditor. Let’s also assume that there is a client who has a collateral, which is a house, and this house has no mortgage. Let’s assume that the client wants to borrow $100 000,00:

To evaluate the expected loss we have to estimate following variables: PD, EAD and LGD (or RR, since LGD=1-RR).

Let’s assume that we have built proper models using logistic regression and decision trees, and we have estimated following values:

Probability of Default: 95%, which means, that in 95 out of 100 cases the client will default at the certain time (usually 12 months);

Exposure at Default: $90 000, which means, that when the client defaults, he still most likely owe us 90% of the amount we lent him.

So now, our estimated loss is given by:

[$] E(L)=0,95 x 90000 x LGD

Basically, so far, this deal doesn’t make any sense to make for us. It’s way too risky and will generate high losses in the long run, right? And for us long run is the only thing that matters.

However, let’s assume that the client’s house is worth $500 000 and is considered to be a liquid asset.

Now, the LTV Ratio (Loan to Value Ratio) is quite low and is equal to 0.2, which is great for us. It means that in case of the event of default occurring the Recovery Rate is close to 1, or equals 1.

This is because the collateral is not only liquid, but the LTV is low enough to cover not only the loan, but also the penalty interests and side costs.

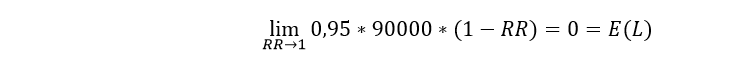

In connection with the above considerations, if RR is going to 1, we’ve got:

and also

As we can see, despite the fact, that the client will most likely not be able to pay his debt, and what is more, will probably default very quickly, the estimated loss, which matters the most, is going to 0. Will we take this deal and give credit to this client? Since the estimated loss is going to 0, it is obviously a profitable for us, so yes.

How about the client? Will he take the loan we are going to offer him?

Probably yes.

Is it a good deal for him? Most likely not.

Why does he take the loan, when the Probability of Default and the chance of him being forced to sell his house in order to pay the debt is so high? Does he even know what his Probability of Default is? He most likely doesn’t, and he won’t know that from us nor from the financial intermediary. This is what is called an information asymmetry.

One may ask: why would he take the loan if he knows that he is most likely not going to be able to pay it back in time? Well, first of all, he wishes he will be able to, and what is more, he definitely more appreciates current consumption than future liabilities. This is related to the so-called perspective theory, which we will be discussing in subsequent articles.

Ad.2 What does the moral hazard has to do with cryptocurrencies?

Once I realized what financial advisers and financial intermediary are capable of in order to achive their goals, mostly financial goals, I have no doubt whatsoever what most of the people, often kids, who give their viewers not official investment advices on their youtube channels actually have in mind. I wanted to make sure you are aware of that and make you think about that who these people actually are. Most of the people who talk about making all this easy money, "lambos", promoting financial pyramids such as "Bitconnect", are most likely not trustworthy.

Be smart.

Hope you enjoyed it. Thank you for reading.

✅ @crypto.series, let me be the first to welcome you to Steemit! Congratulations on making your first post!

I gave you a $.05 vote!

Would you be so kind as to follow me back in return?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The better way to look at it, is to forget ALL of these definitions which are silly legal-ese, and just do what makes sense to you. YOU know if you've put in the time to understand something, and YOU know when you're trying to make money too fast and just trusting without verification. So YOU are ALWAYS to blame or credit when deploying YOUR money.

Stop suing everyone for your own mistakes in life, and the world becomes a better more efficient place. Trust those who earn your trust, it's as simple as that. No definitions required, just meeting people and getting a feel for whether they are full of shit or not.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your comment, but I don't think i can agree with you, and I will tell you why:

When we talk about trust we talk about a knowledge or a faith, a belief that someone's actions will be accordance with our wishes. And you are right, when it comes to financial intermediaries it is often about TRUST based on faith and believes, because their clients are usually not educated enough to be able to verify if the intermediary not only is qualified enough, but also honest with them. The clients are in most cases not capable of veryfing that, because they are not only educated enough (and yes, in my opinion, they should be and), but also often do not have enough time to make their research in order to verify the given informations.

I believe that the greatest enemy of knowledge is not ignorance, but the illusion of knowledge, and due to that I believe that people who are not educated enough and not qualified enough (just like many of youtubers) SHOULD NOT try to form opinion of others. You are probably fully aware of its implications. In my opinion, because of that, the world becomes bigger and bigger mess, instead of better and better place.

We were not talking about my own mistakes and I can't see how you deduced that.

By the way, did you find the article interesting overall?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypto.series! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit