INTRODUCTION

Decentralized Finance (DeFi) has brought about a lot of innovations that is enriching the crypto community. The DeFi landscape includes Oppurtunties such as; trading, lending, borrowing, staking, and mining crypto assets. But many DeFi platforms have turned this services to be tedious and painful for the participants.

Crypto Community faces low liquidity in the DeFi platforms available and the yearn for a platform that will aggregate liquidity, facilitate, and automate crypto asset trading with tight security and efficiency.

A platform that will provide the crypto industry with better data and insights into managing risk and portfolio.

Another innovation that has been brought about by decentralized finance is decentralized exchanges (DEX), these were made to be better and more efficient than their centralized counterparts, who are isolated and prone to breaches. But some DEX face the problem of low liquidity and are often difficult to use with bad UX/UI.

REEF FINANCE - PROVIDING EFFICIENT LIQUIDITY FOR CRYPTO OPERATIONS

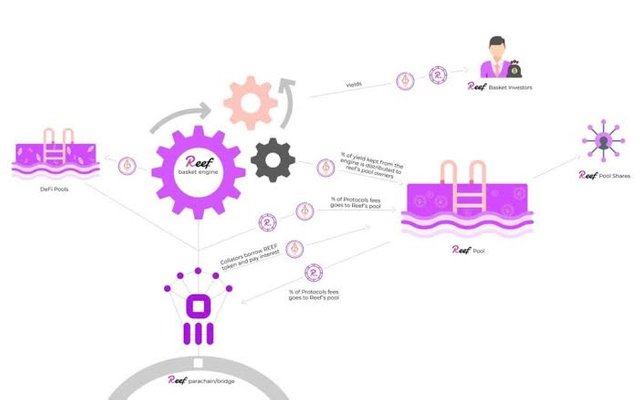

Reef is a DeFi operating system that has been initiated to resolve these issues facing the crypto industry through its main components. Reef achieves this by making available trading liquidity, for both crypto asset buyers and sellers, from different exchanges as its source.

The Reef system is integrated with an AI driven trading engine that will maximize yield returns within each risk category.

Reef Finance ensures that its users get a great trading experience by giving them unrestricted access to both liquidity from CEX and DEX through the trading of assets via the global liquidity aggregator, and an AI based system that will enhance smart lending, borrowing, staking, mining, and ensure increased yield returns for farmers.

COMPONENTS OF THE REEF PLATFORM

The Reef platform consists of three major components that makes the Reef platform stands out from all other DeFi platforms, these are;

Global Liquidity Aggregator: There are many liquidity aggregator in the crypto market today, majority of which are inefficient. Reef global liquidity aggregator will act as a tool for interexchange arbitration that shields market participants against some of the more common types of front-running attacks. Reef will access the centralized exchanges liquidity through the use of prime brokerage services, such as; Tagomi, Caspian etc. And Reef will access the decentralized exchanges liquidity through on-chain order book and smart contract liquidity pools.

Smart Yield Farming Aggregator: The Reef smart yield farming aggregator uses AI and machine learning algorithm to optimize the assets distribution of Reef users. The smart yield farming Aggregator will have a Reef intelligence system and augmented decision making.

Smart Assets Management: The third component of Reef that differentiate it from other DeFi platforms is the Reef assets management, which is a set of powerful portfolio management features that are available to Reef users, the include; Active Asset Rebalancing, Guided Asset Management, and Diversification.

Reef Finance also has a fully decentralized governance structure called DAO (Decentralized Autonomous Organization), that places the community members in charge of the system, ensuring that transparency and efficiency is maintained.

SUMMARY

Reef platform has come to change and revolutionalize the DeFi industry by providing better DeFi services to the crypto community. The Reef utility token (Reef Token) and the Reef DAO will play a big role to achieve Reef mission of Better DeFi Services.

For more relevant information, kindly visit https://reef.finance

Article Written by: Adasofunjo Michael Oluseye

Telegram Username: @Seyeski