If you are a business owner, you might have come across a customer who asked“do you accept cryptocurrency” and he might have been specific about it maybe bitcoin or litecoin or you might just be curious and want some of the advantages of adopting cryptocurrency in your business. Well, here is a guide on how to get started.

Some major companies like Microsoft have started accepting it for their products you can too. If you are curious about these companies, you can check my article on how to spend your coins.

Accepting cryptocurrency comes with a lot of benefits.

No Chargebacks

When a customer carries out a card transaction he can ask for a chargeback either because the product is bad, was not received or he might just be a fraud. With cryptocurrency adoption you can protect yourself from frauds and those with legitimate complaints can contact you.

You can also protect yourself from cases of identity theft since there are no card details to steal.

Increase in New Customer Traffic

Cryptocurrency owners will patronize you when they learn you accept cryptocurrency as payment for your goods. This will increase you profit and you also get to keep your fiat customers.

Decentralized System

No individual entity or institution controls your funds or transactions. You are in full control of your money and you can use it whenever you want with no transaction delays. Your funds are at your disposal always meaning no rigorous processes to follow before you can access them no matter how much.

Low Fees

Transaction can be carried out with very low fees. To process a transaction, you spend less than 1% of your funds or sometimes nothing at all in fees payment.

Free International Trade

There are no border barriers and clearing delays when international trade is done. Funds are simply sent between you and the customer with no intermediary, low fees and faster processing time (can be in minutes or seconds).

Security

Cryptocurrency transactions do not expose personal and sensitive information of the participants. They are protected with cryptography and the blockchain. The transaction can be checked with various block explorers depending on the blockchain used.

Payment Processors

You might want to employ the services of a payment processor to help facilitate cryptocurrency payments for your services or goods. They protect you from volatility by converting the cryptocurrency used in payment to fiat instantaneously. They also offer a host of other services to both online and offline businesses.

Bitpay, Coinify, Coinbase and Coinkite are some well-known payment processors you might want to do your own research before picking one

Now that we have seen some of the benefits of accepting cryptocurrency let’s see how we can accept them for our online and offline business.

Offline (brick and mortar)

Wallets

A wallet is a software that stores data needed to access your funds on the blockchain. There are different wallets for various platforms e.g. web, mobile and desktop.

Mobile

Jaxx, Coinomi, trust wallet

Web

MyEtherWallet, blockchain.info, Xapo

Desktop

Exodus, armory, greenaddress

Some of them support some specific cryptocurrency while others support a wide range.

Setting up Your Wallet

For a web wallet you can simply signup and get your wallet address with which you can use in receiving funds.

For mobile and desktop platforms, the wallet has to be downloaded. After download and installation open the wallet and follow the step-by-step guide. Make sure to store the mnemonic phrase you will be given in a safe place this is to help in easy recovery of your funds in case of device loss or change.

When setup is over you will see your wallet address. To receive a payment, you simply tell the customer to send it to your wallet address.

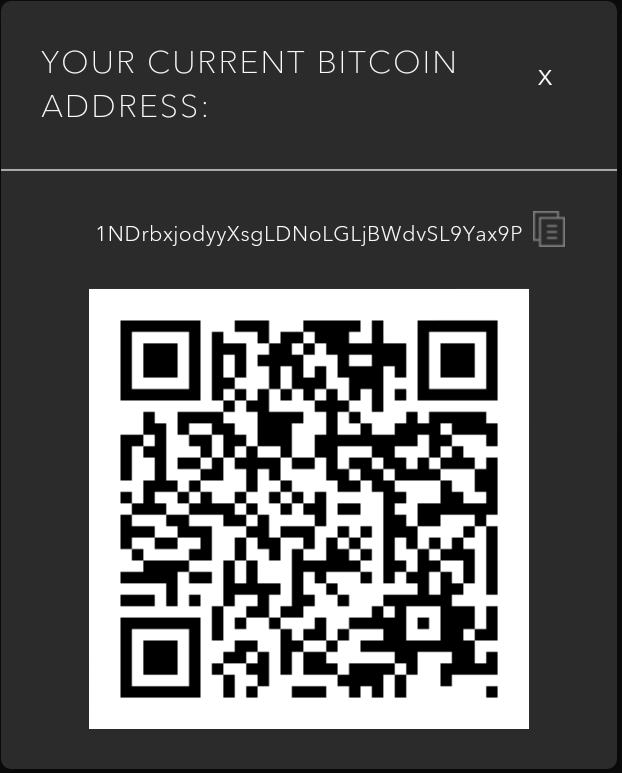

The wallet address is a combination of letters and alphabets. This is cumbersome to type and prone to errors when the customer tries to input it in his device. A Quick Response (QR) code will also be used to show your address. This code can simply be scanned by mobile devices and the funds can be sent with ease. You can also put the QR code on paper and put it on the wall for any customer to sign and pay.

Below is an example of what you will see after setup. The alphanumeric string is the wallet address while the QR code is the series of dots below.

Gift cards

You might have noticed that retail giant Amazon does not accept cryptocurrency but they have giftcards which can be bought from third parties with cryptocurrency and in turn be used to purchase goods from Amazon.

You can employ this easy strategy in your business by getting a giftcard for your business with a private label gift card service provider. These cards can be bought with bitcoin which in turn can be used to buy from you. The accounting for cryptocurrency can then be narrowed down to only gift cards.

Hardware Terminals (Point-of-Sale)

Some specific hardware have been made to process cryptocurrency transactions. This hardware vary in functions and capabilities. APIs can be integrated in some of the existing Point-of-Sale terminals. There is also hardware that can scan QR codes and handle cryptocurrency based debit cards to process payments.

The only drawback is the cost of these terminals but they are cost-effective for businesses with many cryptocurrency customers. Payment processors offer them.

Online

Button

Adding a“Pay with cryptocurrency”like the one below to your checkout page will increase the range of options for goods and services payments for customers.

To integrate a cryptocurrency button in your website you have to choose a payment processor and open a merchant account with them. A HTML code will be given which can be integrated into the site easily. It's best to give this job to a competent programmer to avoid glitches and possible loss of funds.

Invoice

If your business sends out invoices to customers, you can add a line of cryptocurrency payment option. It would be best to give each customer a different payment address to know when a payment has arrived. Sending an invoice with the public address and amount payable may put your customer at risk of being sent fake invoices by frauds. To prevent this giving them a part of the address and instructing them to access the complete address from an SSL link on the invoice would be a good option.

To protect yourself from volatility it would be best to update the current price of the product in BTC after a particular time interval.

Spread Awareness

To spread the word of the latest development in your business you can start with a sign in you shop like the one below.

This tells current and potential customers of the new development. Current customers will now accept cryptocurrency payments knowing there is a place they can spend it.

If you have a company blog you can include it in you blog, share out flyers or put it up in the local magazine or newspaper.

You can also add your business location in some cryptocurrency map services. Coinmap allows you to add a business location upon signup.

Taxes and Regulations

Although cryptocurrency is not totally banned in most countries but there is usually no clear rule of operation. But they may still be some regulations which have been put down and must be followed by citizens.

Find out about the regulations in your country on cryptocurrency and how to pay taxes on them. Legality of bitcoin by country and bitlegal would be good places to start.

Accepting cryptocurrency for payments also comes with its cons.

High Volatility

This is one of the main reasons there is slow adoption of cryptocurrency. Prices rise and fall fast which may lead to excess loss on your part or that of the consumer. Payment processors help to reduce the effects by a great extent.

Price Fluctuations

Price changes fast due to high volatility which makes it stressful to always check prices before sale.

Fund Loss

When you serve as your own bank a lot of human errors can be made which can lead to complete loss of funds. Always keep your mnemonic phrase safe and never expose your private keys.

Accepting cryptocurrency puts you a step ahead of your competitors and prepares you for the future. Studies by Urban Airship as shown by the table below shows that in the future the millennials and Generation Z are more likely to use cryptocurrency.The

Generations and their Wallet Usage in percentage is shown below.

Millenials (1977-1995)

67%

Generation X (1965-1976)

51%

Baby Boomers (1946 – 1964.)

28%

Why not prepare your business for the future and take it to the next level of success and growth by accepting cryptocurrency for payment.

Very good guide and you hit a lot of the key points while still being an easy read. Hopefully with your post you can inspire a least a few retailers to give crypto a try!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @greybat! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness and get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello greybat, welcome to Partiko, an amazing community for crypto lovers! Here, you will find cool people to connect with, and interesting articles to read!

You can also earn Partiko Points by engaging with people and bringing new people in. And you can convert them into crypto! How cool is that!

Hopefully you will have a lot of fun using Partiko! And never hesitate to reach out to me when you have questions!

Cheers,

crypto.talk

Creator of Partiko

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit