Cryptocurrencies are breaking new price levels this week as markets are seeing gains across the board during the last two weeks of April. Yesterday’s trading sessions saw bitcoin cash touch a high of $1,560 per BCH as the currency has been on a relentless run over the past week. BCH prices are hovering around $1,477 at press time. Bitcoin core (BTC) prices touched a high of $9,410 but prices have dipped to the $9,340 range since reaching that vantage point. Overall there are quite a few digital assets seeing more significant gains than BTC as the spring trading season starts to melt the ‘crypto winter’ blues that recently plagued the community.

The Cryptocurrency Price Reversal Rampage

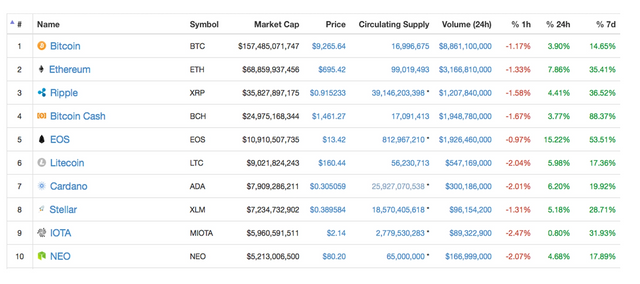

Digital currencies are seeing significant price reversals just before the month of May approaches. Out of all the 1,590 listed cryptocurrencies on Coinmarketcap, the cumulation of these assets have accumulated a market valuation of $422Bn USD. Bitcoin Core (BTC) markets have gained 14.4 percent over the last seven days but many other cryptocurrencies have seen much larger gains. In the top ten positions, some notable increases include EOS, as its markets spiked 53 percent over the past week, while IOTA jumped 31.9 percent. But Bitcoin (BCH) markets were the clear winner over the past seven days as BCH weekly prices have increased by 88.3 percent today.

Bitcoin Cash Markets Climb Over 88% Over the Last Seven Days

Bitcoin cash market volume has quadrupled over the last three weeks as the currency now commands close to $2Bn in 24-hour trade volume. This has propelled BCH into the fourth position in overall trade volume compared to all 1,590 other digital assets. The top five exchanges swapping the most BCH today include Okex, Bitfinex, Upbit, Huobi, and Binance. Fiat volume for bitcoin cash trades continues to rise over the last 48-hours as BTC pairs only account for 35.8 percent of today’s BCH trades. This is followed by the U.S. dollar (27%), tether (USDT 19%), the Korean won (11.3%), and the euro (2.6%). Ethereum pairs represent 1.4 percent of today’s bitcoin cash trades as well.

BCH/USD Technical Indicators

Looking at weekly, daily and the 4-hour charts show BCH bulls have been relentlessly charging without much exhaustion. At the time of writing bitcoin cash values are close to more powerful resistance levels in the $1,500 territories. Both the daily and 4-hour Relative Strength Index (RSI) indicator overbought conditions. MACd shows it may be heading southbound in the short term as well.

The two Simple Moving Averages (SMA) both short-term 100 SMA and the long-term 200 SMA have recently crossed paths. The 100 SMA is now above the 200 trend line indicating the path to resistance is on the upside. Order books show some stiff resistance for bulls between the price point now all the way up until the $1,600 region and a little more upwards past $1,700. On the backside some solid foundations have formed between the price level now and $1,400 but after that books begin to look quite thin.

The Top Cryptocurrency Market Performances

Cryptocurrencies, in general, have done well over the last two weeks and the current momentum continues. BTC markets have seen a daily volume increase of $8.8Bn and a $157Bn market capitalization. However many other digital currencies have seen much bigger gains and BTC dominance is down to the 37 percent threshold today. Ethereum (ETH) markets are doing considerably well this week and are up 35 percent over the last seven days. One ETH is averaging around $695 per coin during the April 24 trading sessions. The third largest cryptocurrency valuation held by ripple (XRP) has seen seven-day gains around 37 percent. The market value of XRP today is $0.91 cents and markets command a $1.2Bn 24-hour trade volume. The cryptocurrency EOS has taken over the fifth top market capitalization as its markets have increased significantly this week. One EOS is hovering around $13.42 per token today with a $1.9Bn daily trade volume.

The Verdict: Crypto-Optimism is in the Air

Overall cryptocurrency market participants are extremely pleased with the past week’s runups in value. However, some traders are still skeptical that we are out of the bear market range as there have been a lot of false positive rallies over the last four months. So far the verdict is many traders and digital asset enthusiasts are confident 2018 will be just as spectacular as last year.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/markets-update-cryptocurrencies-bring-bullish-gains-this-spring/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit