It's been 54 days since the last spike in GAS, the token that drives the NEO cryptocurrency network, and it may be time for another one. GAS has been known for it's random, or not so random spikes in the last couple of years, and this article is an attempt to draw some conclusions from the historical data with regards to the timing and ferocity of these spikes.

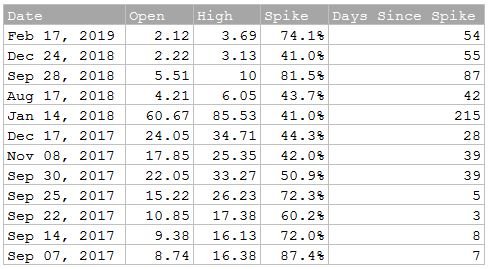

Calculating the percent change between the High and the Open, on a daily basis for GAS, and then sorting this data to show the highest percentage moves at the top is the first step to identifying these so called spikes and drawing conclusions from them. I am using the High and Open to calculate the spikes as a spike is almost by definition an intraday move, and thus looking at Close to Close wouldn't be of much help.

With just over 640 data points the next step is to mathematically calculate what constitutes a spike. I first took the mean of the daily percentage change between the High and the Open, which was 7.2%, and added 3 Standard Deviations on to this, which returned 44.8%. This tells us that an intraday spike of over 44.8% is statistically significant. The next step is to isolate these moves, and in fact I will look at spikes above 40%, and do some analysis.

Above is a the final table , with intraday moves of over 40%, sorted by date, and with each spikes percentage move, as well as the number of days since it last occurred. So you can see for example, that the last spike, on 17th February this year was 54 days ago, with a move of 74.1%. The spike previously was 55 days ago (will we get a spike tomorrow!?), with a move of 41.0% and so on and so on.

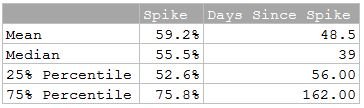

What I did then was simply calculate the average time between spikes and the average size of each move, along with a 25% and 75% percentile, represented in the table below.

As you can see the mean would suggest we are overdue for a spike by a few days, however, with the longest gap between spikes being 215 days, and the 25% percentile being 56 days, we might have to wait a little while longer. Another good indicator that is worth keeping in mind is the GAS/NEO currency pair trading on KuCoin. This is currently at rock bottom prices at around 0.275, and in the previous spike moved from 0.272 up to 0.43 before tumbling back down, representing a 58% spike in GAS/NEO, also suggesting that NEO doesn't always follow GAS with the move.

Although this study has been rather simplistic, and there are many more reasons besides statistical ones for a spike, I have nonetheless gone and bought a small amount of GAS, so as ever, Caveat Emptor. GL.