Digital forms of money represent an aggressive danger to Bank of America's business, the organization said in an administrative recording Thursday.

"Customers may lead business with other market members who take part in business or offer items in zones we consider theoretical or dangerous, for example, cryptographic forms of money," the bank said. Such expanded rivalry may "contrarily influence our profit" or influence "the eagerness of our customers to work with us."

The remarks were a piece of a yearly 10-K recording with the U.S. Securities and Exchange Commission about the bank's tasks and business dangers. The bank said it had no further remark.

Bank of America's recording included that across the board selection of new advances in money related administrations, including cryptographic forms of money, "could require significant uses" keeping in mind the end goal to adjust to developing industry gauges and buyer inclinations.

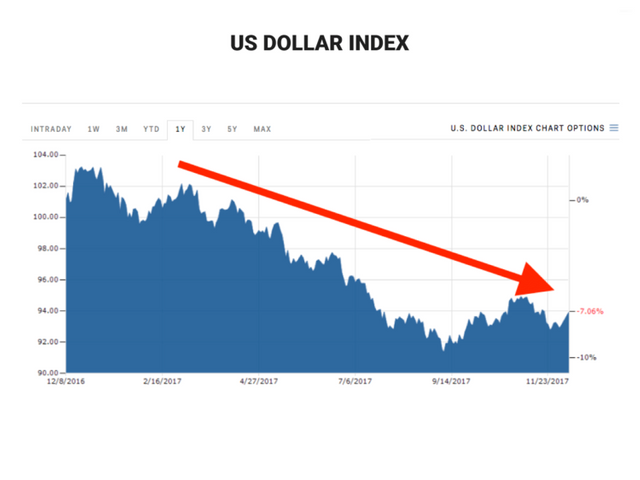

Prevalent enthusiasm for advanced monetary standards has taken off over the most recent a while, sending bitcoin from under $1,000 toward the start of 2017 to a high above $19,000 in mid-December. The surge of intrigue prompted the dispatch of bitcoin prospects by CME, the biggest fates trade, and its rival, Cboe, in December also. Bitcoin was exchanging admirably off its record highs Friday, at around $10,000.

Be that as it may, Bank of America has not grasped the ascent of enthusiasm for digital currencies. The company's Merrill Lynch riches administration arm restricted its around 17,000 budgetary counselors from purchasing bitcoin-related speculations for customers. The bank additionally said not long ago that clients can't utilize its Mastercards to purchase digital currencies.

The SEC documenting likewise noticed that advanced monetary forms confine the bank's capacity to track development of assets and conform to laws, for example, hostile to tax evasion control.

Hypothetically, the blockchain innovation behind bitcoin and different digital forms of money is a danger to the presence of major budgetary firms. Blockchain takes out the requirement for an outsider go-between like a bank by making a moment, perpetual and secure record of exchanges.

The improvement of cryptographic money exchanging so far has seen the development of another industry with quickly developing organizations, for example, trades like Coinbase and bitcoin "mining" organizations like Bitmain.

In the interim, Bank of America has been discreetly looking into blockchain innovation, as are other real banks.

The organization has in excess of 70 licenses that can join uses of blockchain, and a few dozen different licenses for "computerized wallets," methods for verification and different procedures expected to apply the innovation in saving money and trade, as indicated by David Pratt, overseeing executive at Mcam-International. The firm keeps up a chronicle of patent-related reports in 160 nations.

They are running scared.... And that is awesome!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @faizn! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good info

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit