There are no token offerings for international micro-financing based on our research analyst of ICObench.com. As of 1st Jan 2018, out of 126 banks, we could only find cryptocurrencies too generic or industry specific like migrant workers’ remittances. We participated in the Human Global Challenge which was set up to unearth projects that were generating useful services, or to provide the ability to generate income remotely for people living in unbanked regions in the world using just a simple smartphone.

UnbankedX was one of the winners of Humaniq Global Challenge 2017. Out of 600 ideas submitted ours were chosen to be the best and viable by Humaniq, a leading cryptocurrency company. Our aim is to harness blockchain technology and the rise of smart mobile devices to empower a market of two billion people who currently do not have access to employment and financial services across the world. Almost half the world — over three billion people — live on less than $2.00 a day . At least 80% of humanity lives on less than $10 a day. More than 80 percent of the world’s population lives in countries where income differentials are widening.

PART OF UNBANKEDX ADVANTAGES

- Traditional financial structures are too costly for small accounts. With a fully automated system, we are able to overcome cost barriers and scale to the millions of users who have been neglected.

- Eliminating need for intense and costly credit assessment.

- Reducing cost of managing ledgers. Preventing corruption with immutability

P R O B LE M S THAT U N B A N K E D X ARE FIGHTING AGAINST

We are addressing the following problems in the market with our proposition.

- Lack of access to banking services and financing

Conventional banking limitations exclude this segment of the market as they are considered not credit worthy and operationally difficult to administer due to remoteness and small clusters that do not justify investment spend in setting up bank offices and employing staff to monitor and manage loans. Whilst we do not seek to replace existing available informal micro-finance arrangements, money lenders and formal enterprises that currently exists in some countries, we do believe that with current progress of technology, we can be an alternative option.

- Corruption

Corruption is found in all countries but evidence shows it harms poor people the most as it stifles economic growth and diverts desperately needed funds from education, healthcare and other public services. In addition, it also reduces foreign investments and this has impact on employment opportunities and economic development. This also deters commercial banks from providing finance to projects and whilst this would be in the remit of multilateral development banks (MDB), these institutions are also cumbersome and unable to finance at micro levels of the economy. From our study, many of the underbanked and unbanked recognise this problem and seek to create opportunities for themselves through some form of self employment or increasing existing capabilities to improve from mere subsistence.

- High Cost of Distribution

One of the limitations of conventional banking is the distribution of proceeds to remote regions which is a costly process. With the availability of mobile transfers, we believe that loans can now be made in faster and more cost effectively.

- Limitations of Mobile Money

Mobile money has been an a revolution in the emerging markets by enabling many to have access to financial services such as payments and remittances which were previously difficult to access. It has also helped to increase efficiencies in the speed of payment, access to remote areas and payment security. However, there are still challenges including limited growth in other financial services provided users. Deficient mobile agent networks, a lack of interoperability Very few mobile money services have reached profitability.

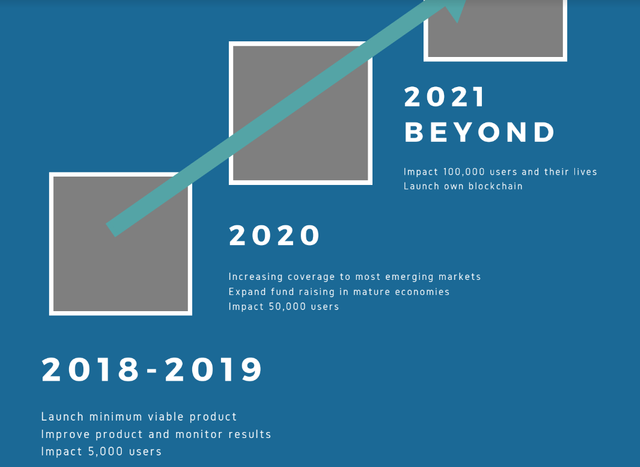

THE ROADMAP

T O K E N S A LE

Tokensale Summary

Pre-Tokensale participants will be allocated 10% of all tokens issued. Primary Tokensale participants will be allocated 55% of all tokens issued. A part of these tokens will be used as bounties and digital media for marketing purposes.

Advisers will receive 5% of all tokens for their insights and contacts to help succeed.

The price of tokens will bid from USD 0.06 per token. This will be floated on decentralized exchanges for purchase In case not all tokens will be sold, the remainder will be distributed during a SCO (secondary coin offering) in the future.

HARDCAP for all tokens is 200,000,000.

There are no voting rights for tokens.

Token holders who are on the team and advisors will escrow 50% of their tokens for 1 year

Transaction revenues will be sent to the smart contract every week to holders of tokens pro-rata This means, that if a holder has 1% of all outstanding tokens, he will receive 1% of all utility transactions

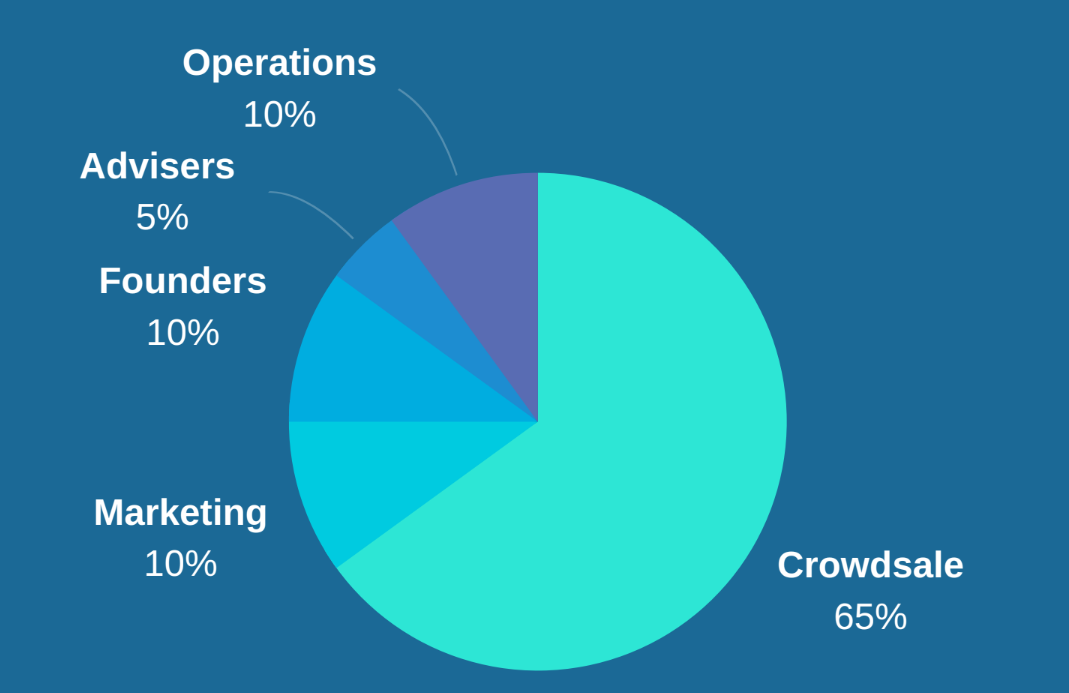

Token Allocation

The tokens will be allocated among participants of the pre-ICO, the full ICO as well as management and advisors. The proceeds raised will be split as follows:

• 65% to be deployed for microfinancing

• 10% to be deployed for marketing

• 10% to be reserved for founders

10% deployed for operations (ongoing development)

• 5% for advisor and partners to build the

For more information please visit

WEBSITE: http://www.unbankedx.com/index.html

WHITEPAPER: https://drive.google.com/file/d/1TuxIyPa2ho603uHtWxp-o_tjEOzx4nqF/edit

ANN THREAD: https://bitcointalk.org/index.php?topic=3038733

TELEGRAM: https://t.me/joinchat/GzuZeBCNMfHHcLOVKv_Vzw

TWITTER: https://twitter.com/unbankedx_ico

FACEBOOK: https://www.facebook.com/UnbankedX-172044893559527

MEDIUM: https://medium.com/@unbankedxico

REDDIT: https://www.reddit.com/r/UnbankedX/

Author: Tosin David

BTT Profile: https://bitcointalk.org/index.php?action=profile;u=1180815

Disclaimer: This article was published in terms of the bounty campaign. I am not a project team member or its representative but a supporter of this incredible project.