There are 1000+ articles on the web describing what Bitcoin mining is, but there are not that many that emphasize the economic side of mining. Regardless of your opinion, Bitcoin is an economic system, and it’s both very complex and quite simple at the same time. It would take a large book to accurately describe everything that goes into Bitcoin mining and the intricacies, but my goal is just to provide a high level overview.

Bitcoin mining and the economics of it, is the value of Bitcoin. It is the only thing unique to Bitcoin that made it a success.

If you are NEW to how Bitcoin mining works check out the short paragraph at the 👇 bottom of this article.

How Mining Started

Bitcoin mining started the Bitcoin project in 2009, out much like the Bitcoin Core view of things. All users were basically running their own nodes and participating in the distributed consensus mechanism. This was essential for such a small vulnerable network. And of them users, most were miners as mining had 0 barriers to entry and could be done with any computer simply using CPU. The pooled CPU protected the network, and started out the economic experiment mining the valueless coins at a negative cost - if they took their electricity into account.

The Bitcoin Mining Economics Experiment Worked

In may of 2010 Bitcoin became money in the eyes of hungary Lazlo Hanyecz who paid 10k Bitcoin for 2 pizzas delivered to his house. Value is always subjective, and while there may have been value transfers prior to that date, the first person to subjectively valued 10k Bitcoin above the $20 to buy pizza for Lazlo.

Now that Bitcoin was known to have value, the economic experiment of mining started to progress. If Bitcoins started having value, mining them could start to be thought of in terms of profit instead of a hobby. Right on cue in Oct of 2010 the code for mining Bitcoins with GPUs was released as computer savvy minds around the world started working on the task of making profit Mining Bitcoin.

From Hobby to Industry

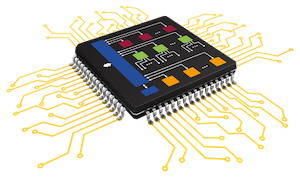

Very quickly some brilliant minds figured out and created ASIC mining which is still used today. ASIC stands for (Application-Specific Integrated Circuit) which in layman's terms simply means a computer chip optimized to only do one thing, which in the case of Bitcoin is SHA-256 hashing.

From there the race was on and multiple companies and organizations raced to deliver more and more powerful and efficient hardware to miners that were willing to invest more and more into the idea of Bitcoin.

Competition, Competition, Competition

Bitcoin mining is not only competitive in that there is a fixed supply of Bitcoin and the best time to mine was yesterday, but it is competitive in multiple other ways. To name some:

➜ Mining Difficulty

Bitcoin is programmed so that a block is created every 10 minutes. This adjusts regardless how many miners there are. So more miners simply means more people fighting over same amount of resources. This alone makes Bitcoin mining very competitive and is the #1 contributor to the competitiveness.

➜ Coin Distribution

Block reward halving in which reward is cut in half every so many blocks or years leading to sense of urgency as reward right now is higher than it will ever be in the future.

➜ Mining Technology

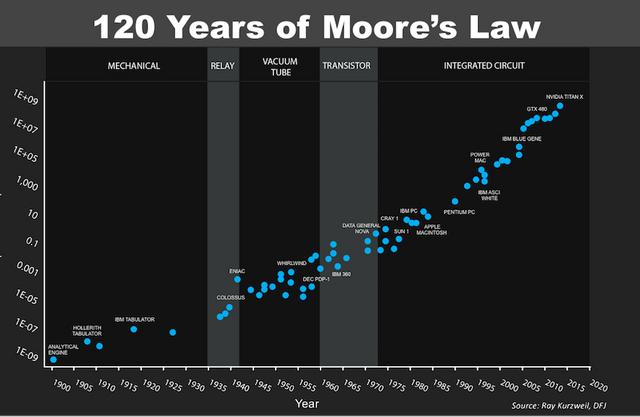

Computers since they have been invested have progressed at a truly exponential rate. Sometimes referred to as Moore’s law which is observation and rule technology has followed where number of transistors per square inch doubles every year. This is true for more than just transistors and is more than prevalent in Bitcoin mining where miner efficiency and output has more than doubled every year.

➜ Mining re-investment

Because of this, serious miners need to continuously buy new equipment as old equipment becomes obsolete and basically useless very quickly. This also levels the playing field as very large miners’ equipment will get old and they will need to invest in new technology just like a new miner would have to.

➜ Block propagation

Often overlooked is the fact that Bitcoin is a small world network. This means if your going to be a big miner, you better be able to get your mined block out to the other miners very quickly or risk mining an orphan block or a Stale block. So miners must invest in fast internet connections and servers to get blocks transferred to other miners as fast as possible. This is another investment and a way for miners to compete.

➜ Economies of scale

This goes without saying, but the bigger you are the more you can spread out overhead costs. Bigger is better in mining, bigger buildings, bigger fans, more miners. It's all cheaper and more efficient to do in bulk on a huge scale.

➜ Electricity contracts

Electricity companies like constant demand. Fluctuation of demand is an electric companies’ enemy. Electric companies are built for peak demand, that means for the other 90% of the time there is not peak demand, electricity companies are leaving money on the table. As they can produce and sell more with no extra overhead cost. So electric companies are able to make lucrative deals with miners for bringing them consistent demand especially when there is significant excess capacity.

➜ Pre-payment and 1 year contracts

Timing of making these contracts can make or break miners. For example in 2017 many miners bought 1 year electricity contracts while Bitcoin was at $17k. This put them in good shape the remain profitable mining Bitcoin even as the price went down and it become less profitable.

➜ Big Industrial Miners

All of these competitive factors lead to the best miners becoming very big and hosting large chunks of the overall hash power. This puts up high barriers to entry for small hobby miners to be competitive. However, small miners can buy a small chunk of the big miners operations in what is called a cloud mining contract.

These contracts have become the dominant way for unspecialized miners, investors, or anybody else for that matter to get involved and play with the big boys. And that is a super high level view of why Bitcoin and other cryptocurrency mining is the way it is.

If you want to learn more...

Below is a paragraph on how mining works, or you can check out this full article on how mining technically works.

1 Paragraph on how Bitcoin Mining Works

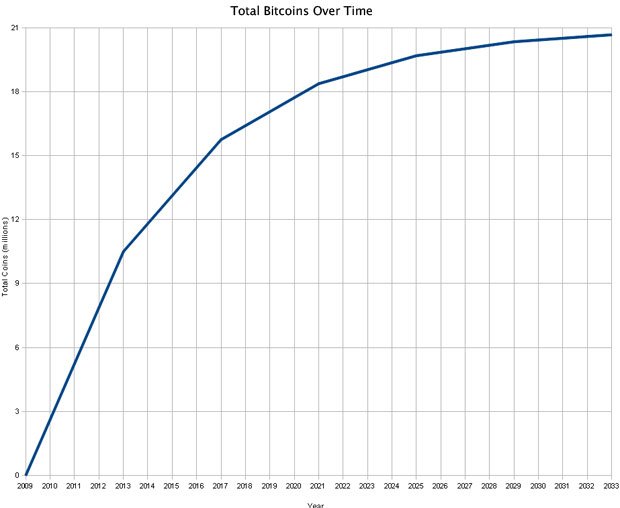

Bitcoin is an economic experiment which is analogous to gold mining. Like gold there’s only an x = amount in existence, in Bitcoin’s case, it’s 21 million BTC. Just like gold, it is costly to mine and obtain. Gold mining produces a shiny rock, Bitcoin mining produces a secure ledger of coins. Like gold, Bitcoin is distributed over time in a parabola approaching 100%.

@cryptoroi, thank you for supporting @steemitboard as a witness.

Click on the badge to view your Board of Honor.

Once again, thanks for your support!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptoroi! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit