1. Not doing research on coins

Almost everybody who start whit cryptocurrency is going directly to Telegram, Twitter, Medium or Youtube. What everybody looking for is thumbnails, to the moon, next bitcoin, 10x or 100x coin's in a month and similar staff to get rich quick. Not many people actually not even go to coin page, not read whitepaper, some of they doesn't even know why they bought this and that coins ant what this coin or token does and what is the value of that coin. We can see it on youtube when people like trevon James and Craig Grant have more views and people to follow them, then youtubers who is saying true and not giving people stupid thumbnails with "be millionaire in month, or make 10x in one week.

Do your on research, think about what you buy it, what value have coin or token, how can you use it in future. Be smart and invest wisely.

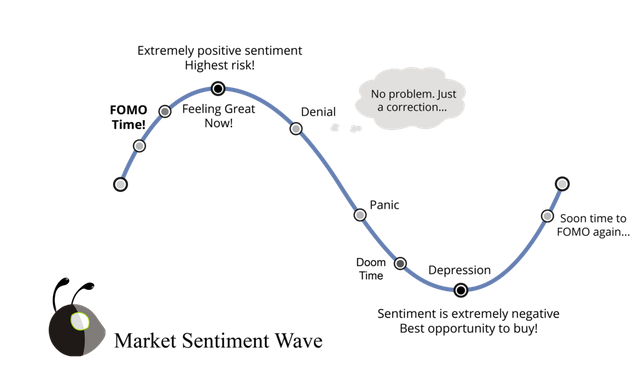

2. Don't FOMO buy

Don't FOMO (fear of missing out) buy coins. It is one of the worsted think to do. When you see some news or youtubers pushing some coins or even you will find some Pump and dumb group... Just stay away from it. You have to realize that iinvesting in cryptocurrency is not short run but long run. You cannot miss anything, everything has its time. Just be patient and think before you invest.

3. Not understanding basic charting fundamentals

Most traders think charting or technical analysis is either extremely complicated, or just over-rated. While both views can be argued, there is no denying the fact that market movements and coin prices have patterns that can be identified and used for, at the very least, ‘increasing’ the chances of successful trades.Just like everything else in life, there are no guarantees in the crypto market, and given how it is largely speculative and emotion-driven, charting and technical analysis will, and does fall apart now and then.That being said, if you are serious about trading, you should understand the basics, such as candlesticks, support and resistance zones and trend lines.

Details of technical analysis will not be discussed in this piece, but we will be publishing more in-depth guides and tutorials in the future.For starters, you should understand that resistance zones are price ranges which a coin has repeated failed to break through, while support zones are where the price often bounces back. Identifying these zones can help you assess where the current price stands, and whether it has room to go higher or drop further. Trend lines are also quite simple, where an uptrend is indicated by the price making ‘higher lows’ (green line in the screenshot below) and a downtrend is reflected by ‘lower lows’.

4. Panic sell on bottom, buying at on top

I see this many time. And all you need to do to prevent that from happening is doing research in first place. When you know why are you buying coin, you know if it good price or have it potential and room to grow. Never panic sell for no reason. If you will connect 3 mistake with this they will equal each other. What i mean. If you dont FOMO buy, but you will do you reaserche and you know that project is undervalue and need just time to grow than you will never panic sell. Many people does that in December 2017 when many people came on market and start buying like crazy, investing in anything. And then when January crypto market make small correction, fud news pop up and all this people just panic sale and market came down from 800 bil. market cap to 350 bil.

5. Not taking profit

I see many people doing that mistake. They buy it on bottom, chart go crazy and people doesnt know what to do. Waiting for moon? Sell and Exit? Either of this two options in my eyes are bad decisions. Why? Let's say you do you research, you have great entry point, but you dont have plan what you will do later. Having strategy from beginning till end of trade is one of the most important think to have.

So what is my strategy for taking profit? Best think what you have to do is spliting your position on 3 1/3. What do i mean by that. Lets say I will buy token for 1 dollar. Market go up price stop on 3 or 4 dollars and then it will go sideways in this moment i will sell 1/3 of my tokens, another 1/3 i will send to wallet and keep it there for long term and rest of them i will keep on exchange and waiting for another major movement.

6. Never get emotional with coin

Let's say you do your research, you join some promising ICO, great whitepaper, good team, you buy ico token which is best way to double or triple your investition no problem. So token finish Ico, came on market and you looking on 5x profit but on every single forum or twitter you see it will go to the moon. Don't get emotional, follow your strategy and don't listen empty words.

That happen to me when i bought Electroneum, project have good idea, good team and extreme hype. So when coin hit marken i was looking on 10x. So i wait one day but from everywhere i heard dont sell it it will go to moon, it will hit 100x in january. But i follow my strategy and even adjust when they didnt bring what they promise and i sell my position. And price after few day drop almost on Ico price.

7. Don't put all your eggs to one basket

Even the most hyped of coins can, and do suffer from major dips while the market as a whole stays green. Cryptocurrencies are unpredictable and in a state of evolution, which means there is no single coin (not even Bitcoin) that is ‘guaranteed’ to survive down the road.Whether you are holding, or trading, you cannot afford to put all your funds in one coin. Diversification and risk management is the key to a sound portfolio and finding good entries in multiple coins will increase your chances of profiting.

8. Looking on price

Many people who starting with cryptocurrencies are looking on price. They dont wanna buy Bitcoin because it is too expensive so instead they will invest in some shady coin's.While it is true that it’s easier for a $0.05 coin to reach $0.10 compared to a $500 coin reaching $1,000, but it is also easier for a $0.05 coin to go down to $0.01, wiping you out completely. The key here is to not just take price as an indication of profitability, and conduct your research to understand why a particular coin is cheap, and which, if any, upcoming developments can boost the price.

I upvoted, nice post! #upvoteforupvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit