I was wreck $600 eventhough I have bought after the big dump because it turned out that the dumped had not finished. Slowly, it was still dumping a half price more and for once in my life, I sold at the bottom. Second to worst than buying high selling low which was buying middle selling low. This is my story:

It all started with https://www.publish0x.com/canuhodl/how-i-turned-373-dollars-to-7563-dollars-with-ampleforth-in-xzyroqm?a=4oeEw0Yb0B&tid=amplwreck which was the first time that I heard about Ampleforth (AMPL). I saw that it was on all time high and took article's advice that it was a financial risk. After this was the biggest dump and I was saved from the worst situation but wait, I did not know there is still a second worst.

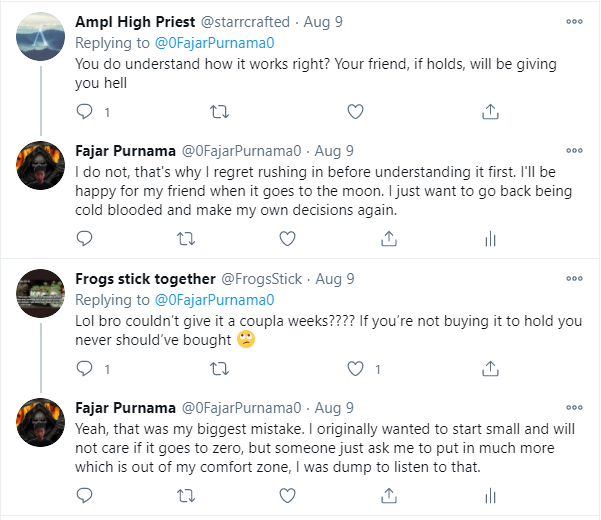

The worst came true, the biggest dump happened. It was at this point that I had my eyes on $AMPL. I went to its website https://www.ampleforth.org/ to see what $AMPL is and I learned that is a unique currency where mainly the supply is elastic that a deflation will occur when the price goes below $1 and an inflation will occur when the price goes above $1. The currency was different from everything else and potentially the most uncorrelated ot any assets which was worthy of my collection where here I bought $50. Everything should have been well with this plan, but the devil came (note, my friend here is not the devil but just a description of provocations of bad choices).

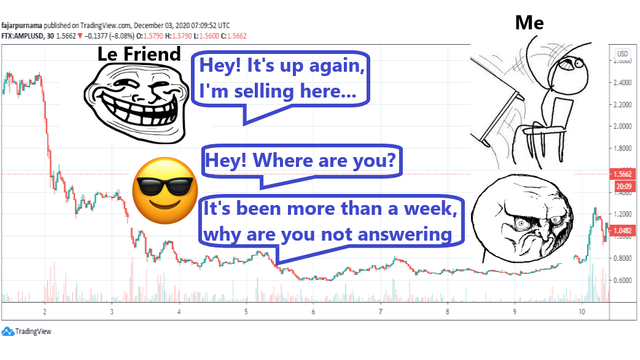

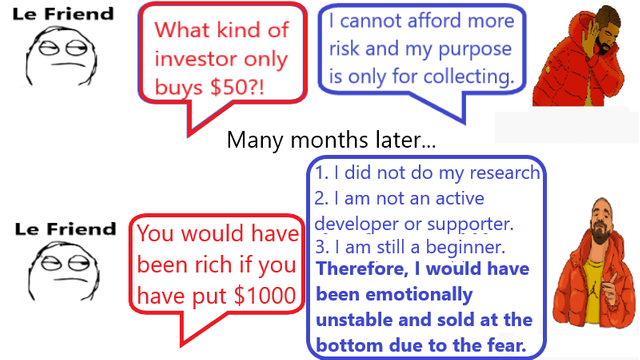

I rarely express to anyone of what I have invested in, but my friend asked and he was interested in investing in cryptocurrency and demand to tell him of what I have bought or he will think that I left him out of being rich he said. So, I told that I bought $50 of $AMPL and the reason was because the unique concept of $AMPL and that it was one of the most popular defi coin at the time where even Coinbase was considering of listing. The other reason why I bought is that because it dumped and those on the sidelines may see this as an opportunity to get in, I told my friend. He replied with what kind of investor only puts $50 and what return can I get. I was mentally young and instable and usually what other people said is right that I will regret if I do not listen which was a though buried in my subsconscious maybe from years of families' and friends' conversations and televisions.

The next day, I told him that I added another $50 and he replied in a mocking way of what difference does another $50 made. I would have been alright up to here and kept my position but he made an argument that from the chart that there is now way that it can dump further. Emotionally I replied that I added another 1 Ethereum or $350 at the time into my position. He gave a salute and bought along with me. The biggest mistake started here where most of the time is not a good to involve emotions in trading.

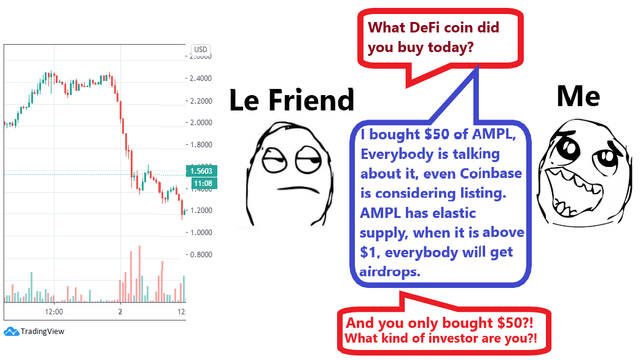

However, it dumped further and I clearly and strongly quoted to him of how he said that it could never fall further but it did. He just laughed and asked for what my plan is. I said to leave it as it is because theoretically will always go back to $1 and now is below $1 so what are we waiting. I dug my grave even further by buying another 1 ETH.

It was up again and I could've stop loss but still hesitating. It was a momentary relieve.

It dumped again, and this is not what people said. It is not theoretical that it should be close to $1 and even in the past, it was highly volatile that it would be $1 and below over and over. I planned to ignore and just wait patiently even months but my friend was the one who panicked this time. He asked whether I know the reason and I searched that there was rumors that the founders took profit at the top and was heard by the investors and they dumped. He kept on pestering of how long we should endure and I lost my patience and promised until $0.6.

It actually went below $0.6! My friend came again to me strongly reminding me when it was exactly $0.6. Well, I made a promise and I must do though I considered of breaking my promise but I did some research. I found out forks of $AMPL which are Antiample (XAMP) and Random AMPL (RMPL) which made me think that eventhough AMPL is unique, it can easily be forked and have the elasticity mathematics changed based on the forkers taste and if the people liked the math better then it they would go there. It made me think why people on the sideline did not see this as a chance to jump it eventhough a big dumped happened. I checked the sentiment on Twitter with "$AMPL" and almost all are negative. Lastly, the fear came to me that the negative rebase will just eat my asset away where if it is not for the negative rebase, I would have hodl. This made me decide to fulfill my promise and sell even if I will lose $600.

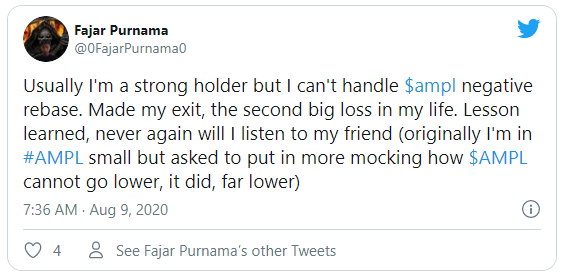

When I sold, it went further down a bit but it bounced! This was the first time I sold almost at the bottom where I usually take it to the grave. My friend was lucky to sell after the bounce. At that time I was depressed and locked myself in my room for long.

1. It is here that I learned a very important lesson to always make a decision yourself and never let anyone make the decision for you unless you are forced which you can sue the person later. Also, do not forget to do your own research. By making your own decision, you are also responsible to do your own research such as skimming through Ampleforth's whitepaper and it is wise to keep up with news regarding your investment and even better, support the project by developing yourself, create adoptions, or spread information through well written articles or the simplest word to word. Other than making your own decision, the lesson that I have learned:

