My previous post for Ethereum classic can be found here.

https://coinanalyst.investments/2018/05/10/elliott-wave-analysis-of-ethereum-classic-4hr-tf/

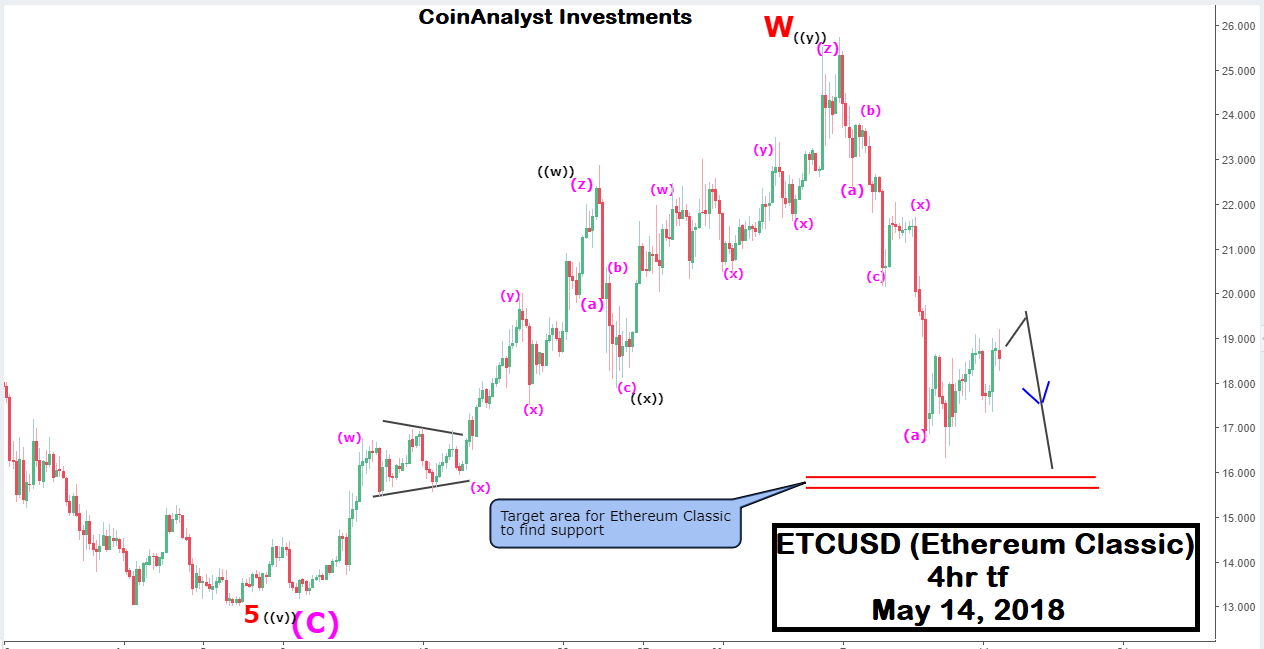

It was mentioned in the post that that a deep retracement was possible for Ethereum classic (ETCUSD) before the resumption of a sustainable uptrend. That is what Ethereum classic is working on currently as prices are currently in a downtrend on the 4hr tf.

Besides, the previous analysis expected a slight bounce off of either support 1 or support 2 before further selling continued.

Ethereum classic rather continued to sell off, taking out support 1 white it is meandering around support 2 at the time of this post. Price swing on the 4hr tf from ~$25.32 on May 7, 2018 to ~$16.93 is identified in this analysis to be part of a double zigzag Elliott wave structure that is not yet complete.

A possible termination point for the current downtrend is indicated on the chart with horizontal red lines (~$15.90 and $15.66). Failure of Ethereum Classic to hold support at the red lines could see prices return to test $13.75 region or even lower.