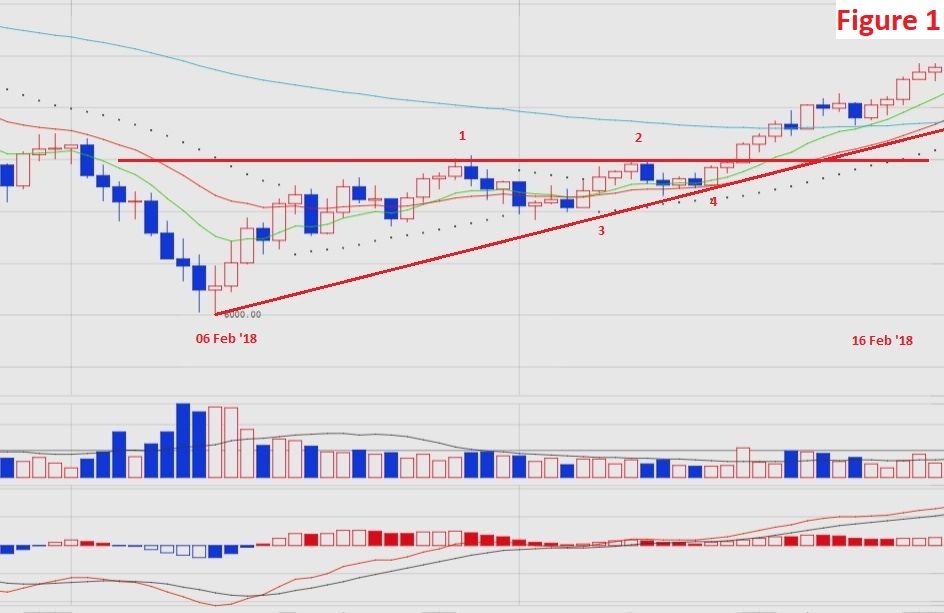

After BTC/USD's recent collapse down to it's support level of $6000 on perceived bad news, it has up-trended and broken it's near term resistance level of $9499. This happened through the formation of an ascending triangle pattern, which saw two higher highs and two higher lows, along with decreasing volume and a compression of daily trading range. All that coiled up energy was ready to explode, and it has done so over the last few days with a sudden, boisterous bounding up to the high $10,000 region (fig.1):

Indeed, as of 20.30 UTC, the 30 minute / 1 hour charts indicate the emergence of a potential triple top pattern. These patterns can constitute a reversal of a trend, and in this case the near term trend upwards away from the $9499 support level is potentially threatened. However, for this to truly materialise would require both decreasing volume and breaking of the support level formed by the lowest part of the triple top structure ($10,522). Any of these points could hold the price and see a continuation of the near term uptrend (fig.2):

If, however, these support levels are broken, the pattern could see a reversal from the recent uptrend. Given the appearance of this formation, trading should be avoided until a clear pattern, either the continuation of the uptrend towards $11,000 and possibly beyond or a breakdown below $10,860 crystalises.

Potential plays:

Buy now

- possible triple top reversal

- loss

- avoid

Sell now

- possible failure of triple top reversal and continuation of uptrend

- loss

- avoid

Buy later

- if breaks $10,860 resistance level

- potential gain

- seek

Short later

- if falls below $10,522 support level

- potential gain

- seek

Cryptonym.

NB.

Values in USD are representative of prices traded on the Bitfinex exchange.

Times are UTC standard.

This does not constitute official investment or trading advice. Your losses are your own.

If you appreciate this work and would like to support Cryptonym, please consider donating:

https://www.patreon.com/CryptonymFund

Bitcoin Address - 3EYtdz4J7aCsW3wnz64rMvqzmkyBKPahee

Bitcoin Cash Address - 17VXEM8gRYrms1jtoadoLob5DvBFwWkVug

Litecoin Address - MQhdRXjojwCwzFLQxtExMKaaYyFZ9ftdB7

Ethereum Address - 0x46Aa8d31f5d1a7e72b38A13e5E7F9bD5FBC7d8ea