What is Staking or (POS) Proof of Stake Coins?

Should you buy POS coins?

Buying POS (Proof of Stake) coins are an intriguing proposition. You can think of them like dividend paying stock, as if you stake your coins you will get staking rewards similar to dividends. This may sound a little too good to be true, but it is! However, there are some extra dynamics that go into it that you should be aware of before investing.

Quick Overview

Staking or (POS) Proof of Stake, was developed to solve the issues on the original method for verifying Bitcoin transactions in the Blockchain, which is called (POW) Proof of Work, also known as crypto Mining.The main purpose or goal was for the security of the transactions by deterring cyber attacks. The algorithm to make this possible has complex equations that are difficult to compute. Because of this, it requires expensive specialized computers and a lot of power/electricity.

POS or Staking is also distributed consensus method like POW and reaches the same goal. However the economic and security models are different. Proof of Stake mining, also known as staking can be done on normal computers and doesn’t take much electricity at all. The network is secured by ‘incentives’ and ‘disincentives.’ Users are incentivized to participate in the consensus mechanism through staking rewards. By staking, users help secure the network against attack. There is also the main disincentive of losing your coins your staking, if you choose to attack the network.

GET FREE staking coins!

This faucet automatically stakes your FREE claimed coins 4 U!

They’ve recently gained a lot of attention due to this feature.

Here’s a link to their faucet.

Extra Things to be aware of when Buying Proof of Stake Coins

If your looking to purchase POS coins, here are some key metrics to look into to help you determine if its a good investment or not. You should always do a lot of research before investing in any coin such as:

- Development team research

- Use cases

- Market demands being met

- Active users in the project

- Roadmap

- Legal

- and much more...

And if the coins are Proof of stake coins, here are some extra items to consider;

Coin Inflation Rate: How many coins are created each year to incentivise staking

- Coin inflation or staking APR can be both good and bad. A high APR means your coins will grow faster, but so will others. And like all inflation, the more there is, the less the underlying coin is worth. For example Sprts coin had a 600% APR for a long time. It was fun to 6x the coins you owned by staking each year, but the price went down faster than inflation. A reasonable inflation rate (3-8%) normally outperforms an overly high or low APR in the long run.

Number of coins in circulation: How many coins are out there

- This should be part of your normal research, but it matters a little extra for POS coins as well. For example, if there is a maximum supply of 100,000,000 coins, and 90,000,000 coins are already in circulation you know there are only 10,000,000 in staking rewards left, and you will have to stake against people with 90,000,000 coins. (not a good value proposition for staking)

Coin distribution and age: Who holds the coins

- Large coin holders have an advantage when it comes to staking. So if you can look at the “rich list” which is available on most coins on https://chainz.cryptoid.info/ explorers. If the top 100 addresses hold 90% of the coins, they are going to get 90% of the staking rewards and will likely always be staking. Whereas if the top 100 addresses only hold 10% of the coins, that means a lot more people hold the coins and not as high of % of coins will always be staking.

Masternodes: Many POS coins have a masternode model which is when if you stake a large amount, you get special rewards and responsibilities .

- Masternodes are a topic in themselves. Look into how the masternodes are incentivized and how many coins are locked up in masternodes. For example if it takes 10,000 coins to have a masternode, and masternodes get 3x the rewards as normal staking...the staking portion of your investment decision makes much more sense investing to buy over 10k coins, rather than under 10k. Here is a helpful list of masternodes and their ROI.

IMPORTANT: Don’t invest only for staking, but do consider it in your investment decision

Please, don’t invest in a coin just for staking rewards. The rewards are meaningless if the coin is useless. However, if a coin has a good value proposition, strong team, and lots of use cases, then it's a good idea to incorporate staking information into your decision.

Thanks for reading if you liked this content and found it helpful please follow us on social media and share.

WHERE CAN YOU GET PROOF OF STAKE COINS LIST?

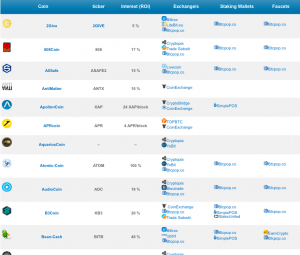

To save us both time here is a list of 120+ coins to stake, including their top exchanges and faucets. https://topstaking.com/staking-coins

✅ Enjoy the vote! For more amazing content, please follow @themadcurator!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@cryptocurrencyroi/buying-proof-of-stake-coins-dc23bf55a64d

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit