there is a video link below for those who prefer audio version

Scalability is one of the big buzz words in cryptocurrency, It represents how well a blockchain project is able to scale as their business grows. Ethereum’s theoretical speed is 1000trx/ sec, but practically it functions at 16 trx/ sec, because it is not scalable. There have been many theorectical scaling solutions proposed over time, e.g. sharding, lightning, raiden, plasma etc. We are reaching a very exciting time in Crypto world where many of these scaling solutions that have been talked about for years and were just concepts are finally starting to be really integrated into projects on a practical level and used to reach transaction speeds previously unheard of. IOS is one such project that aims to use Sharding to achieve transaction speeds of up to 100,000trx/sec. That would easily make it one of the fastest platforms in the world.

IOS describes itself as:

In layman terms, IOS is basically a blockchain platform. It’s a platform on which other blockchain projects or Dapps (decentralise apps) are built on.

A blockchain is basically a store of data, or information.

It’s the world’s safest way of storing data, and it achieves this by the process of decentralisation. Decentralisation is spreading the processing of data across thousands of nodes, rather than a single entity who can be hacked or corrupt. All these thousands of nodes will then check with each other and come to a consensus before storing the information on the blockchain. Every node also has a copy of the information. Because the information is stored on thousands of nodes, to change one copy, you literally have to change all the information on all the node at exactly the same moment, which is impossible. Thus the blockchain is supposedly unhackable and untemperable.

But the limitation of the blockchain uptil now is that the above model only works well for small volumes. When the data you are processing and storing, grows from megabytes to gigabyte to terabytes to petabytes and beyond attempting to process and store every piece of information on every single node results in an extremely slow throughput, or movement of data through the blockchain.

To solve this problem, IOS uses a process called Sharding to speed things up. Sharding is essentially splitting all the available nodes up to smaller groups of equal number of nodes and getting each of them to process/ validate and store different bits of data.

So instead of having one system validating data, I now have like a thousand systems or shards processing the data. This speeds the whole system manifold, but more than that, it’s sustainable, meaning as the system grows the processing power and speed actually improves rather than slow down because you have more and more shards to do the work. This is scalability.

Now IOS is not the only project using sharding. There are a few other projects e.g. Zilliqa (whom we have done a review for as well) who use sharding as well. There not many projects that can successful implemented a scaling solution at this point int time, and in my opinion all of them are worth paying attention to. Every project that uses sharding is using the same concept of partitioning the data, but what makes each sharding project different is the WAY they implement sharding.

IOS have called their sharding method “Efficient Distributed Sharding”. To the best of my understanding, there are 4 features that make them unique as a sharding program.

The first is what is known as TransEpoch. TransEpoch is basically a node-to-shard assignment protocol. So where some sharding schemes are static meaning the nodes don’t change. IOS uses a dynamic rolling scheme where the nodes are swapped in and out in batches. This improves the security of the system the biggest disadvantage of sharding is by using shards not all the nodes to verify a transaction, theorectically you lower the security of the system as well. So having a dynamic rolling scheme really helps.

The second feature is not only are the nodes swapped in and out, they are also picked by random, to reduce the chance or impact of any malicious nodes.

The next feature is called Atomoix, which for those familiar with computer science, this is atomic commitment protocol.

It’s basically a way transmitting data across shards instantaneously. In addition, there are some security features, e.g. 2 tier verification etc… to make the transactions both safe and fast.

The fourth feature is the way they store the data. IOS uses a technology called “Micro-State Blogs” to store Data.

Think of this as summary of all the transactions. So the system will set checkpoints and at those checkpoints, a snapshot or summary will be taken. So if a new node joins the pool, or recovers from a crash, rather than having to download the entire history of the blockchain, they can now just take a copy of the summary. So it saves a lot of time.

Now currently in testnet, their speed is 8000 trx/ sec. Which is a lot faster than most platforms already. The average speed for the new generation platforms currently is 1000-2,500 trx/sec. It is estimated that by this year they should be able to achieve speeds in the 10,000’s trx/sec and the max estimated transaction by the team is 100,000 trx/s which would make it one of the fastest platforms in the market.

Now besides the EDS, the other key feature of their tech is their concensus algorithm which is Proof-of-Believability or (POB).

The oldest concensus algorithm is proof of work, that’s what Bitcoin uses. It’s not used very much anymore because its not very efficient and also uses too much electricity. These days, the most popular concensus algorithm is Proof-of-stake (POS) or Delegated-proof-of-stake (DPOS). The weakness with POS is that those who have more stake more and earn more, as a result, there is infinite earnings by those who are richer and can stake more and earn more and stake more again etc… the entire concensus then becomes monopolised or centralised around a few rich people. DPOS tries to solve his by doing a voting system. So masternodes are voted by the community and can also be voted out by the community. However, the difficulty with DPOS is that there are a set number of supernodes, in some cases less than 5 supernodes. So these are the stake pools that smaller token holders join to stake. But it ends up being the same problem where the concensus is centralised around just these few supernodes.

Proof of believability in construct is very similar to Proof of stake and delegated proof of stake. But instead of using pure amount of tokens or voting to select which nodes can participate, it ensures fairness by using something called the believability mechanism.

How it works is like this. All nodes are divided into 2 groups, believebale league and a normal league.

Believable validators process transactions quickly in the first phase nad the normal validators sample and verify the transactions in the second phase to provide finality and ensure verifiability. This means the whole process doesn’t go depend on one node, but is checked and validated to prevent malicious activities.

The chance of a node being elected into the believable league, which is like a semi-masternode. Is based on the believability score, which is calculated by a complex algorithm including contribution to the system, tokens held etc..

There is also a punishment system, where if the normal nodes detects any inconsistency in data, the culprit validator node will lose all his tokens and reputation. This is very harsh, but it is set to strongly discourage misbehaviour. You would have to be intentionally trying to sabotage or hack the system to warrant this punishment.

Tokens:

Let’s talk about the token use. With any platform project, as token investors, we are not investing in the shares of the company as we would if we bought the shares on the share market. The difference between buying shares on the sharemarket vs buying tokens on the crypto market is a shareholder owns a share of the company and what they are investing in the is the actual value of the company. As a token holder, we are investing in the value of the token, not actually the value of the company. Usually the two are related, so to have good token value you must have a successful company. But its not necessarily vice versa. Meaning you could have a great company, but if there isn’t good token mechanics i.e. token use. Then the company can be earning a lot of money through its technology, but the token price actually stagnants and doesn’t rise. Crypto is currency, for any currency value to rise it must be in demand, it must be used. The more a currency is being used, the more the demand and value of the token rises. The less it is being used, the lower the value of the currency. So as token investors, token use is very important to consider. Also what you want to see with token use is a circle. Meaning there is an avenue for money to go out, and an avenue for money to come back in. This means the economy is sustainable and can last a long time. If you only have money coming in or going out in a one directional way, than that economy is a bubble e.g. a Ponzi scheme.

SO in this case, IOS has a very healthy token mechanic set-up. It is a service centric model with high performance, meaning they are aiming big companies. Companies like visa require systems with Trx speeds of 45k / sec or more. So a lot of smaller blockchain platforms will not be usable by these big companies. So aiming to be a service platform to these big companies, the IOS tokens can be used for payments, commissions to validators and believability score (so this is the outflow of currency from the user’s point of view). But the user can also earn IOS token through block validation, community service e.g. contributing resources e.g. storage space or buy them directly from exchanges.

So it’s a very healthy sustainable economy.

Something I noticed in their whitepaper which I have not seen any other review mention is that they will have a second token known as a Servi Token.

Servi token is a token designed to encourage members to contribute to the continued development of the IOS community. It is non-tradeable, so you cannot buy it, it can only be earned after contributions and it is self-destrutive after validating a block. I think a better way of looking at Servi, rather than a currency is more like a score system to keep the believability score dynamic, so just because you contributed a lot to the IOS project once before doesn’t mean that your believability score will always be high and you will always be the top node. The score/ Servi token will be destroyed after validating a block, so it ensures people have to keep contributing if they want to remain a top earning node. Very clever, haven’t seen this economics done before in the blockchain space, but it makes a whole lot of sense.

The last thing to mention about the token and this is more a piece of news rather than token mechanics.

Just 2 days ago the team released an announcement that they will be locking the tokens reserved for the Foundation, so 35% of all total supply in a public wallet which can monitored at anytime by the public. And the wallet address is on the article itself. I think this is attractive to investors, because it means stability in the price point, but it a lot of confidence by the team in the project. Because by locking in the tokens, the team cannot bail out even if the project crashes, so they have to be very confident to make a statement like that. And by the way, their mainnet as we see in their roadmap later is not around the corner, its over a year away. So this is a big commitment by the team.

The team is not the only ones with confidence in the project, if you look at their sponsors/ partners.

There are a lot of capital firms in the list, whom you will assume are investors. You have Sequoia, Danhua capital, LinkVC, nirvana capital, Zhen fund, even huobi. A lot of these names are investor companies we’ve come across in previous reviews and they have very good investment portfolios that tend to pick winners. So if even one of these investors include this project in their portfolio that inspires confidence. But you so many capital firms investing in them. I think this is possibly the most capital investors ive seen on a blockchain project so far. Personally, this one page itself inspires more confidence in me that all the youtube positive reviews. I follow crypto youtubers and I have a lot of respect for many of them, but ultimately, all the reviewers including myself are not professionals, but these guys are, and in their evaluation of this company. Many of them are seeing something worthwhile investing into in IOS. That has got to carry some weight.

This is their team. I don’t really like that they put a cartoon profile pic up.

You can click on their linkedin link to open up their profile. It just seems unnecessarily troublesome.

They have 5 co-founders.You can go through each of the profiles if you wish. I’ve gone through quite a few of them and I would summarise it as a impressive team, with strong resumes from universities like Princeton, Harvard, John Hopkins etc… individuals with awards e.g. gold medal ACM programming contest, previous working experience in big companies like Goldmans Sachs, Morgan Stanley, Microsoft etc..

Age wise, they co-founders seem young, but some like Jimmy Zhong has actually had multiple successful startups worth 10s of millions. And in their lifestream he mentioned as well as several of the co-founders were friends with him from previous projects, so we know well they work together. If you’ve been in crypto space long enough, you would know of some dramatic fall outs in some of the bigger projects e.g. Vitalik and Charles Hoskinson co-founders of Ether falling out, and Charles left and Cardano. Or Brad and Jed McCaleb co-founders of Ripple falling out and Jed starting Stellar after etc… so fallouts are interesting news, but not what you want in a project you are investing in. With many co-founders you worry about such drama behind the scenes, but with this team, its reassuring they have worked on multi-million dollar projects before.

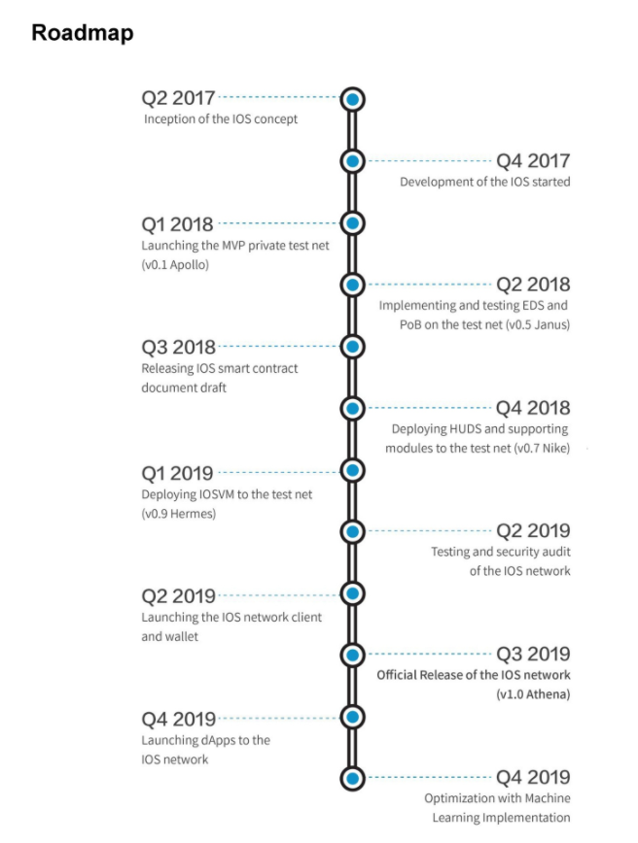

This is their roadmap:

It’s a good roadmap with consistent goals spaced out every quarter and the team is definitely keeping to schedule. Very clean and easy to read roadmap.

The main take home from this I want to point out is that official release of mainnet is only in Q3 2019. And Dapps only officially launching in Q4 2019. So it’s a long HODL. This long HODL is a double edge sword. On one hand they might miss first mover’s advantage market which is a huge thing in crypto, but on the other hand it gives them flexibility to see what issues the quicker third generation platfroms are facing and adjust to address those issues. So they will potentially more complete at launch. Personally I don’t mind the time frame, I don’t think it’s too long cos we are still in early days of blockchain and the roadmap looks reasonable in terms of milestone, so I think are approaching things carefully and not rushing it, which is great.

Couple of things you can look forward to this quarter include implementing and testing EDS (so their sharding) as well as POB on the testnet. These are core features of their tech, so it’s still a big deal to pay attention to.

One small consideration I have that I couldn’t find answered satisfactorily from the whitepaper or the community, was about security. So the other good scaling platform at the moment is Zilliqa and Zilliqa has something called Sybil resistance, which is basically a protection against a specific type of attack. This is not a negative point against the project, its just a question I have that I couldn’t find an answer to. In fact I should give a shoutout to their telegram community. They have a huge telegram community 39k members, and I was on there yesterday for about half an hour shooting out tech questions and 3 of their admins patiently took their time to answer my questions and the community chipped in and was very helpful as well. So it was the most helpful telegram community I’ve ever come across so just want to say a big thank you to them. If anyone has an answer to the Sybil questions above, please post a reply in the comments below so others can see the answer.

Ok, finally rounding up with price prediction:

When they hit the exchanges back in Jan, they opened at $0.022, and then they had the Binance jump at the price went up to $0.12. This spike here was from Binance listing. It was not the big price jump on the other graphs in early Jan where altcoins went up 20-50x. IOST was not released then yet, so they haven’t seen their first bull run. You can only imagine what will happen then.

Currently they are sitting at $0.035. If you look at the graph on a whole, this is a pretty low price to get in despite the recent green market. IF they were every to get back to their all time high, that’s already almost 4x gains, and that isn’t that a hard prediction I think given it wasn’t a bull run mark. I’m feel confident they will get there by this year.

In terms of longer term predictions. We always say, platform projects are lucrative investments, because they will have stable income from projects that are built on them, like Ethereum for example. And if you are one of the first projects to successful implement a scalability solution like Sharding, you are instantly attractive to new users. IOST is an easy project to believe in, because you have the team showing confidence in it by taking a token lock, you got many capital investors showing confidence in it, and you have the market showing confidence in it, with a ranking of number 54 despite being a very young coin. Their community is big, they have a lot of momentum. I personally think for myself this is a potentially good investment.

But I am not a professional and this is not financial advice. I am just sharing my thoughts on my own crypto journey with you. So please always do your own research and make your own decisions.

Alright guys, thanks so much for hanging out with me. Drop a comment, let us know what you think of IOST or this post!

You did so much effort in this post. It is well written and the information is very informative. The only problems with these blockchains will be the one that has the most adoption. The highest performing one normally doesn't win but the one that reaches the highest adoption the soonest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think over the next 2-3 years we will see mass adoption of blockchain, so much more businesses for platforms. Early market helps, but hopefully it's not make or break :) hopefully

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I bought into Iost and was doing ok when all of a sudden, yesterday bitcoin and ether went up huge but Iost went down a lot; don't know why that happened; also, now that ether has gone up a lot but iost hasn't I'm thinking I'm going to have to set my prices much higher to get the same returns...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit