This report presents data on cryptocurrency and ICO market changes during 2018. Special emphasis has been placed on an analysis of the changes that have taken place during August 2018, including over the past period (August 12-19, 2018).

Information as of August 20, 2018

Professor Dmitrii Kornilov, Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox

Dima Zaitsev, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox

Nick Evdokimov , Co-Founder of ICOBox

Mike Raitsyn , Co-Founder of ICOBox

Anar Babaev , Co-Founder of ICOBox

Daria Generalova, Co-Founder of ICOBox

Cryptocurrency Market Analysis (August 12-19, 2018)

1. General cryptocurrency and digital assets market analysis. Market trends

1.1. General cryptocurrency and digital assets market analysis

1. General cryptocurrency and digital assets market analysis. Market trends

1.1. General cryptocurrency and digital assets market analysis

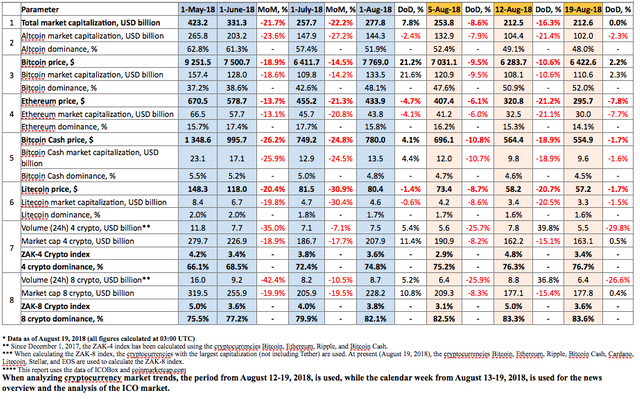

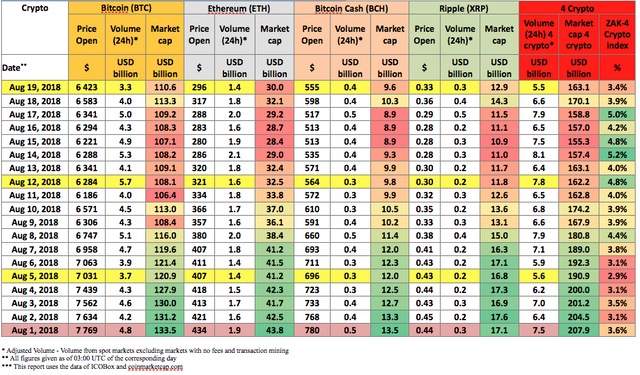

Table 1.1. Trends in capitalization of the cryptocurrency market and main cryptocurrencies from May 1, 2018, to August 19, 2018

Cryptocurrency market capitalization remained practically the same over the analyzed period (August 12-19, 2018) and as of 03:00 UTC equaled $212.6 billion (see Table 1.1). At the same time, bitcoin dominance increased to 52%. The market dominance of the four and eight largest cryptocurrencies as of 03:00 UTC on August 19, 2018, equaled 76.7% and 83.6%, respectively (see Table 1.1).

The drop in cryptocurrency market capitalization compared to the start of the month equaled around $65 billion, including a drop in bitcoin capitalization by $23 billion and altcoin capitalization by $42 billion.

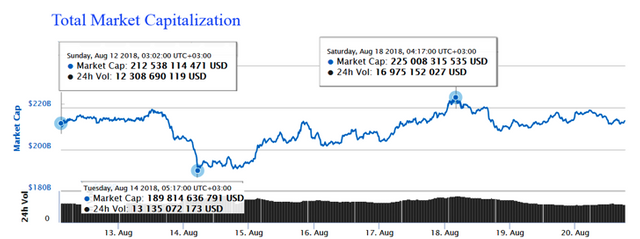

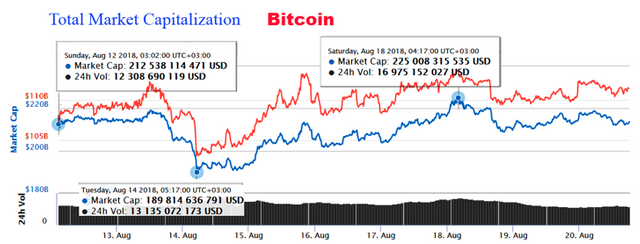

Last week cryptocurrency market capitalization fell below the threshold of $200 billion for the first time this year, reaching the level of November 2017. During the period from August 12-19, 2018, cryptocurrency market capitalization fluctuated from $189.8 billion (min) to $225 billion (max) (Fig. 1a), i.e. within a range of $35 billion. For its part, bitcoin capitalization fluctuated from $103.2 billion (min) to $113.7 billion (max), i.e. within a range of $10.5 billion.

Figure 1a. Cryptocurrency market capitalization since August 12, 2018

Figure 1b shows bitcoin capitalization (red line) superimposed on cryptocurrency market capitalization (blue line). The lines are practically identical, but more intensive growth in bitcoin can be seen compared to overall market capitalization. As a result, over the past week bitcoin dominance increased by 1.1%, from 50.9% to 52% (see Table 1.1).

Figure 1b. Capitalization of the cryptocurrency market (blue) and bitcoin (red) since August 12, 2018

A clear downward trend can be seen on August 13-14. What could be causing this fall in capitalization? All that can be said for certain is that after August 14 most of the news stories were positive (see Tables 1.3, 1.4)

The rise and fall of cryptocurrency prices over the past seven days (August 12-19, 2018)

Last week’s leaders from among the top 500 cryptocurrencies by capitalization, which showed an appreciation of more than 50%, were the projects TaTaTu (+252.13%), Ternio (+98.39%), Aston (+76.31%), Cortex (+73.53%), and All Sports (+64.24%). The growth of Ontology (+44.67%), Nano (+38.28%), VeChain (+35.76%) should also be noted.

During the period from August 12-19, 2018, the change in the prices of cryptocurrencies in the top 500 ranged from -50% (Paypex) to +252.1% (TaTaTu). The growth leader during this week was the TaTaTu project, which completed its ICO and token sale in late June with a considerable amount of collected funds ($575 million). Over the past week, its price appreciated by more than 250%. Two major jumps in price were seen on August 16 and 18. However, no notable news items took place on these days. In the end, the project’s capitalization increased from $20 million to $71 million (on August 20, 2018). This growth can be explained by manipulation by major market players and the gradual development of the project. Information was published on August 19 on the largest crypto giveaway from the TaTaTu project: $50 million for its users (The Biggest Crypto Giveaway: $50 Million for Users Who Join).

On the other hand, the Paypex price showed the worst result, falling by 50% over the week despite more than a threefold jump in price on August 15. This intense volatility may be due to the currency’s relatively small trading volume, which fluctuates from $30,000-50,000 per day.

Only 147 cryptocurrencies and digital assets from the top 500 showed growth, including 29 from the top 100 (not including Tether and TrueUSD).

Over the past week the number of cryptocurrencies with a capitalization of more than $1 billion fell from 16 to 15, with the price of all of them decreasing except XRP (+7.8%), Monero (+2.26%), Bitcoin (+1.11%), Stellar (+0.29%), EOS (+0.1%) and Tether (the price of which is tied to the US dollar).

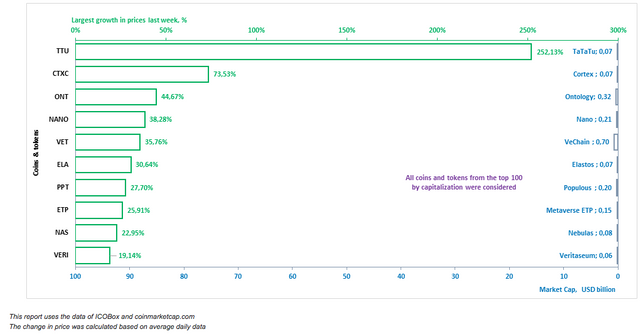

The coins and tokens from the top 100 that demonstrated the largest price growth are given in Fig. 2.

Biggest gainers and losers over the week (August 12-19, 2018)

The prices of some cryptocurrencies may fluctuate from -50% to +50% over the course of a single day. Therefore, when analyzing cryptocurrency price trends, it is advisable to use their average daily amounts on various cryptoexchanges.

Below we consider the 10 cryptocurrencies that demonstrated the most significant change in price over the past week (Fig. 2-3). In this regard, only those coins and tokens included in the top 100 by market capitalization were considered2.

Figure 2. Largest growth in prices over the past week

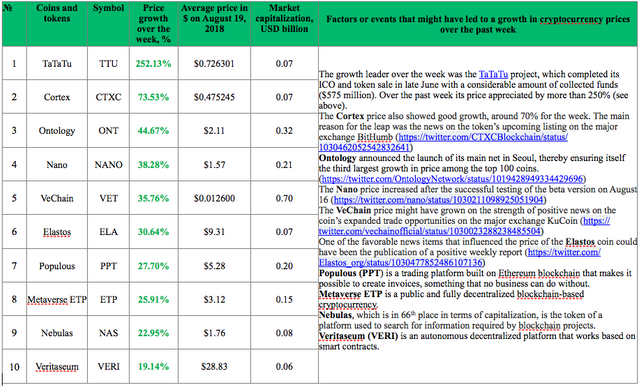

Tables 1.2 and 1.3 show the possible factors or events that might have influenced the fluctuation in prices for certain cryptocurrencies. Table 1.4 shows the possible factors or events that might have influenced the cryptocurrency market in general.

Table 1.2. Factors or events that might have led to a growth in cryptocurrency prices over the past week

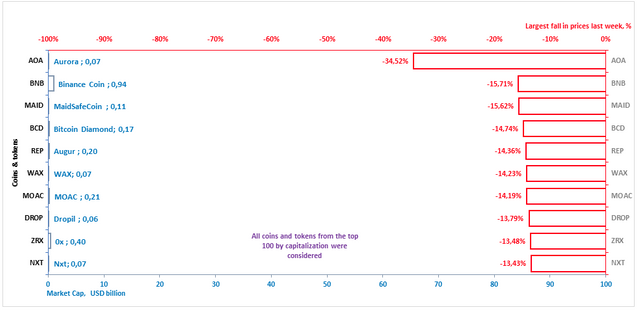

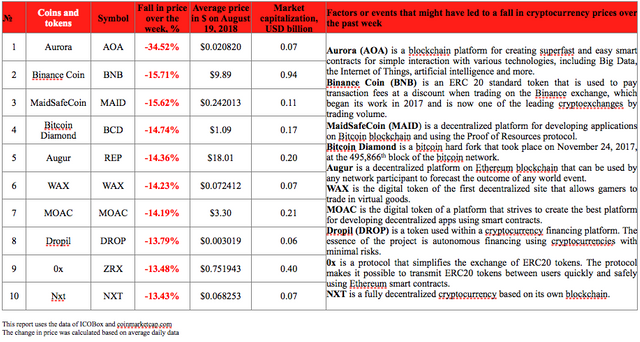

A depreciation in price was seen last week for 353 coins and tokens from the top 500 cryptocurrencies and digital assets by capitalization. The ten cryptocurrencies from the top 100 that experienced the most noticeable drops in price are shown in Fig. 3 and Table 1.3.

Figure 3. Largest fall in prices over the past week

Table 1.3. Factors or events that might have led to a fall in cryptocurrency prices over the past week

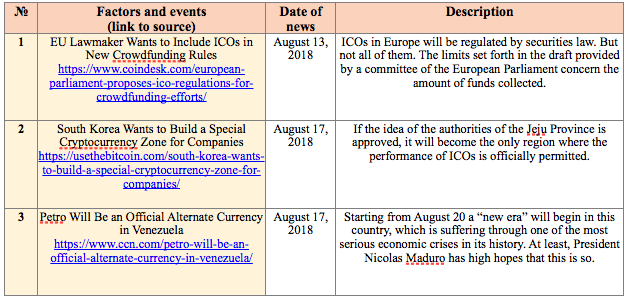

Table 1.4 shows events that took place from August 13-19, 2018, that had an impact on both the prices of the dominant cryptocurrencies and the market in general, with an indication of their nature and type of impact.

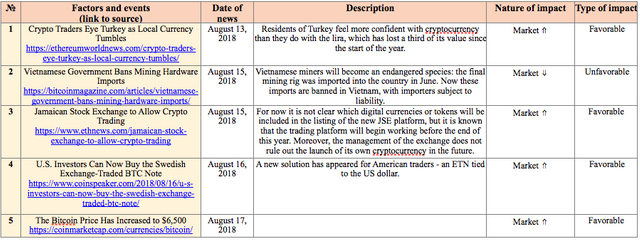

Table 1.4. Key events of the week having an influence on cryptocurrency prices, August 13-19, 2018

To analyze trading activity on cryptocurrency exchanges, the ZAK-n Crypto index is calculated (see the Glossary). The values of the ZAK-4 Crypto and ZAK-8 Crypto indices are presented in Tables 1.1, 1.5.a, and 1.5.b. In August the 24-hour trading volumes (Volume 24h) for the four dominant cryptocurrencies (Bitcoin, Ethereum, Bitcoin Cash, Ripple) equaled from $5.5 billion to $8.1 billion (Table 1.5.a). The value of the daily ZAK-4 Crypto ranged from 2.9% to 5.2% of capitalization. The highest trading volume was seen on August 14.

Table 1.5.a. Daily ZAK-4 Crypto index calculation (from August 1-19, 2018)

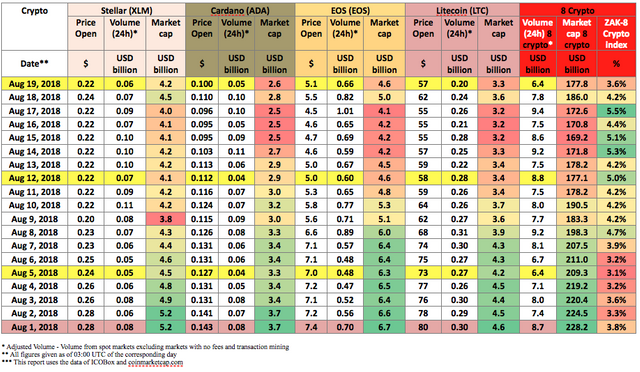

By the end of the week the 24-hour trading volumes (Volume 24h) for the eight dominant cryptocurrencies not including Tether (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Stellar, EOS, and Cardano) equaled $6.4 billion (Table 1.5.b), or 3.6% of their market capitalization. The ZAK-4 Crypto and ZAK-8 Crypto indices are considered in more detail in Tables 1.5.a and 1.5.b.

Table 1.5.b. Daily ZAK-8 Crypto index calculation (continuation of Table 1.5.а)

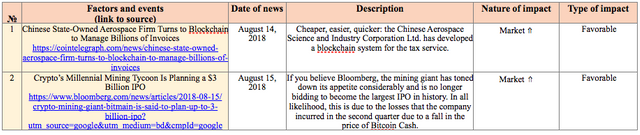

Table 1.6 gives a list of events, information on which appeared last week, which could impact both the prices of specific cryptocurrencies and the market in general.

Table 1.6. Events that could have an influence on cryptocurrency prices in the future

1.2. Market trends

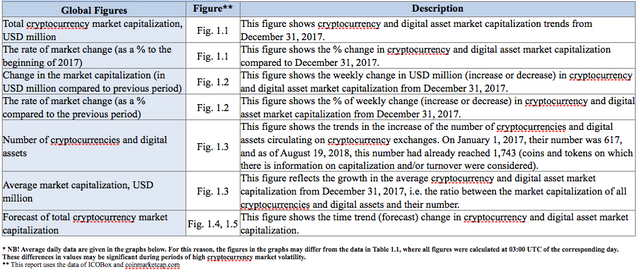

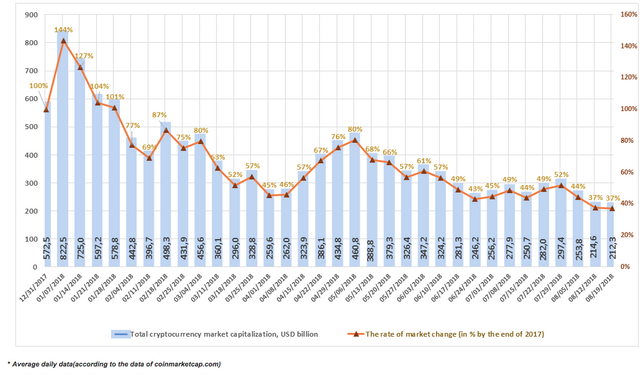

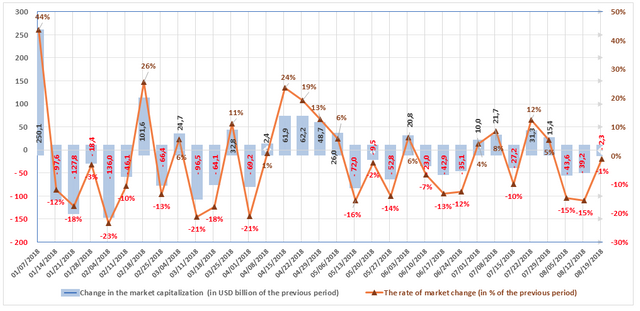

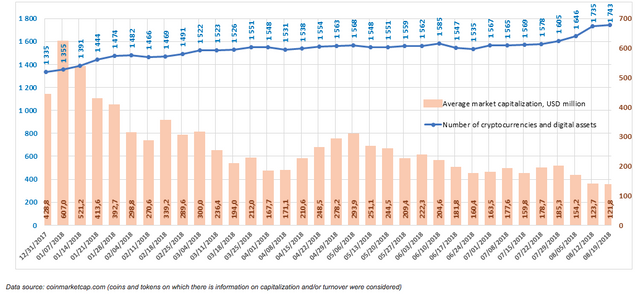

The weekly cryptocurrency and digital asset market trends from December 31, 2017, to August 19, 2018, are presented as graphs (Fig. 1.1-1.5).

Table 1.7. Legends and descriptions of the graphs

Figure 1.1. Total cryptocurrency market capitalization

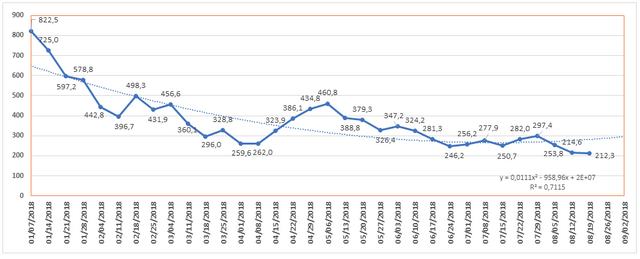

Figure 1.1 shows a graph of the weekly cryptocurrency market change from December 31, 2017, to August 19, 2018. Over this period, market capitalization dropped from $572.5 billion to $212.3 billion, i.e. by 63%. Last week (August 12-19, 2018) cryptocurrency market capitalization decreased from $214.6 billion to $212.3 billion (as of August 19, 2018, based on the average daily figures from coinmarketcap.com).

Figure 1.2. Change in market capitalization

The market is susceptible to sudden and drastic fluctuations. Nine of the thirteen weeks in the first quarter of 2018 were “in the red,” i.e. capitalization fell based on the results of each of these weeks, and the weekly fluctuations ranged from USD -136 billion to USD +250 billion.

Six of the thirteen weeks in the second quarter were “in the red.” The market grew based on the results of the other seven weeks. As noted earlier, a growth was seen in April, while in May and June there was generally a reduction in capitalization. The weekly fluctuations ranged from USD -72 billion to USD +62.2 billion.

Three of the past seven weeks of the third quarter saw an increase in capitalization, and four a decrease (with due account of average daily data of coinmarketcap.com, see Fig. 1.2). On the whole, since early July capitalization has fallen by approximately $45 billion.

Figure 1.3. Number of cryptocurrencies and digital assets

Since December 31, 2017, the total number of cryptocurrencies and digital assets presented on coinmarketcap has increased from 1,335 to 1,855. However, when calculating cryptocurrency market capitalization only those coins and tokens on which there is information on trades (trading volume) are taken into consideration. Over the past week their number increased from 1,645 to 1,743, while average capitalization decreased to $121.8 million. In total, over the past month 230 new coins and tokens have appeared on coinmarketcap.com. However, it should be noted that a number of other coins and tokens were also excluded from the list. Among the tokens that were added to coinmarketcap.com last week, Smart Application Chain, HitChain, TTC Protocol, and Ubex showed high trading volumes.

Figures 1.4 and 1.5. Forecast of total cryptocurrency market capitalization

Without a doubt, right now we are experiencing one of the moments of truth for the crypto industry. Opinions are split on whether there will be further growth or a continued fall.

Ethereum co-founder Joseph Lubin, in an interview on the Bloomberg television channel, said that the price surge at the end of last year was a bubble and in previous years “we’ve seen six big bubbles….,” but this is a normal process for a growing ecosystem that is becoming stronger, even when prices fall. Lubin sees a future in which Ethereum will be significant among hundreds of other co-existing protocols.

At the same time, last week, on August 13, the Ethereum price dropped below $300 and almost reached the level of $250 (i.e. the level of October-November 2017). In the opinion of the head of BitMEX, today Ethereum is making its way to $200. Meanwhile, the prices of most projects’ tokens have fallen, in the best-case scenario, by 50% since 2017. In the worst-case scenario, they are barely above zero.

Naturally, the Ethereum price depends on the capitalization of the tokens issued on its platform, therefore its ascent took place during the ICO boom.

In the opinion of the President of the Xaro startup, which he expressed on his Twitter account, “we could be in the midst of the extinction-level event for ‘cryptoassets’… 90%+ of @CoinMarketCap list will disappear. Meantime, lower BTC price means incredible opportunity to buy more #bitcoin.”

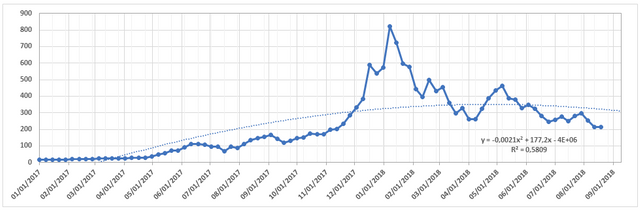

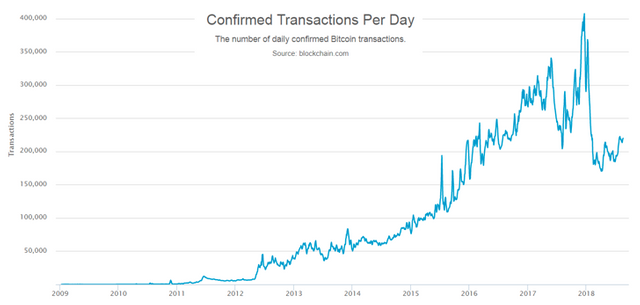

Meanwhile, according to the data of Blockchain.info the number of transactions in the bitcoin network has fallen to the level of early 2016.

There is a distinct relationship between the bitcoin price and the number of transactions.

For instance, CoinDesk analyst Omkar Godbole believes that bitcoin may soon set a new low for this year.

Coinbase CEO Brian Armstrong, in an interview with Bloomberg, expressed the opinion that the mass acceptance of bitcoin will take time. He highly assesses the potential for countries that are experiencing an economic crisis to use cryptocurrencies, and believes that in 3-5 years people will see a real alternative in bitcoin and other cryptocurrencies.

The prime example of Venezuela’s use of cryptocurrencies can be seen as a confirmation of his words. The country’s President Maduro plans to tie prices and wages to the national cryptocurrency, El Petro.

The crypto industry is developing. The lifespan of some projects is very short, and they are replaced by new projects, but the strongest projects remain and grow and develop with each new turn.

On August 13 Square published in Twitter that the Bitcoin application Cash App has become available in the 50 US states. The Chinese Aerospace Science and Industry Corporation Ltd. (CASC), meanwhile, plans to use blockchain to manage billions of invoices. CoinDesk writes that the South Korean Ministry of Economy and Finance is investing $880 million in the development of innovative technologies.

As Bloomberg reported on August 15, exchange-traded bitcoin notes tied to the US dollar have been introduced on Nasdaq Stockholm. This is an alternative to regulated bitcoin ETFs, which everyone is tired of waiting for the SEC to approve.

The Internet giant JD.com presented a blockchain platform for the corporate sector on which digital apps can be used to track invoices.

In conclusion, it can be said that he who correctly determines where the bottom is for bitcoin and Ether will get richer!

ICO Market Analysis (August 13-19, 2018)

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

Table 1.1. Brief ICO market overview, key events, news for the past week (August 13-19, 2018)

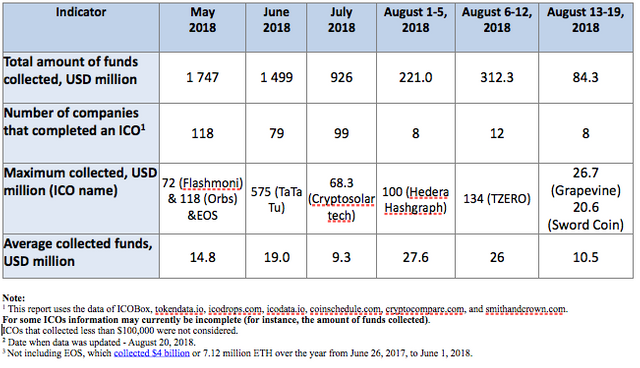

Table 1.2 shows the development trends on the ICO market since the start of May 2018. Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered.

Table 1.2. Aggregated trends and performance indicators of past (completed) ICOs1,2,3

The data for the previous period have been adjusted to account for the appearance of more complete information on past ICOs. Over the past week (August 13-19, 2018) the amount of funds collected via ICOs equaled $84.3 million. This amount consists of the results of 8 completed ICOs, with the largest amount of funds collected equaling $26.7 million (89% of the hard cap) by the Grapevine ICO. The average collected funds per ICO project equaled $10.5 million (see Tables 1.2, 1.3). A total of around 40 ICOs were completed last week. However, not all projects indicate the amount of funds collected on their official websites. This can be explained by the crisis in the industry and the fairly protracted fall in cryptocurrency market capitalization, which has gradually eroded the amount of funds being collected via ICOs. Many projects are unable to collect even the minimum amount (soft cap) announced in their White Papers.

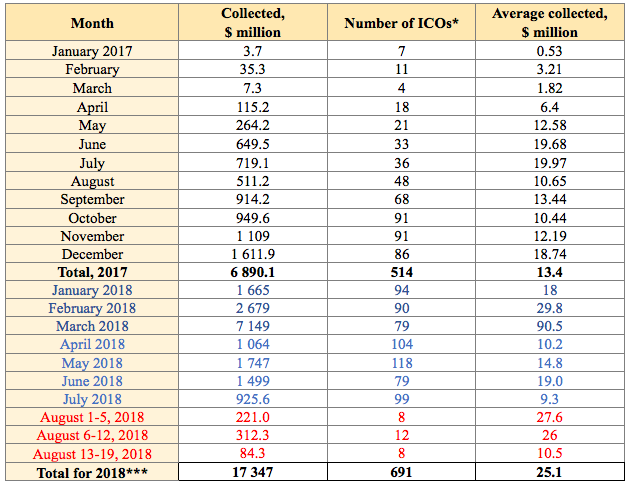

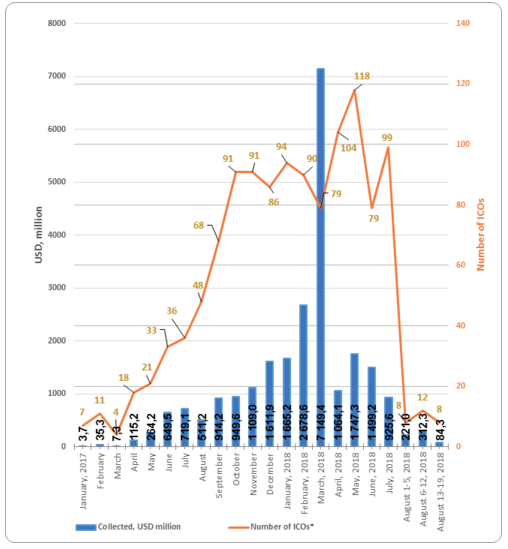

Table 1.3. Amount of funds collected and number of ICOs

Table 1.3 shows that the largest amount of funds was collected via ICOs in March 2018, mainly due to the appearance of major ICOs. The highest average collected funds per ICO was also seen in March 2018.

Figure 1.1. Trends in funds collected and number of ICOs since the start of 2017

1.2. Top ICOs during the last week

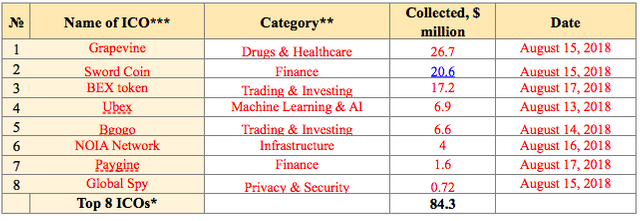

Table 1.4 shows the eight largest ICOs

Table 1.4. Top 8 ICOs by the amount of funds collected (August 13-19, 2018)

The data for the previous period (August 13-19, 2018) may be adjusted as information on the amounts of collected funds by completed ICOs is finalized.

Last week’s leader was the Grapevine project. According to the data from its official website, Grapevine World is a decentralized, borderless ecosystem for the seamless exchange of health data in a standardized, secure manner. The amount of funds collected equaled 89.33% of the hard cap ($30 million), i.e. approximately $26.7 million.

In second place by the amount of funds collected was the Sword Coin project, which will use blockchain to perform functions specific to Fintech trade and app platforms. The use of Sword Coin for trade operations through the Sword Capital platform will give traders an advantage in the form of lower transaction fees and other benefits. The broker software of Sword Capital is already being used in more than 100 countries.

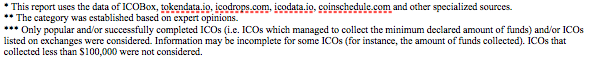

Figure 1.2 presents the eight largest ICOs completed in early August.

Figure 1.2. Top 8 ICOs by the amount of funds collected (August 13-19, 2018)

1.3. Top ICOs in the Drugs & Healthcare category

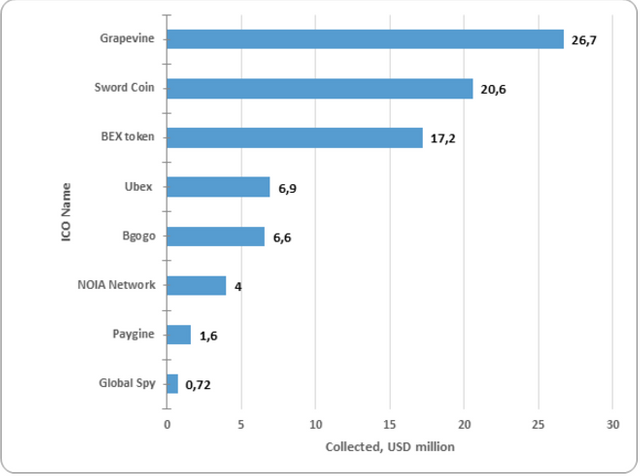

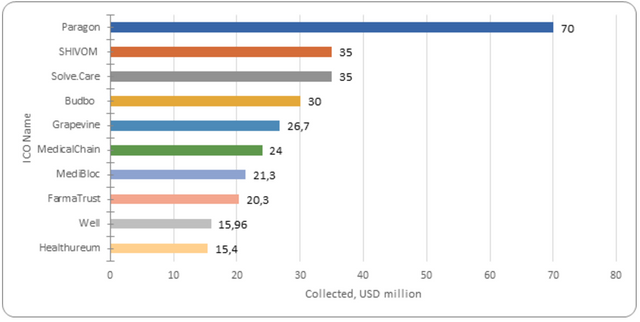

The list of top ICOs by category is compiled with due account of the categories of the leading ICOs for the week. The Grapevine project was among the top 10 largest projects by the amount of funds collected via ICO in the Drugs & Healthcare category (Table 1.5).

Table 1.5. Top 10 ICOs by the amount of funds collected, Drugs & Healthcare category

At present, all projects from the top 10 in this category have a token performance indicator of 0.03x to 0.5х. For example, the MediBloc project has a current token price to token sale price of 0.5x, i.e. the price is 50% lower than during the ICO. The current market capitalization of MediBloc (MED) is around $12 million. However, it is important to remember that this project performed a fairly successful Airdrop on June 1, 2018, and gave all its MED (QRC20) token holders MEDX (ERC20) tokens. Accordingly, the capitalization of MediBloc [ERC20] (MEDX) is currently higher than that of the parent project, and equals around $20 million.

It must also be pointed out that the market capitalization of the leader in this category by the amount of funds collected, the Paragon project, has fallen to $4.4 million.

Figure 1.3. Top 10 ICOs by the amount of funds collected, Drugs & Healthcare category

During the analyzed period (August 13-19, 2018) at least 8 ICO projects were successfully completed, each of which collected more than $100,000, with the total amount of funds collected equaling more than $80 million. Last week’s leader was the Grapevine project, which collected $26.7 million. The total amount of funds collected by a number of ICOs failed to reach even $100,000 (the information for some projects is still being finalized).

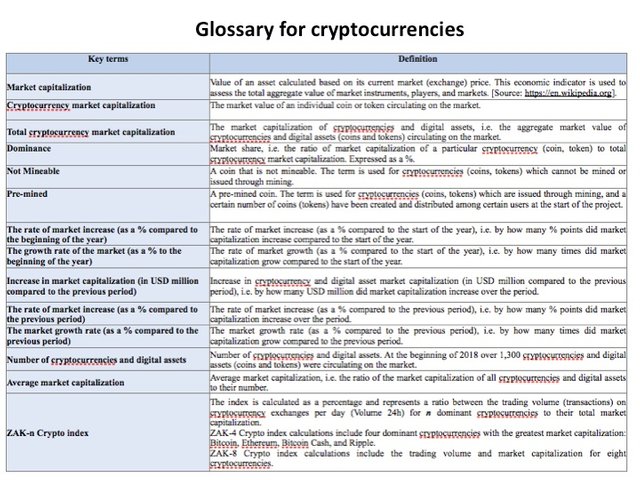

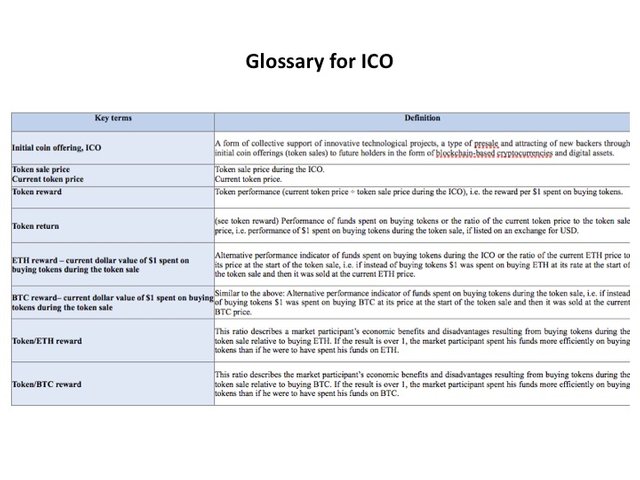

The Glossary is given in the Annex.

Annex

Glossary

@resteemator is a new bot casting votes for its followers. Follow @resteemator and vote this comment to increase your chance to be voted in the future!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit