How to choose your trading coins?

In my previous Beginners Guide Articles, I wrote about reserved coins such as bitcoin and dash and generally speaking I suggested going for trading costs which cost below $1.

In this article I will go to next step and explain some stratagem which will help you to choose a right coin based on some real facts. I suggest you read this article once to get the whole idea of what is trying to say and then read it again as the points below are related.

I hope it will help you to make the correct decision.

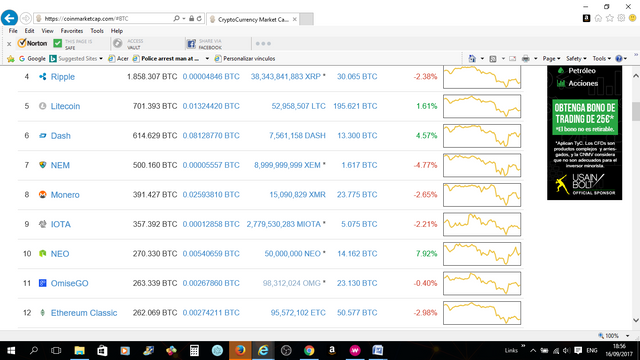

- As you know in market cap there are some coins which are not mind (the ones with a star after their circulating amount).

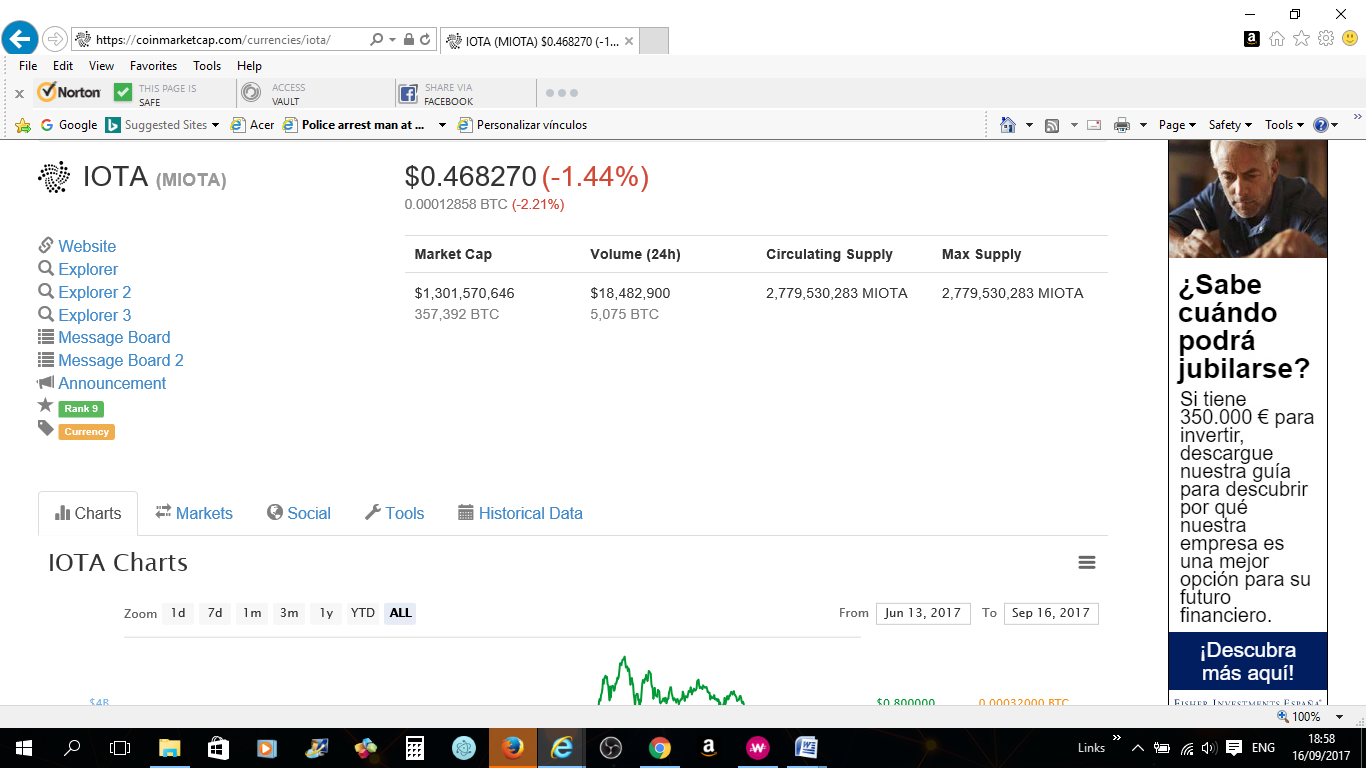

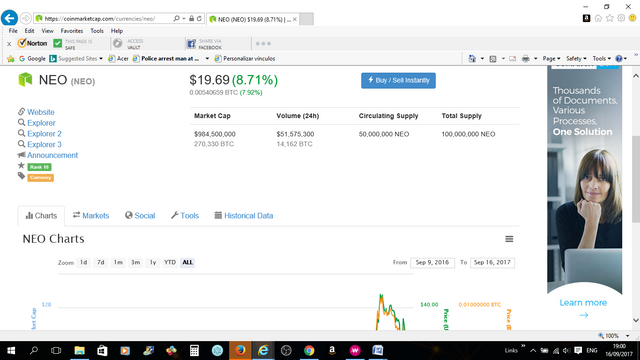

You must make sure that you choose the one which has its total circulation amount in the market such as IOTA (which it has)and not NEO (which it does not).

This indicates that if a coin such as NEO does not have its full amount circulating and at the same time it loses a lot when the market goes down, it is not a good election for mid or long term.

It might (as it has proven) have very good short term gains but as we do not know when the rest are going to be available, I believe we should be careful.

This rule appeals to all the coins which are not mined.

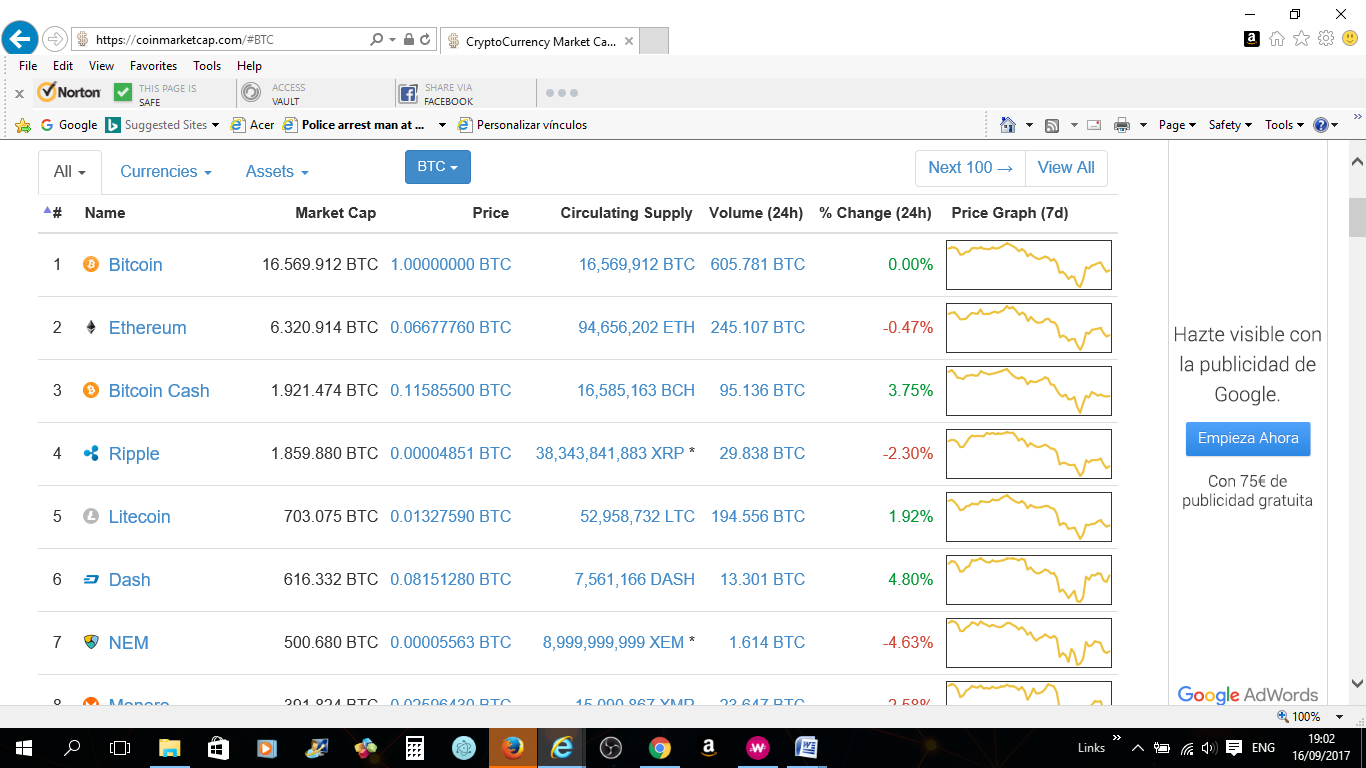

- As we know the major part of the coins in market cap gains or losses are shown depending on the value of bitcoin so they can be considered Bitcoin Related.

There are very a few which are based on dollar, euro or pounds. Even the ones which are ethereum related are indirectly related to bitcoin price.

So let’s find out the three classes of these kinds of coins. But first go to Coin Market Cap Page and at the top where it says USD change it to BTC.

By doing so, you will have a list of all the coins prices related to BTC which:

1.1) Do not lose and are in blue (when the bitcoin price goes down).

1.2) Do lose when the bitcoin price goes down.

1.3) And the ones which lose very much when the price goes down.

Now by considering both points mentioned above you have enough information to start analyzing and choosing one or several trading coins and/or create different portfolios.

You can have different portfolios such as for not mind coins that when the price of bitcoin goes up can give you more profits or other way around and activate or deactivate them as market going to behave.

Now, when you look at the market cap, and do the steps mentioned here (for other coins such as Ethereum, Dash, etc) and think about it, you are able to see how many combinations are available to you and after a few days you will be able to read between the lines and take out your own conclusions.

TO BE CONTINUED………………………………………………………………………..

Thank you, this is perfect not only for myself but to introduce outsiders to crypto... looking forward to part 2. Upvoted and followi ng you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i have read all thee parts and they are quite good ...thanks man...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am happy you liked it and thank you for your support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very useful, didn't know that

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your support.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@originalworks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The @OriginalWorks bot has determined this post by @cryptousage to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To nominate this post for the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice n informative...thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks and I'm glad you liked it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit