ICO Trends

From couple of months, the ascent of ICOs has tested the investment business in its capacity to back beginning time organizations and activities.

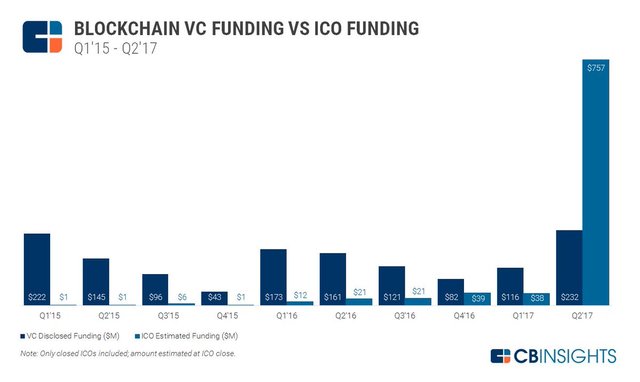

As appeared by the chart underneath (from CB Insights), the ICO drift is genuinely later yet exponential. From nothing in 2015, the subsidizing represents an expected $757 mln in Q2 of 2017. That figure surpasses by more than 3x the unveiled financing sums by investors for Blockchain organizations and tasks.

At the point when such a monstrous stream of capital shows up, two primary wonder typically take after: fakes and disappointments. It is practically sure that the present market will see various cases of both.

Be that as it may, the guage disappointments won't shroud the huge problematic capability of the Blockchain in a large number of enterprises and markets. Among these, the benefit administration industry might be most ready for interruption.

Assets & Quantitative Management and Blockchain

Among the fruitful undertakings of the main ICO wave, a few, as Melonport, are bringing exemplary instruments of the benefit administration industry into the crypto world. Be that as it may, the greatest interruption lies in more mind boggling instruments. Quantitative administration, specifically, has uncommon potential.

Quantitative methodologies are calculations delivering offer/purchase motions on an arrangement of hidden resources when given information, for example, costs. As opposed to what a great many people envision, unadulterated quantitative administration in conventional fund is as yet a little segment (around 10%) of the $75 trln resource administration industry.

In the crypto universe, quantitative procedures, for example, exchanging bots normally developed and found a specialty. Different cases of Blockchain's troublesome power in the advantage administration industry are tokenizing of benefits, or undertakings like Iconomi endeavoring to make a differentiated performing reserve from a crate of advanced monetary standards. Different cases incorporate Blackmoon which will dispatch a high return store or NaPoleonX which will dispatch a progression of total profit reserves based for conventional value lists.

Isolate the goods worth keeping from the waste

With all the more exchanging bots and assets being set up, computerized cash speculators end up thinking about how to survey the nature of quantitative director, and how to isolate the person who was fortunate in the past from the person who has a solid aptitude that should prompt supportable execution.

At the point when a youthful market has developed exponentially for a few years, a large number of "wannabe quants" have created working and well-performing calculations. In any case, what does that inform you regarding their capacity to create solid returns in various economic situations?

Another idea yet a characteristic arrangement

As indicated by the CEO of NaPoleonX, Stéphane Ifrah, the organization's originators were resource directors overseeing billions in level 1 banks; all things considered they confronted the issue comprising in "persuading financial specialists to profit." Backtesting is typically the initial step to persuading clients that you've built up a quality calculation.

This procedure includes utilizing the calculation on past information to decide if its forecasts would have been exact. Backtesting isn't flawless, on the grounds that the analyzers can utilize overfitting or potentially undisclosed calculation changes to get the coveted outcome. That is the reason NaPoleonX imagined the verification of execution idea.

Verification of execution comprises of utilizing an open Blockchain as the trusted outsider to approve continuously the exchanging signal stream of any low-to-medium recurrence exchanging procedure. It's a two stage process: to begin with, the flag is sent in a hashed and muddled path to the Blockchain, and afterward, a few days after, the flag is sent once more, yet free, with the arbitrary string empowering the hash confirmation.

As an outcome of doing as such, the director is capable:

1:- To demonstrate the exchanging signals at the time they ought to have been executed on the budgetary markets

2:- To figure the gross execution the quantitative methodology would have accomplished in a confided in way

Evidence of execution could alter the quantitative administration industry, especially concerning advanced monetary forms. It stays to be seen whether this idea will take a shot at a substantial scale, or whether different tasks will influence further to upgrades.

This is for sure and definitely meet the standards also :)

I am sure we all going to see some more buzz.

Thank you sharing this information, by the way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure and thank you for your comments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit