OVERVIEW

The blockchain technology opened the pathway for other amazing technologies to come on board. Shortly after its introduction and development, the blockchain technology was closely followed by a digital way of making secured payments.

Cryptocurrencies became the bedrock of many digital financial transactions and is greatly making waves in the industry. The earliest cryptocurrency was the Bitcoin followed by Ethereum. Other cryptos such as Litecoin and Dash came on board. The number of cryptocurrencies available in the digital space was speculated to be above 900.

This was contained in a report by CoinMarketCap – a platform responsible for crypto market capitalization. The report pegged the value of these cryptos at about $290 billion and with the volatility of cryptocurrencies, these figures might be tripled.

Crypto investors on their part are positing that cryptocurrencies might hit a $1 trillion USD all-time value by 2022. While crypto transactions moved from its $100 million value as at 2017 to about $6.6 billion USD, it has not been fully accepted by many. Its acceptance is not the problem; the problem is why cryptocurrencies are not feasible collaterals. We shall look at some of the issues that caused this.

Statement of the Problem:

The problem here is that cryptocurrencies are not recognized nor used as collaterals. In traditional and centralized financial platforms, cryptocurrencies being digital assets backed by a decentralized technology – the blockchain will find it hard coping in centralized platforms.

Financial platforms such as banks do not accept cryptocurrencies or any other digital asset as collateral for loans. Most times, crypto investors run short of funds and will be looking for ways to top up their finances.

In situations when crypto holdings are booming , there are tendencies that crypto investors will hit huge profits if they kept their holdings. How then can they hold when they’re short of funds?

Out of desperation, they might approach banks for loans promising to give out some of their cryptos as collaterals. It is common knowledge that the process of obtaining loans from centralized platforms such as banks are tedious. What then will be the prospect of obtaining a loan with a non-physical and abstract asset as cryptocurrency?

That’s likely the line of arguments banks and some other centralized platforms might bring up to disqualify a crypto investor from obtaining loans in fiat currencies. I guess the days of anguish is over as crypto investors, enthusiasts and traders can now obtain fiat loans. Not from banks as you might think!

The Solution:

The solution to the myriad of problems rocking crypto collaterals would be patterned by the concept of like begetting like. Centralized platforms such as banks offered loans when conditions for physical collaterals are met.

Likewise, for you to obtain loans using your cryptocurrency as collateral, you should use a decentralized platform so there’ll be harmony in the transaction. The solution for crypto-collaterals is a decentralized platform using the blockchain. The platform known as Ecoinomic was developed as a response to problems faced by investors in obtaining fiat loans for their transactions.

How it works:

Ecoinomic will use the blockchain technology for its operations. It aims at issuing fiat currency or stable cryptocurrency loans to prospective crypto investors and traders. The platform will accept cryptocurrencies or similar digital assets as collaterals for the issued loan.

When it accepts cryptocurrencies from parties in need of fiat loan, it keeps these collaterals in a safe condition and refunds them to the owners when the loan and its accumulated interests are paid.

Prospects:

Ecoinomic is creating conducive atmosphere for all who wish to obtain loans to do so almost immediately. Its target audience is not limited to crypto traders and investors. Anyone who has a digital wallet with sufficient funds can apply for loans.

If you’re tired of walking into banks and getting humiliated because you applied for a loan, Ecoinomic is offering you seamless and secure loan-to-collateral transactions. You get to give your crypto holdings to the platform as collateral security and obtain a loan of the same value. Upon your payment of the loan and its interests, Ecoinomic refunds you the same value of digital assets you gave as collateral, notwithstanding the change in prices.

Among its numerous aims, Ecoinomic aims at hedging risks associated with exchanging crypto assets. It’s also offering its users long and short-term loans with reasonable interest.

Token Allocation:

Sales: 72%

Team: 13%

Advisors: 12%

Pre-Sale and Development Stages: 2%

Bounty: 1%

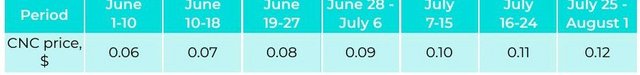

Token Sales Information:

Ticker: CNC

Platform: Ethereum

Token Standard: ERC20

Soft Cap: 6 million USD

Hard Cap: 106 million USD

Price range: 1 CNC= $0.6 - $0.12 USD

Current price: 1CNC = $0.1

Accepted: LTC, ZEC, BTC, NEO, BCH, XRP, and XMR

Country: Estonia

Restricted Areas: China, Singapore, and the USA

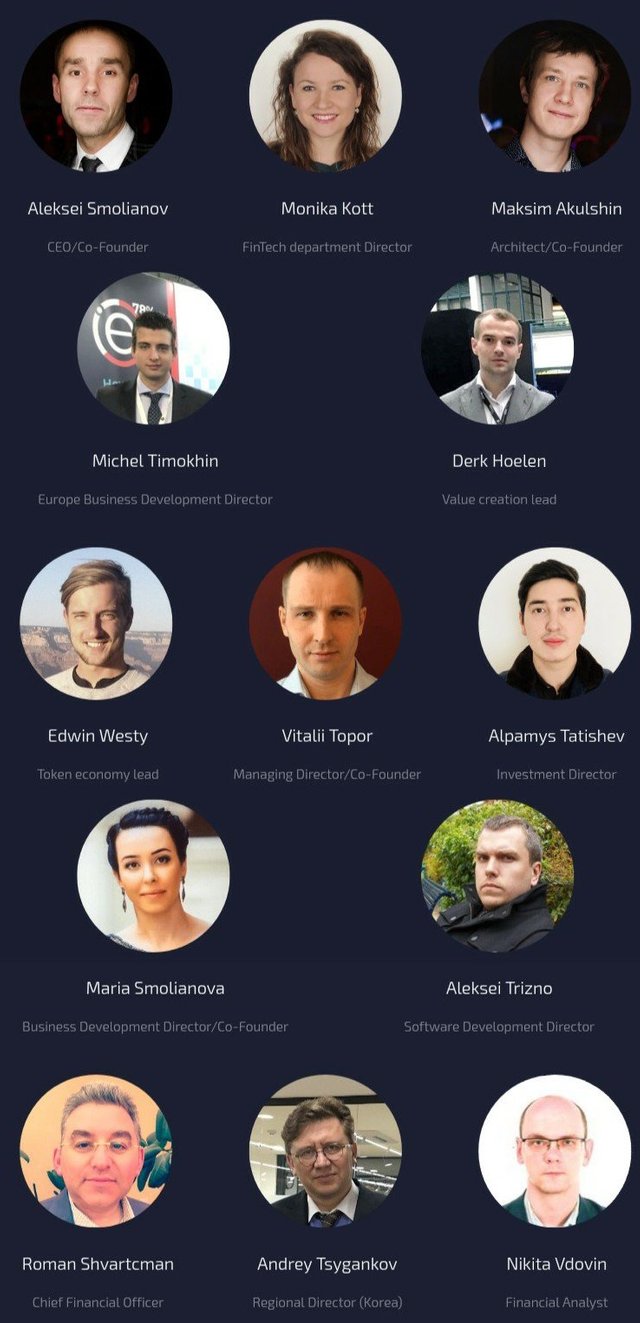

The Amazing Team and advisors :

Partners :

Conclusion:

The team behind the Ecoinomic really did a good job. Obtaining loans is a very tedious task. Coupled by the limited scope of cryptos, issuing cryptocurrencies as collaterals for loans are practically impossible.

With Ecoinomic, you can now obtain both short and long-term loans and use your cryptocurrency or any similar digital asset as collateral. Ecoinomic is a good project and willing investors can strike while the iron’s hot.

USEFUL LINKS :

visit the links below to get more insight about this remarkable project (Ecoinomic). Ensure you follow on various social media.

Website : https://ecoinomic.net

Whitepaper:

https://ecoinomic.net/docs/whitepaper

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=2878954

Telegram group : https://t.me/ecoinomicchatroom

Telegram news channel : https://t.me/ecoinomicchannel

Facebook : https://m.facebook.com/ecoinomic/

Twitter: https://twitter.com/ecoinomicnet

LinkedIn : https://www.linkedin.com/company/ecoinomic/

Reddit : https://www.reddit.com/r/eCoinomic/

Writer's bitcointalk username: deodivine1

Writer's bitcointalk profile : https://bitcointalk.org/index.php?action=profile;u=1390292

Great piece. Good to know eCoinomic will do what traditional financial institutions have failed to do for crypto investors. Crypto backed collateral for loans sounds good 👌

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit