I've been in the cryptocurrency 'game' for about half a year now. Since then I've witnessed the industry explode into mainstream conversation - just yesterday I heard my colleagues talking to each other excitedly about "getting into Bitcoin". It seems everybody is excited about taking their finances into their own hands and away from banks and making a few bucks along the way.

I am finally ready to take the next step and transition my entire financial life to cryptocurrencies. This post is some background on my journey into crypto so far, and where I think we're all heading. My subsequent posts will be a diary of my transition into a financially independent crypto life.

Wave 1

I heard about Bitcoin in 2011 when I was introduced to darkweb and tried mining from my laptop. Unfortunately my laptop was taking hours to mine anything so I gave up - 50 bitcoin just didn't seem worth it to me - if only I knew...

Wave 2

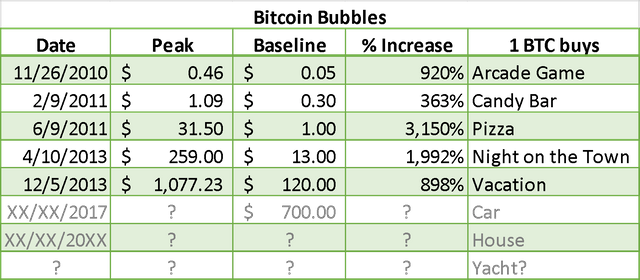

The second wave came in 2013 when the price exploded to over $1k and it looked like it was gearing up to take over. I didn't know too much back then and I didn't have any interest in buying in at such a high price. That was a good move - the subsequent market crash led to Bitcoin crawling back under that rock into obscurity from whence it came.

The world wasn't ready for crypto - crypto wasn't ready for the world.

Wave 3

Then, late 2016, I came across a TED talk touting the potential of Bitcoin and the Blockchain. I was sold on the underlying merit of the technology in its ability to free us to be sovereign over our own information.

In my subsequent web searches I came across a video by Crypt0 which took a look at the graph of Bitcoin and analysed the shape of all the previous periods of volatility bubble, burst, and subsequent stability. The conclusions was that we were entering a new period of serious volatility and price increase. He predicted we would end 2016 with $5000 bitcoin. He was wrong in the specifics, but very right about what the charts were telling him.

I found this speculative Bitcoin adoption/price theory which hypothesises:

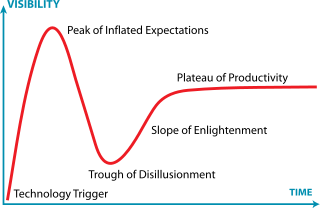

The growth of adoption of Bitcoin and therefore bitcoin price is following an S-Curve of Technological Adoption, which is itself characterized by fractally repeating, exponentially increasing Gartner Hype Cycles.

So I started putting money into cryptocurrency - only what I could afford, a little at a time. I treated it as my savings account, albeit with ridiculous interest rates. Of course, there will be a burst to this bubble (who knows when, or why - maybe caused by overvalued ICO's) however, like the last time, it will likely go under the radar again as further developments are made. During this time I will be accumulating as much as I can, preparing for the next bubble.

The future of Crypto

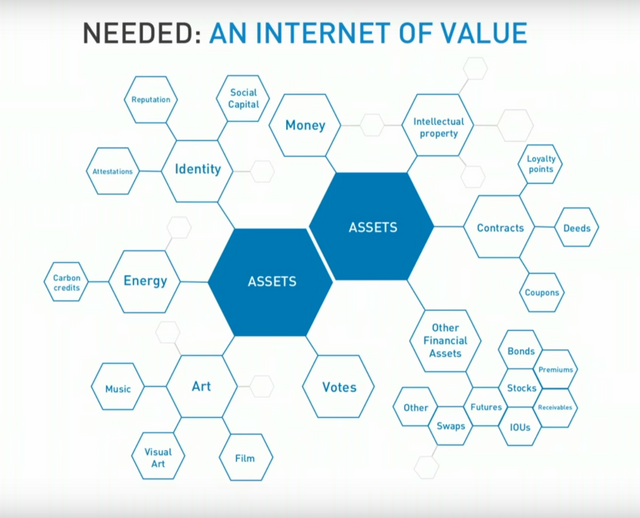

We are currently in the very early stages of building not only a new monetary system, but a new system of value exchange in which we are compensated justly for providing value. Say goodbye to middle-men.

Steemit is a great example of how this will play out. It's quite difficult to believe that people are making real money using this platform. However when you take into consideration the more traditional platforms and advertisers that profit from our content, it makes a little more sense.

If you look about 10 years down the line it's likely that we will all be living crypto lives. I suspect the turning point will be when children grow up using crypto - opting not to start bank accounts when they are old enough. Let's be ahead of the curve.

Transitioning to crypto

In this series I will be documenting my transition to Crypto-centric living, experimenting and answering questions like:

- Is it possible to live on cryptocurrency and blockchain technology in the current climate?

- What are the trade-offs?

- How difficult is it to transition?

- How to stay safe?

I will be experimenting with transitioning to a crypto centric life. I intend to pay for things in cryptocurrency, use crypto Visa cards, invest, and increasingly use digital blockchain platforms and technology.

I will be documenting the experiment here on Steemit.

Be sure to follow

and get in touch if you're transitioning to a crypo life.

I'm wondering if you could help me by directing me to the best web site that I should purchase my first cryptocurrency from..

I am getting in at a late stage, but better now than never..

Thanks in advance..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure! coinbase.com is one of the easiest platforms to buy from. You can buy Bitcoin, Litecoin and Ethereum.

Let me know if you have any questions or if you'd like me to send a test transaction.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was looking at this site last night..

I understand they had some problems awhile back..

I don't have a hard wallet yet, does that matter much..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TL;DR: use localbitcoins or coinbase to buy - store in a paper wallet.

Coinbase does certainly have its fair share of issues - it's the simplest to buy with though since you don't have to deal with buyers/sellers like you would on a traditional exchange.

If you're concerned about Coinbase then try localbitcoins. It's where I sell my bitcoins because coinbase doesn't allow me to sell in the UK.

The benefit of local bitcoins is that you have access to your private key (coinbase don't allow you to see this) but it does mean you are dealing with a bitcoin dealer rather than coinbase.

Either way, I wouldn't recommend storing your currency long-term on any of these.

You can store many different ways, the most secure way (what I use) is a paper wallet. You can download the wallet generator to your desktop and create a wallet offline without ever being connected to the internet, then print it out, send some bitcoin to the address and store the paper somewhere safe. The downside to this method is that your coins are only as safe as you're physical storage of the wallet. Think of it like storing cash.

I personally haven't tried a hardware wallet like Trezor - it is certainly intriguing and I might invest in the future. And then you have software wallets like Jaxx, Mycelium, and actual Bitcoin Core (which syncs the blockchain on your PC - useless unless you're a miner), these wallets are great but I find it difficult to trust the security of my phone/PC these days - hackers are pretty good at what they do - if you want the full security of blockchain you can't leave any holes. Which is part of the reason I think Coinbase is a better place to store if you're unsure, since they keep all the coins in air-gapped cold storage, and are insured against loss (however much stock you put into that claim).

Good luck!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot..I have been doing some researching, but find things aren't clear cut.. And like you said, security is an issue..I want to invest into some long term coins, but am trying to figure which web site to use..

Will follow you for responding to my post..Thanks again...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit