Bitcoin continues on its roller coaster ride falling from a high of $19,870.62 on December 17th to around $12,000 this morning. Cryptocurrencies and especially Bitcoin more than caught the attention of investors in 2017 when they became infatuated with it. It started 2017 at $963.38 and ended at $13,850.40 for a gain of 1,338%. It nearly reached $20,000 coming close at $19,870.62 on December 17th. This has led to Bitcoin and other cryptocurrencies getting huge media exposure and the creation of thousands of new ones. (Note for this article I’ve abbreviated cryptocurrencies as CCs).

A visual representation of the digital Cryptocurrency, Bitcoin. Photo by Dan Kitwood

There are many reasons that Bitcoin and CCs could increase or fall in value but the underlying reasons should be supply and demand. I wrote an article with 9 reasons that Bitcoin’s price could rise to $100,000 or more. However since Bitcoin and the other CCs are in a nascent stage I believe there are at least 12 reasons that Bitcoin could fall back to $1,000. It was not even a year ago, March 26, 2017, to be exact that it traded for under $1,000. To get a handle on what could drive the price of Bitcoin significantly lower I’ve outlined them below.

Regulation could have the biggest impact

Regulators could have the biggest impact on Bitcoin and CC prices as multiple countries have either implemented some regulations or have discussed plans to limit them. If the regulations become too burdensome they could negatively impact the usage and therefore price of CCs.

South Korea

South Korea has implemented some regulations and is considering additional ones. A few days ago it announced that CC traders would be fined if they do not convert from virtual accounts where they could trade anonymously to real-name accounts.

One indication on how much regulations could impact a CCs’ price is when the South Korea’s Ministry of Justice issued a premature statement on banning CC trading. After the statement was corrected the price of EOS, a popular CC in South Korea, jumped 40%.

Japan

Japan started to regulate Bitcoin and other CCs after Mt. Gox, a Bitcoin trading platform, collapsed and went out of business in 2014. It also passed legislation last year that legalized Bitcoin and other CCs as legal currency and an asset. These were positive steps in helping them become more mainstream but as with any legislation additional rules could be put in place to hurt them.

China

There is a Reuters article this morning saying “authorities should ban centralized trading of virtual currencies as well as individuals and businesses that provide related services.” This would be in addition to the country’s ban on ICOs or Initial Coin Offerings, CC trading exchanges and limits on Bitcoin mining.

US regulation

The SEC Chairman released a statement last month on “Cryptocurrencies and Initial Coin Offerings”. It laid out where the market is currently (wide open so investors should be very careful), what questions an investor could ask and that the SEC is very interested in this new technology.

The US Senate is planning on meeting with the SEC Chairman and the Commodity Futures Trading Commission or CFTC Chairman next month. While I wouldn’t expect much to come from the discussion at least initially it could bring CCs more into the regulatory framework.

The challenge with many of the current and potential regulations is that even though one or multiple countries could ban trading or exchanges it doesn’t necessarily keep investors from executing trades in another country.

There is no “value” to it

Bitcoin or CCs don’t generate revenues or profits in the traditional sense. Miners do create revenue for themselves and traders charge a commission but a Bitcoin doesn’t do anything. There isn’t a physical presence to it (pictures such as the one at the beginning of this article are just representations) as it and other CCs are bits in computers.

Since it doesn’t generate profits or cash it can’t be valued in ways that most other assets are. While a commodity such as gold can be used to create something of value a Bitcoin resides in a computer. If enough uses aren’t eventually developed for them their demand could decrease.

Volatility can create nervousness

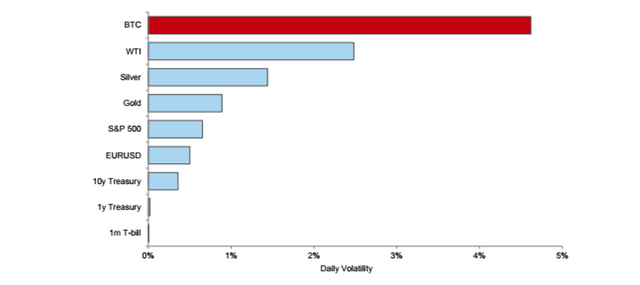

Goldman Sachs has a chart that shows the daily volatility of Bitcoin vs. other investments such as WTI (West Texas Intermediate or oil), Gold, the S&P 500 and a few others. Bitcoin has been much more volatile than any of the other assets. This is good for traders (as long as they know what they are doing) but is mentally tough for longer-term investors. If this continues I believe it dampens demand from a wide range of investors.

Leverage can be very bad

The CBOE or Chicago Board Options Exchange and the CME Group started to make a market in Bitcoin options last December. These can be leveraged investments where only 44% of the total value needs to be covered. While the 44% is higher too much higher than other future contracts given the volatility and risks involved it makes sense. However if Bitcoin’s price moves too much it could force contract holders to liquidate putting more pressure on Bitcoin’s price.

A shakeout is coming

There were 1,450 CCs listed on coinmarketcap.com as of Tuesday morning with over half of them having a market cap under $10 million (note that Bitcoin’s was over $200 billion even with the price down to $12,300).

There may be some legitimate uses for the “smaller” CCs but I suspect that hundreds of them will disappear. This would in theory decrease the supply of CCs which could mean investors may move their money to other CCs. Or the investments could be wiped out and the stain of so many going under would decrease demand.

ICOs or Initial Coin Offerings

The rapid increase in Bitcoin’s price has led to hundreds of ICOs or Initial Coin Offerings launching in the past few months. Dentacoin was launched in August last year for the dental industry. The value of all its coins spiked to $2 billion last week and has fallen to $600 million.

While Dentacoin may be legimate and survive there are also instances of what appear to be outright fraud. The SEC has warned about ICO fraud and this CNN article describes three potential ones. While there aren’t any assets behind Bitcoin or other well-known cryptocurrencies a huge percentage of the new ICOs really could be all fluff. If too many ICOs are fraudulent this will hurt investor demand for CCs in general.

Hacking theft of CCs

Probably the most well-known and largest theft of Bitcoins was Mt. Gox, a Bitcoin exchange in Japan. It was handling over 70% of all Bitcoin transactions but was hacked in February 2014 and 850,000 Bitcoins were stolen. At the time they were valued at $450 million and would currently be worth about $10 billion.

Just last month Youbit, a South Korean Bitcoin exchange, was hacked. Almost 4,000 Bitcoins or 17% of its assets worth about $48 million were stolen. A Reuters article said that all customers CC assets would be marked down by 25%. That isn’t very comforting to CC investors.

FOMO or Fear of missing out

The fear of missing out or FOMO has helped to create a lemming effect. Investors don’t want to miss out on the next big thing and to a degree also want bragging rights that they own Bitcoin.

It was reported by CNBC that Coinbase, a CC exchange, had 11.7 million accounts in October last year compared to Schwab’s 10.6 million. It increased in November adding 300,000 in one week to get to 13.3 million. If this isn’t a rush to participate nothing is.

However, this could turn on itself. If enough Bitcoin owners decide they want or need to get out the value of a Bitcoin could drop dramatically.

Bitcoin mining scams

From an article I read on 99bitcoins.com about Bitcoin mining there was a section about scams. It said, “There is a new concept called “cloud mining”. This means that you do not buy a physical mining rig but rather rent computing power from a different company and get paid according to how much power you own. At first this sounds like a really good idea, since you don’t have all of the hassle of buying expensive equipment, storing it, cooling it, etc.”

It went on to add, “However, when you do the math it seems that none of these cloud mining sites are profitable in the long run. Those that do seem profitable are usually scams that don’t even own any mining equipment, they are just elaborate Ponzi schemes.”

It wouldn’t surprise me that this is true given all the hype around Bitcoins. If this burns too many people it helps to break down the trust in Bitcoin and CCs.

Becomes too associated with criminals and rogue states

One of the reasons that governments are concerned about Bitcoin and cryptocurrencies is that they could and are being used by criminals and money launderers. It has also been speculated that countries such as North Korea and Russia will or have been using Bitcoin and CCs to circumvent sanctions.

Since Bitcoin users can remain anonymous and can work from anywhere in the world this could lead to an increase in demand for them at the margin. However if governments are able to find a way to regulate them due to the above concerns then the demand would be lessened.

Third parties changing their minds

There have been Bitcoin debit cards available from various providers. However on January 5th it appears that Visa Europe told many of them to close their debit cards immediately due to being out of compliance with its regulations. While this was probably a very small market it is not a positive step in CCs becoming more broadly accepted.

Bitcoin & Blockchain movie looks a lot like Dot com in 1999

Kodak and Long Island Ice Tea (now Long Blockchain Corp) are two companies that have recently changed their names or announced that they were creating cryptocurrencies or a digital currency platform. Both of them saw their stocks jump after they revealed they were getting into digital currencies.

While Kodak’s initiatives potentially have some merit Long Island Ice Tea’s is pretty much beyond the realm of any imagination. If too many other companies jump on the CC bandwagon it feels very similar to the dot com era in 1999. That movie didn’t end well.

It all comes down to Trust

In many ways the global financial system is based on trust between individuals, companies and governments. One thought to kick around is that we trust all the computer bits that show how many shares of a company we own, how much cash we have at the bank and the credit card charges and payments for the stuff we buy. To a large degree these are computer bits stored as various locations. Bitcoin and other CCs are similar in this respect. However if the trust in CCs falls apart it will lead to a fall in their prices.

Please feel free to check out my other Forbes.com articles “9 Reasons Bitcoin Could Hit $100,000 Or More” and “3 Reasons To Not Get Excited About Seagate’s Investment In Ripple/XRP” regarding digital currencies.

Follow me on Twitter @sandhillinsight, find my other Forbes posts here or join the LinkedIn group Apple Independent Research to get real-time posts.

Chuck Jones

https://www.forbes.com/sites/chuckjones/2018/01/16/12-reasons-bitcoin-could-fall-below-1000/6/#473951dd7f3b

This is a long read and I doubt it will go this low

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So we should organize our efforts to sue our government for regulation induced losses and mainstream media for spreading business damaging FUD. Don't miss this opportunity.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly – Featured Posts are voted every 2.4hrs

Join the Curation Team Here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly – Featured Posts are voted every 2.4hrs

Join the Curation Team Here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit