My previous post for Ethereum Classic (ETCUSD) can be found here:

https://coinanalyst.investments/2018/04/24/elliott-wave-analysis-ethereum-classic-4hr-tf/

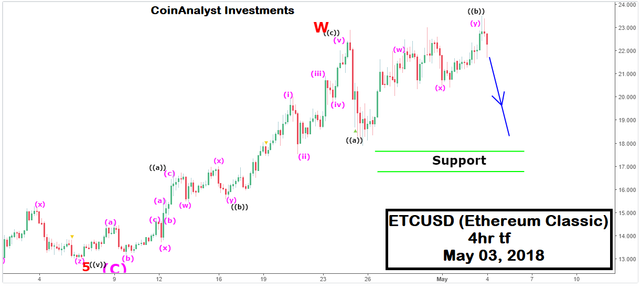

It was mentioned in the post that Ethereum classic (ETCUSD) was progressing as an impulse wave from the price bottom of ~$13.16. However, based on how price action has transpired since the last post, price swing for Ethereum classic (ETCUSD) from ~ $13.16 to ~$22.24 on April 24, 2018 has been updated and identified in this analysis as a corrective move with a minor wave W terminating.

The implication of the above is that a retracement of the previous upswing should occur in Ethereum classic (ETCUSD).

A minute wave ((c)) of an expanded flat Elliot wave structure is identified in this analysis as the current swing in price that Ethereum classic should produce to retrace the current price move from ~ $13.16 to ~$22.24, before further bullish momentum will be sustained.

138.2% (~$17.66 )and 161.8% (~$16.77) retracements of minute wave ((a )) by minute wave ((c)) have been used as the region where Ethereum classic (ETCUSD) is expected to find support (i.e. horizontal green lines drawn on the chart).

Point of invalidation (POI) for this analysis is a price close above $25 at which point Ethereum classic would have invalidated the expanded flat structure.