It would seem that the words ‘revenue share’ or ‘dividend’ have become dirty words in the land of crypto of late. This stems from a planned push from traditional finance, seeking to impose value restriction on investors, to slow adoption inside the cryptosphere (IMO). The benefits in a lot of the current tokenised offerings, are poor at best, giving investors mere digital vouchers for useless token utility. A lot of crypto investors, can see the potential in many of the projects disruptive value propositions, but don’t plan on actually utilizing the disruptive tech, so hodln seems a fools game in speculative risk.

The defamation of what some would class ‘security tokenisation’ is at times, being driven by investors inside cryptocurrency, who have been misguided to believe that ‘centralised regulation’ is the only way forward.

So, how is regulations working out for fiat?

What about the commodities regulatory framework , hows the stagnant SLV price holding against the subvert and overt manipulation?

Thank goodness there are still some blockchains out there fighting the good fight in providing returns to investors. Pushing back on the defamatory slang of ‘security’ by offering project revenue share to the financial backers. One of these current offering is a blockchain project called Corl, let dive in.

So What Is Corl

Corl is a Canadian based revenue share blockchain project niched in the tech startup and accelerator space. The projects native token (CRL) represents equity ownership in the company for profit sharing among participants with profits distributed quarterly based on project performance.

Startup Accelerator Model

With the introduction of blockchain tech, we’ve seen a considerable amount of newly minted tech companies go from seed phase to billion dollar businesses in just a few short years. The rapid market movement in the current fintech space is the perfect storm for a blockchain based startup acceleration. Corl plans to dive head first into this space by selecting small innovative tech startups and providing funding and training to seed their project to the masses.

Corl believes it is time for investing in early-stage companies to become more

intuitive and evolve into what we call, Capital-as-a-Service.

Corl Business Platform

Corl will be implementing a ecosystem where startups seeking funding can apply quickly and directly through the Corl Business Platform. The application process is straightforward. During the screening process Corl will capture payment gateway info, credit history results and available social profile data. An analysis will then be conducted on niche market placement and growth potential.

Corl Investment Platform

Corl will also be implementing a investor based portal where token holders will be able to login to purchase, manage and monitor selected Corl business ventures.

Revenue Share Model

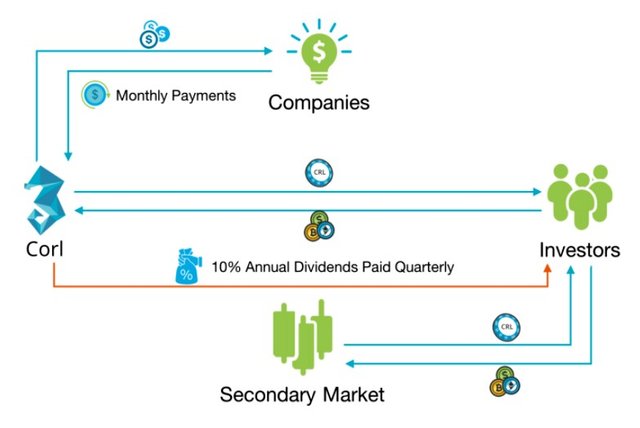

The Corl token will be backed by the seed portfolio in selected startups. Holders will gain access to revenue share in the chosen companies already operational and profit generating. Each startup generates revenue through the following outlets:

- Revenue Repayments, between 2% and 10% of revenue, up to the Repayment Cap of 1.5–2.5x the amount borrowed.

- Origination Fees, minimal initial setup fees, between 2% and 5% of the difference between the Principal Amount and Repayment Cap, which are deducted from the first drawdown by the company.

- Equity Warrants, representing 2% of equity in the company that expires 2 years from the date of full repayment. These sources of revenue will determine the profitability and financial position of the company. Note that since the token represents equity ownership in Corl, the token price and quarterly dividends will depend on the continued growth of these revenue streams.

While only 10% of profits are returned to investors in the early stages (via ETH payments), a 90% reinvestment rate will ensure strong future growth as more startups are funded into the capital pool.

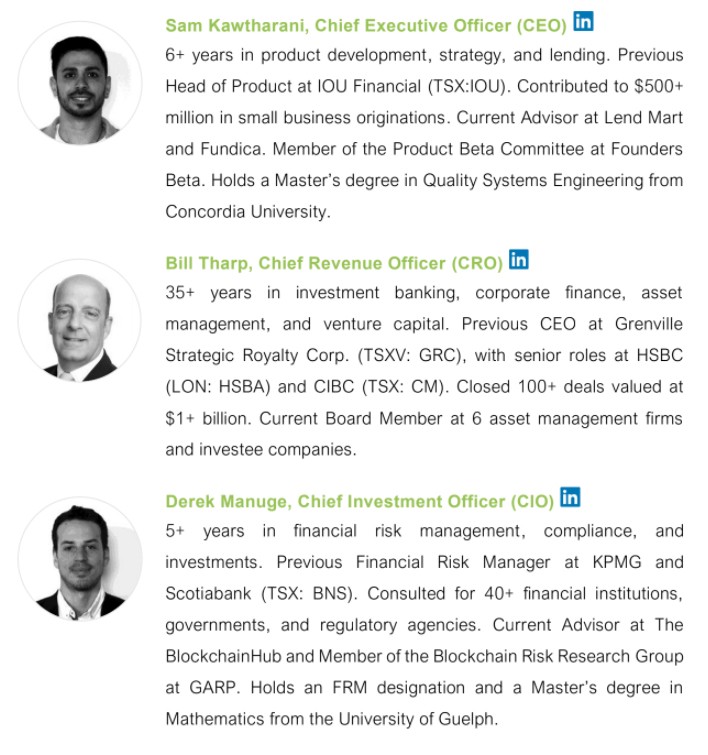

Corl Team

The team have vast experience in the industries of technology and finance. Bill Tharps 35+ years in investment banking and Venture Capital sets for a solid foundation in their targeted niche.

Conclusion

In conclusion, this project is one of those hard to find hidden gem, with potential, if you appreciate the VC and finance blockchain value props, this one is defiantly worthy of some further research IMO. ICO already in motion and set to end April 30th 2018.

Web: https://corl.io/

Whitepaper: https://corl.io/whitepaper

-CryotoBlockBits Signing Out-

As always use this information as a guidepost for further research. Never take anyone’s advice on investments (not even financial advisers). Delve into the project via their social media profiles, search the project on bitcointalk.org, duckduckgo.com and reddit.com and only put money in that you can afford to lose. Cryptocurrency is risky — Fiat is a dead man walking.