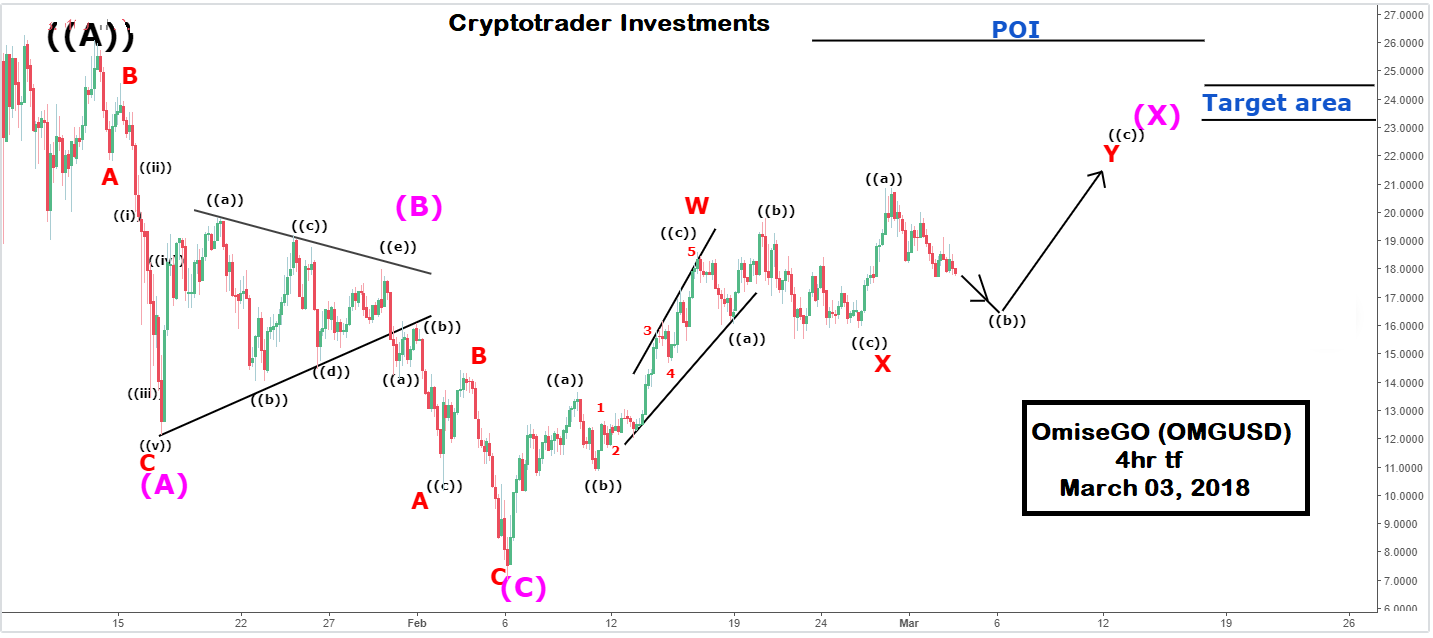

OmiseGO (OMGUSD) trended downwards after it hit a high of~$24.50 on Jan 7,2018 to the price low of ~$7.00 on Feb. 06, 2018.

Price swing from the high of $26.07 on Feb. 13, 2018 to the low on Feb. 06, 2018 is described in the 4hr tf as a corrective (A-B-C) Elliott wave structure (i.e. a correction). Price swing upwards from the low on Feb. 06, 2018 is currently completing another intermediary wave that has been labelled so far as another 3wave move (W-X-Y) upwards, although not yet complete.

The use of projection of wave Y (in red) = 61.8% wave W (in red) gives a price target of $22.85. This is close to the target area indicated on the chart (between $23.26 and $24.52) and therefore increases the chance of OMGUSD reaching the target area.

The implication of entire Elliott wave structure upon completion of WXY (in red) is that OMGUSD should sell off with price reaching or moving below the low made on Feb. 06, 2018 (i.e. $7.00).

POI= Point of invalidation (Price should not close above $26.07 for this analysis to remain valid = $26.07) after which analysis would be revised.

Disclaimer: This is meant for information purposes ONLY and not a buy or sell recommendation