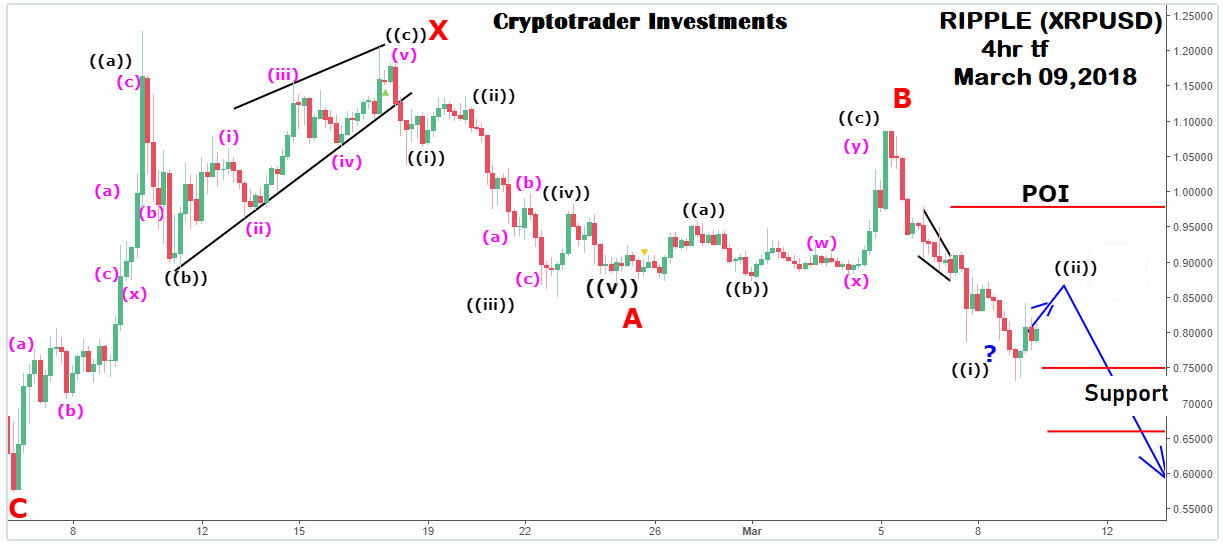

XRPUSD's correction after making a high of ~$3.16 on Jan. 4, 2018 (Ripple) can be described as a double zigzag Elliott wave structure (A-B-C-X-A-B-C). Price action is currently in a minor wave C position (last leg of the correction that is not yet complete).

The implication of the above is that XRPUSD should continue to sell off. Weekly and Daily tf (not shown on this chart) support are present at ~ between $0.57 and $0.41 so perhaps a great probability that XRPUSD will target this support region.

Support as drawn on this 4hr tf chart is present between $0.66 and $0.75 which should be broken as part of the process of completing minor wave C position before any bullish move can be sustained.

This analysis will be subject to revision should XRPUSD close first above $0.98 (POI) before reaching the target area ($0.57 and $0.41).

POI = Point of invalidation at which this analysis will be reviewed.