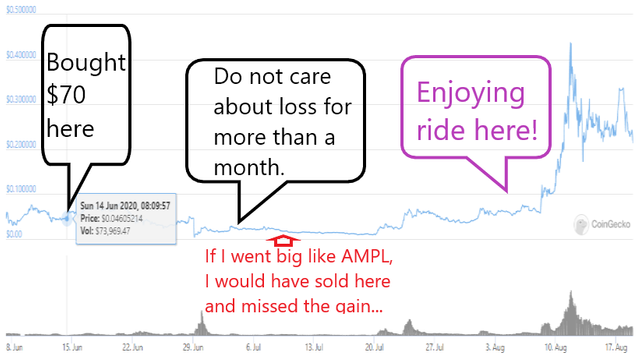

2. Do not invest more than you are willing to lose unless you are emotionally strong. Emotion clouds most people's judgement where in this case seeing drops in price will cast fear if we invest more than our comfort zone. For example, if we invest using everything, the drops in price will make us worry of losing everything eventhough our analysis that it will profit in the future but our heart will not be able to handle it and sell like me. The amount is relative to each people maybe rich people are willing to lose thousands or even dozen of thousands of dollars. Beginner investors cannot even stand losing more than ten dollars and that is alright. Buy only $10 AMPL in centralized exchange and let it go. For me, $30 for unique projects only, $50 when I see potential, $100 when I believe that they will be popular one day, and more for solid fundamental, good narative, trusted team, and everything positive. For example, I participated in Publish0x's Statera's writing contest and I see Statera to have a unique and interesting concept. So I invested $70 and do not care for the loss for more than a month and I was rewarded with more than 100% gain. If I did like $AMPL, I would have been fearful in July of the loss and sold and would not enjoy the moon in August.

3. Do not forget to take profit for beginners and if possible return initial investment. Return initial investment is especially true for those who breaks the first rule of no investing more than you are willing to lose because of the volatility of the market where if you are not strong enough, you will live in fear everyday worrying about the price. The medicine is to take profit because after that, you will lose nothing no matter what happens to the market. I found MYX network's narrative to be very juicy and bought early. It went up over %100 and I learned my lesson from $AMPL and took profit and I was right! Not long after I took profit, there were rumors that the project was a scam and the priced plummeled. I was saved thanks to taking profit.

4. While stop loss was originally for experienced traders when they miscalculate the market. However, here stop loss is very significant for beginners who broke the first rule of not investing more than they afford to lose. For rule breakers who are lucky enough to be in profit, the second rule applies which is to take profit and return to original plan. As for those who are not lucky, it is best to stop the loss before it is too late as to what happened to me. Sure if I hold further, I would have profit, but can your emotion take it? You be fearful just like me who sold at the wrong time.

Another lesson of this article is to always take responsibility when recommending an investment. Even if you are simply telling your story and not pushing other's to invest, it wise to make a disclaimer "this is not financial advice" as you would not want to be responsible for the loss of your listener.

Mirrors

- https://www.publish0x.com/0fajarpurnama0/this-is-my-story-and-lesson-about-my-first-big-wreck-in-trad-xmkprjr?a=4oeEw0Yb0B&tid=steemit

- https://0darkking0.blogspot.com/2020/12/this-is-my-story-and-lesson-about-my.html

- https://0fajarpurnama0.medium.com/this-is-my-story-and-lesson-about-my-first-big-wreck-in-trading-ampleforth-fc9b511e3bc1

- https://0fajarpurnama0.github.io/cryptocurrency/2020/12/04/my-first-big-wreck-in-trading-ampl

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/my-first-big-wreck-in-trading-ampl

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/this-is-my-story-and-lesson-about-my-first-big-wreck-in-trading-ampleforth

- http://0fajarpurnama0.weebly.com/blog/this-is-my-story-and-lesson-about-my-first-big-wreck-in-trading-ampleforth

- https://0fajarpurnama0.cloudaccess.host/index.php/11-cryptocurrency/128-this-is-my-story-and-lesson-about-my-first-big-wreck-in-trading-ampleforth

- https://read.cash/@FajarPurnama/this-is-my-story-and-lesson-about-my-first-big-wreck-in-trading-ampleforth-5207055b

- https://www.uptrennd.com/post-detail/this-is-my-story-and-lesson-about-my-first-big-wreck-in-trading-ampleforth~ODIzOTYw

- https://www.torum.com/post/5fc99d1d7133751da73c6eac